Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Before you say it, yes, I know that I should use the Pay Bill option to do this, but every time I do, QB crashes. I've been round and round with tech support and they can't fix it. I've tried deleting all related transactions and starting over; I've migrated servers; tried back up files, nothing works. It's only this company, others work fine, only this vendor, again others work fine. I just want to clear out these credits and "Pay" the bills that are languishing in my Pay Bills screen.

I'm trying to figure out how to create a Journal Entry to Pay the bill (thus moving it out of AP) with the credit already associated with the vendor. Any help would be greatly appreciated. Trying to solve the tech issue has made me batty and now this AJE is just insult to injury.

K

This is not what we want you to experience, @kmboyettBLH.

I can guide in creating a journal entry to pay your bills in QuickBooks. Also, I'd like to share additional troubleshooting steps to resolve the crashing of QuickBooks

First, you can follow these steps in creating a journal entry.

Once completed, you can now apply the journal entry to your existing bills.

On the other hand, you can re-sort your vendors' list. This resolves unexpected behavior while managing your vendors' list and transactions.

Here's how:

Once completed, you can run the verify and rebuild tool. The tool cleans up any data damage within the specific company file and diagnoses anything that might need your attention.

To Verify:

To Rebuild:

Please feel free to read this article for the detailed steps and information: Resolve Data Damage on your Company File.

You might also want to read this article to learn more about importing GJE: Send and Import General Journal Entries.

That's it! Let's give this a try and let me know how it goes in the comment section. I'll be around if you need any help.

Resorted the vendor list; I've done the verify/rebuild before, just did it again; same problem.

Everytime I go to the Pay Bills screen and apply a credit, QB locks up, regardless of how I enter the credit.

I'm trying to get around using this screen, even if that means logging the bills some other way.

Any help would be greatly appreciated.

Hello there, @kmboyettBLH.

Thanks for providing an update on the troubleshooting steps you've tried. I'm here to help you fix your Pay Bill window.

This sounds like the vendor data is damaged. With that being said, you can create a new vendor and merge them together.

Once you've created a new vendor, here's how to merge them:

For more detailed instructions with merging vendors in QuickBooks Desktop, you can refer to this article: Merge Accounts, Customers, and Vendors.

If you have any more questions, I'm always here to help. Have a safe and productive rest of your day!

I was going to try to merge vendors, but I don't have an Accounting Tools option under Company menu

We have another way on how you can merge your vendors, kmboyettBLH.

The ability to have a merge feature can definitely save time when creating transactions or reports. You can right-click the name of the vendor and edit it to merge the vendor name.

Here's how:

For future reference, you can check out these helpful articles about creating income and expenses in QuickBooks.

Let us know if you need anything else. I'll always be right here to help.

The only issue with applying a credit to the Bill is an extra entry in the bank account ledger that is selected.

Any thought's on preventing the extra entry?

Hi, MrWright.

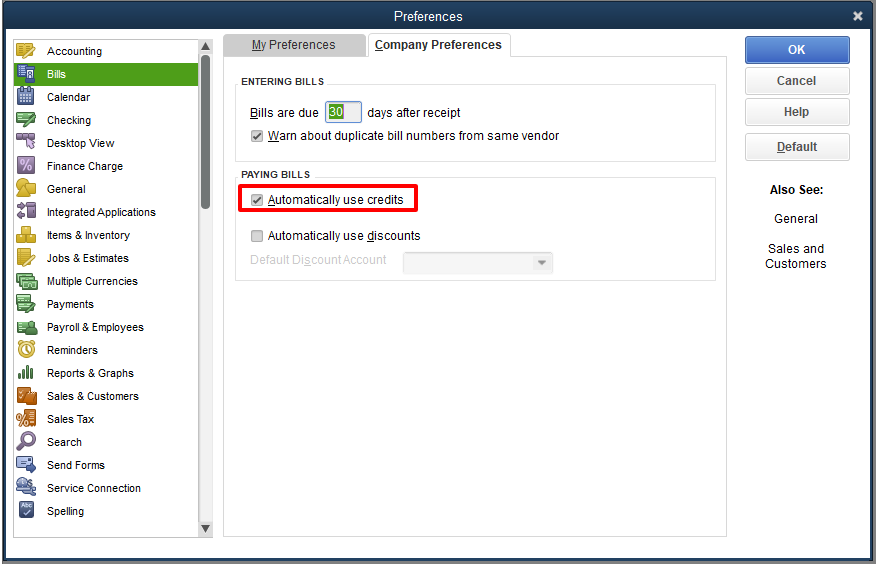

QuickBooks Desktop offers automation features, such as automatically applying credits to your bills. You might want to turn on and use this feature to prevent the extra entry.

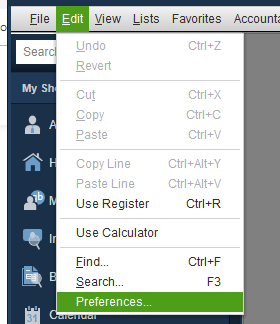

Here's how to turn on this feature:

I'll be sharing with you the following pointers below. These will provide you steps on how to write off vendor balances as well as removing vendor credits from bills:

Remove or unapply a credit from an invoice or bill.

Write off customer and vendor balances.

If you have other questions about vendor credits or anything in QuickBooks, let me know by clicking the Reply button below. I'll be more than happy to share additional help at any time. Have a wonderful week ahead!

I'm familiar with working this process. However, I had to rework my J/E's to correct for "class" errors I made on the original entry. Now I can't figure out how to get the bills "unpaid" so I can apply the credits correctly. Since they aren't actual credits, I can't use that method. Any help is appreciated.

I can help you with handling this scenario, kimme04612.

We can delete the bill payment, create a new one with the credit applied to the bill. I'll walk you through the steps:

For more information, please refer to this article for your reference: Void or delete a bill or bill payment check.

That should get you going. Tag me in a comment if you need more help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here