Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI have QuickBooks Pro Desktop 2016. I have an exception situation where I need to include credit card transactions for a vendor in 1099 reporting. Is there a way to override the exclusion temporarily?

Hi there, @AveryAssistance.

Thanks for checking us out here in the Community. I'm here to help and get you pointed in the right direction.

When preparing 1099 forms, IRS requires 1099 filers to exclude any payments you made to a 1099 vendor by credit card, debit card, gift card, or a third-party payment network such as PayPal from Form 1099-MISC. These payments are considered as non-reportable payments. These payments are reported by the card issuers and the third-party payment networks on Form 1099-K.

To ensure that you file your 1099 for correctly, I'd suggest checking out with your accountant for further assistance.

For more insights about preparing 1099 forms, please check out these articles:

This will help you prepare your 1099 forms accurately.

Feel free to reach back out to us if you need additional assistance. We're always here to lend a helping hand. Have a great weekend!

@AveryAssistance wrote:

I have QuickBooks Pro Desktop 2016. I have an exception situation where I need to include credit card transactions for a vendor in 1099 reporting. Is there a way to override the exclusion temporarily?

Along with what intuit Bettyjane said which is correct

what or why do you have that exception for including CC payments on a 1099-misc?

You don't do this for any reason: "I have an exception situation where I need to include credit card transactions for a vendor in 1099 reporting."

The Credit Card Provider is responsible under the 1099-K regulations.

You fall under the 1099-Misc regulations.

so what happens if you don't receive a 1099 from the credit card companies who paid you?

Hello there, @laurie7112.

Thank you for joining this thread. I can share some insights about receiving 1099-K.

You will receive the 1099-K form if you processed at least 200 card transactions and $20,000 in gross sales during the prior calendar year. If you've met these criteria, you should receive a copy from the credit card companies who paid you. If you believe you should have received a 1099-K and have not received one, consider contacting your credit card provider.

This form should be filed to avoid being penalized, @laurie7112.

Keep me posted if you have additional questions. I'm still here to help you more. Have a good one.

They absolutely are not reported by Paypal or the CC companies! PP has a threshold of 20 K and 200 transactions before a 1099 K will be issued. CC companies don't ask for W9's so how would they issue a 1099? I just got done cleaning up a mess from a CPA telling the former clerical gal that was doing the books to not issue a 1099 for CC payments

If I hadn't reviewed the books the vendcors would have gotten away with not having 8 - 25 K of income reported

I verified with every vendor and nope - none of them in 4 years performing services for my new client EVER got a 1099 from with PP or the CC company

Why wouldn't you "make an exception"? The CC company and PP don't know my EIN or the other vendors so I push it into a "bank clearing" so make it all go into the 1099 reporting

So you're ok with vendors not reporting income because it's under 20 K and 200 transactions? I'm not. I'll issue the 1099s to them all if I know for a fact they won't get one otherwise

Hi there, @Noneatall,

Thanks for joining our forum and for sharing in depth details about your concern. I can add a bit more about the processing 1099 reports to the IRS.

As stated in the IRS Instructions for Form 1099-MISC, credit card payments, including third-party network transactions should be reported on Form 1099-K by the payment settlement entity under section 6050W, and are not subject to reporting on Form 1099-MISC.

To make sure you are reporting the amounts correctly, I'd recommend getting in touch with the IRS Support. There they can give you the complete instructions on what form you need to use for your vendor payments. You can also check this IRS publication to know more about the 1099 K form: Instructions for Form 1099-K (Payment Card and Third Party Network Transactions)

That should do it, @Noneatall. Please feel free to post here in the Community if you have any more questions with QuickBooks. i'll be glad to help. Have a great day!

I know exactly how they SHOULD be reported but the fact remains that they are not being reported by the CC processor. How could they be when the CC processor has no clue what the EIN or SSN's are?

I don't need to contact the IRS support. I know what I'm doing thanks.

I refuse to let people get income and not have it be reported due to the CC issue so I figure it by hand and 1099 them for it.

Thank you for your repsonses. I understand the law regarding reporting. It was for an audit situation where I needed to report all 1099 payments whether paid by credit card or check. I just used customized reports.

Thanks!

Hi,

I found your thread regarding this "exclusion". I agree with you.

Here's the workaround. I have a website person, Joe Smith, account is Internet Advertising. Paid $600 in 2019. Paid with American Express. Not showing up in 1099s!

Created a bill dated 12/31/2019 using Internet Advertising for $600.

Paid bill using Cash Payout account (or use a barter account), I prefer something other than the operational account.

Then I went into the Cash Payout register and without using Joe Smith

I credited out the payment to Internet Advertising.

Result - Joe Smith is now on the 1099 report for $600

Internet Advertising has an in/out of $600 (net zero)

Hope this helps.

Deb Cartier

TOP SECRET Bookkeeping, Inc

"Because it's nobody's business but yours!"

If you look more closely at the instructions you will see that it is still okay for a company to issue a 1099 when paying by PayPal or a credit card. In fact it is better to be safe and issue the 1099. There is no penalty for filing a 1099 but there is a penalty if the 1099 is not filed.

Quickbooks needs to fix this it is really inconvenient for those of us that want to be safe and avoid IRS failure to file penalties.

RE: I know exactly how they SHOULD be reported but the fact remains that they are not being reported by the CC processor. How could they be when the CC processor has no clue what the EIN or SSN's are?

If you make a payment to a vendor using your credit card, and they process it, their processor will issue them a 1099-k. Their processor does know their EIN or SSN.

