Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We made a payment to a vendor which resulted in an overpayment. The payment is currently in the bank feed. I need to match the payment to the open invoices and create a credit memo for the remainder but unsure how to do so. Any suggestions?

Solved! Go to Solution.

Hello @stacymae,

Just to clarify is this a payment made by your customer or payment you made for your vendor?

Matching a payment (deposit or spent) with an open invoice (customer invoice or bill) and a credit is not possible. Because QuickBooks will only let you match a deposit to any sales (money in) or income transactions and a spent to an expense or money out transactions.

With this, consider deleting the credit you created and create a resolving transaction for the overpayment instead. You can do so by toggling the Resolve Difference function in the Match Transaction window.

From here, you can select either of the posting accounts below depending on the name of the payment:

Once done, both accounts will post a credit in the name of the payment so you can apply it to future transactions.

Additionally, you might also want to check out this helpful article to know how to manage your account register and utilize its related functions: Find, review, and edit transactions in account registers.

If there's anything else that I can help you with, please let me know in the comments. Stay safe!

I can definitely help you with these events, @stacymae.

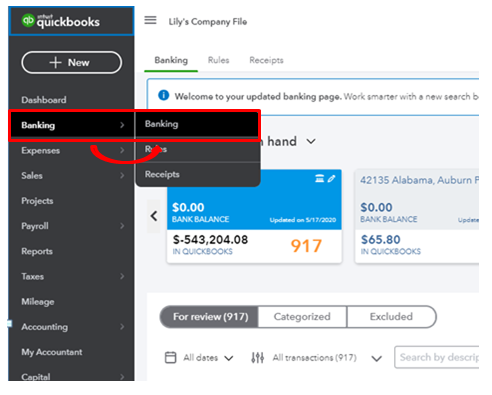

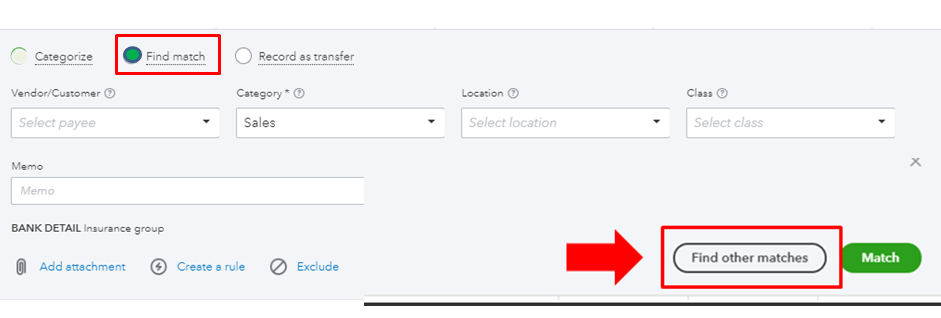

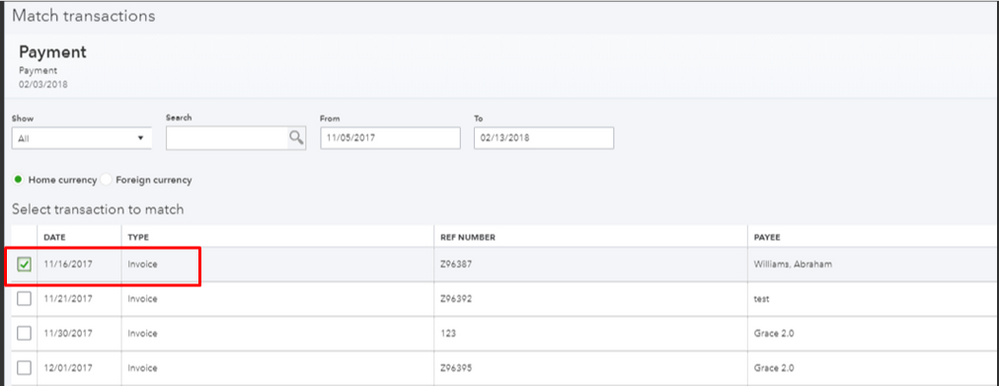

When matching invoices within the banking section, QuickBooks Online looks for open invoices. If it's unable to find one, you can open the payment to expand the transaction and use the Find Match option to search for the transactions.

Here are the steps to do it:

You can get more details in this article about matching and categorizing online bank transactions in QBO.

To create and apply a credit memo in the program, you can follow the instructions below to do it.

I also have a video tutorial here for recording memo and balances in QBO for your visual reference.

Moving forward, you can reduce the amount of time it takes to manage transactions on the Banking page. By setting up bank rules, QuickBooks will automatically categorize transactions for you. And you still have the opportunity to review the events before you add them.

Let me know if you have other questions about payments and matching transactions. I’ll be right here to assist further.

Thank you Madelyn C. However I am not able to save the transaction because it is out of balance due to the remainder needing to be made into a credit memo.

Hello @stacymae,

Just to clarify is this a payment made by your customer or payment you made for your vendor?