In any case, what their processor does or does not do, if they comply with the law or not, is not your legal concern. All you need to do is report the payments you made that are reportable by you.

RE: If you look more closely at the instructions you will see that it is still okay for a company to issue a 1099 when paying by PayPal or a credit card. In fact it is better to be safe and issue the 1099.

If you do this, you will be creating a big headache for your vendor, as they will then have two 1099's for the same income and the IRS will think they made that income twice. If their 1099's then add up to more than their total income, they will be audited and the IRS will tell them they owe taxes.

You should only report the payments to vendors that are reportable. Reporting extra is no better then missing some payments.

There are reasons to override a 1099 limitation, I am running into one now. I have a vendor that was paid $125 by check and $525 by credit card. It exceeds the $600 limit, but is excluded because of the CC Payment. I am overriding to complete a 1099-Misc for the $650, it is not a material amount and my client is vulnerable to IRS Audit. Additionally the vendor does not receive many 1099's so the over reporting will not trigger the IRS's curiosity. This is a tricky area for sure. I suggest contacting your vendor before issuing. Please be assured that that processors are reporting on amounts much lower the the $20,000 and 200 transactions - I am seeing them.

To easily and effectively work around the exclusion simply create a JE on 12/31/xx to the service related account that is mapped to the 1099, offset to a clearing account, include the vendor name on both lines. You would use the excluded amount only not the whole 1099 value. Process your 1099 then reverse your JE on 12/31/xx. That way you have a trail. Simple and clean and if you forget to reverse you have a reminder because your clearing account will have a balance when you balance your financial statements... which we all do right?

I paid a vendor with my credit card and some invoices via check. How do I exclude the credit card payments from being reported on the 1099 when they are all coded to the same expense account that is routed to Box 7 Non-Employee Compensation???

QuickBooks Desktop only supports 1099-MISC, Cindy_S.

This form reports only the non-electronic payments. That means, QuickBooks Desktop automatically excludes the credit card payments even if they are in the same account.

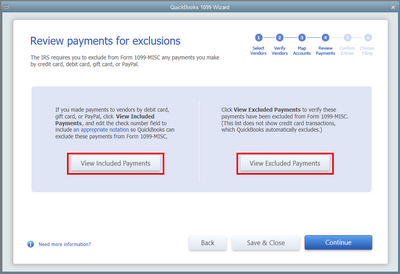

In the 1099 Wizard, we can view both included and excluded payments from 1099-MISC. This is very helpful to verify the payments before filing the form. These are the steps to follow:

In addition, you can pull up the 1099 Summary Report to see all vendors who doesn't meet the IRS threshold which is $600. Just go to Vendors menu > Print/E-file 1099s > 1099 Summary Report. Then, toggle the fillers for the 1099 options.

You can also read this guide about QuickBooks Desktop 1099 setup, troubleshooting, & FAQs.

Please comment again if you need more help from me. I'll be here anytime.

In this case, the requirement to file a 1099-MISC for payments made in excess of $600 to that vendor would not be met, because only $125 would be reportable on a 1099-MISC form. The IRS instructions are quite clear on this front:

"Form 1099-K. Payments made with a credit card or

payment card and certain other types of payments, including

third-party network transactions, must be reported on Form

1099-K by the payment settlement entity under section

6050W and are not subject to reporting on Form 1099-MISC.

See the separate Instructions for Form 1099-K."

As mentioned in other strings, credit card processors and the third-party payment processors the IRS is referring to in the above instructions (such as Paypal) require account holders/payment recipients to provide their FEI numbers in order to enroll and/or remain enrolled in the service. If account holders/payment recipients do not provide their FEI number or provide incorrect numbers, the processors are obligated to backup withhold (24% in 2019).

As an outside vendor, you have no way of knowing whether your vendor does or does meet the threshold to receive a 1099-K. Unless your vendor is providing you with details on their revenues or amount of business they transact, there is no way you would/should know this information. The IRS could not hold you accountable for information that you are not legally privy to.

I am not sure if you will see this response as it has been a year now.

I'm looking at how you did the "work around" on for including the 1099.

QUOTE:

Created a bill dated 12/31/2019 using Internet Advertising for $600.

Paid bill using Cash Payout account (or use a barter account), I prefer something other than the operational account.

Then I went into the Cash Payout register and without using Joe Smith

I credited out the payment to Internet Advertising

My question is HOW did you Pay the Bill without writing a check & do you make a Journal Entry to offset the Internet Advertising?

I'm not quite understanding?

I DO want to report it on the 1099 so that's my end goal.

Mary Ann

Hi there, @Mary Ann4.

You can create a Journal Entry transferring the expense account to remove the 2019 expenses. Then, create a journal entry using the clearing account:

Furthermore, here's an article you can read for more details: Set up a clearing account.

Since every business structure is unique, I recommend consulting with your accountant to determine the correct debit and credit account to use when reclassifying. To ensure your records are right when recording a journal entry.

In the future, I'm attaching some links below which you may find helpful:

Do get back to me in case you have other concerns or questions. I'm always here to help you. Take care!

So let's say a company pays a vendor via a transfer company. No need to name the company, as there are many that do this. You pay the transfer company via credit card, but the vendor is paid by ACH or wire. The transfer company is not required to provide a 1099-K or 1099-MISC/NEC to the vendor, so the fact that it was paid by credit card does not release the payer from the requirement to include these on the 1099.

The problem with exclusion is if I paid the vendor with friends/family option to avoid the PayPal fees, Paypal doesn't send the 1099 to them, BUT quickbooks thinks it did, so how can I override this?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here