Matching a payment (deposit or spent) with an open invoice (customer invoice or bill) and a credit is not possible. Because QuickBooks will only let you match a deposit to any sales (money in) or income transactions and a spent to an expense or money out transactions.

With this, consider deleting the credit you created and create a resolving transaction for the overpayment instead. You can do so by toggling the Resolve Difference function in the Match Transaction window.

From here, you can select either of the posting accounts below depending on the name of the payment:

Once done, both accounts will post a credit in the name of the payment so you can apply it to future transactions.

Additionally, you might also want to check out this helpful article to know how to manage your account register and utilize its related functions: Find, review, and edit transactions in account registers.

If there's anything else that I can help you with, please let me know in the comments. Stay safe!

This is what I was looking for. Thank you very much!

Hey Stacymae.

I'm glad to hear my colleague was able to help you find what you were looking for.

If you have any other questions, feel free to post here anytime. Thank you and have a nice evening.

You said that after you create the resolving transaction, which would a credit amount in this instance, that you would be able to apply it to a future transaction. This is what I am having trouble with. Exactly how do I apply it to a future transaction? I tried opening it and clicking on receive payment, but it takes me a deposit screen and wants to know what funds I want to add to the deposit. I'm totally lost.

I can help you link customer payments that have an overpayment, debi8.

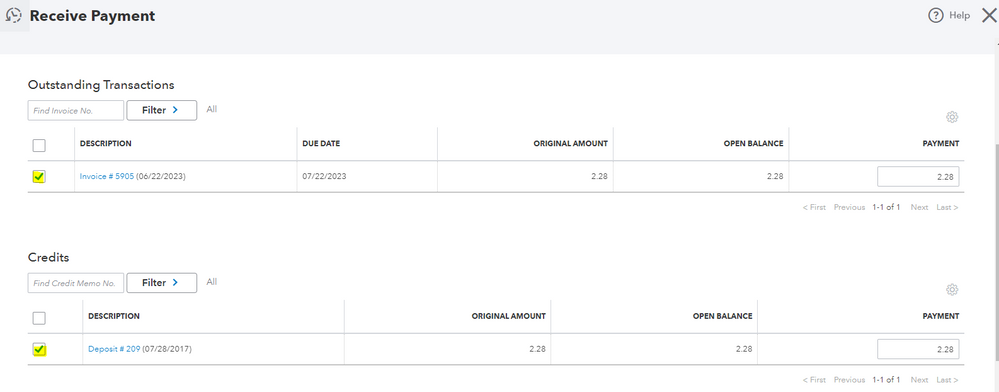

Good job for performing the steps provided by my colleagues. After you selected invoices in the Match transactions window, you'll see that there's a positive difference which is the customer's overpayment. You can resolve the difference and select Accounts Receivable as Category. This way, you can apply it as a credit to your customer's future invoices. When you create a Receive payment option, a Credit section will show.

You can refer to the screenshots below.

For more details on how to receive customer invoice payments, check out these articles:

I'll be here if you need more help. You take care and have a great day!

So here is our situation:

A customer sends a check to pay for an invoice. However they overpaid thinking they owed another invoice. They don't want a refund they want us to credit them for future services.

Do i create a credit memo in their customer account file?

When I match the deposit in the bank, it will be off by the amount they over paid, do I still click resolve difference and follow the steps mentioned, by putting it in accounts receivable?

Or do I just do one or the other? That is where I'm confused. Right now we have just created the accounts receivable difference resolve when we matched the transactions to the bank deposit, so it shows up in my customers account file as a negative amount.

Thanks for joining this thread and providing detailed information about the scenario, pfstx. I'll make sure you'll able to handle the remaining credit.

Creating a credit memo is not necessary. It's because the system will generate a balance after matching the deposit to an invoice from the bank feed.

And, yes, you'll need to utilize the Resolve difference feature affecting the Account Receivable account. This performs an adjustment to resolve the difference in the overpayment.

Afterward, you'll see an open balance by going to Sales> Customers . That is the available credit you can apply for their future invoices. Once you're ready to invoice your customer, here's how you could do it:

Once done, you can make a payment by linking the invoice and deposit. Here are the complete steps on how to do it.

Additionally, here's an article that provides tips on handling a customer credit or overpayment in QuickBooks Online: Learn what to do in QuickBooks Online when a customer overpays you.

That helps you out! Tap me on my shoulder if you have more concerns about applying for credits and matching transactions in QuickBooks Online. I'll be around to help. Take care and stay safe.

Thank you for posting these instructions. We are having a similar issue. We overpaid a bill and the vendor has given us a credit. I used the instructions provided to match the transaction and a credit showed on the vendor's account. We then added the next bill, and that amount was deducted from the credit, but the credit is not being applied to the bill. How do we resolve this?

Thanks for sharing this! Is it a situation where you are not able to save the transaction with the deduction from the credit or something else? Looking forward to hearing from you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here