Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I accidentally paid an invoice twice, both by ACH. The vendor gave added a credit of the duplicate amount on a future invoice. Do I need to link the duplicate payment to the original bill in QBO? Or should I enter a check for that amount? And then would I need to enter a Vendor Credit so that we can add the credit to the future invoice in QBO?

Thank you.

Thank you for explaining your concern clearly, flower00.

I'll be happy to show you the steps you need to take in QuickBooks Online to handle an overpayment to a vendor.

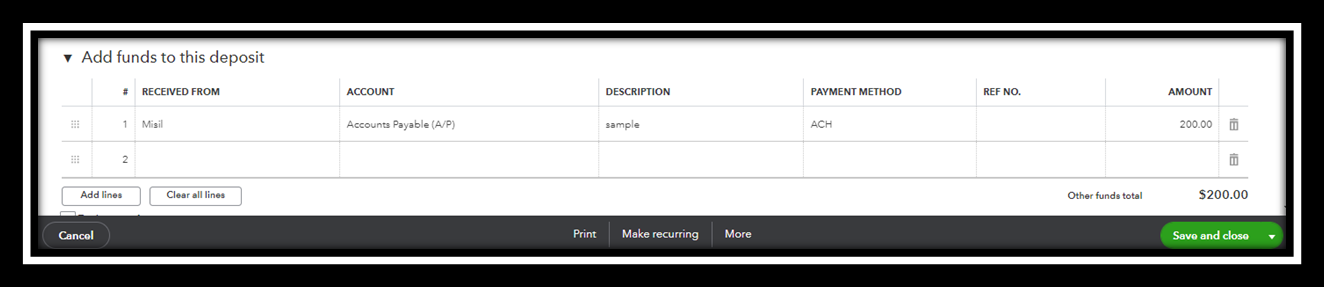

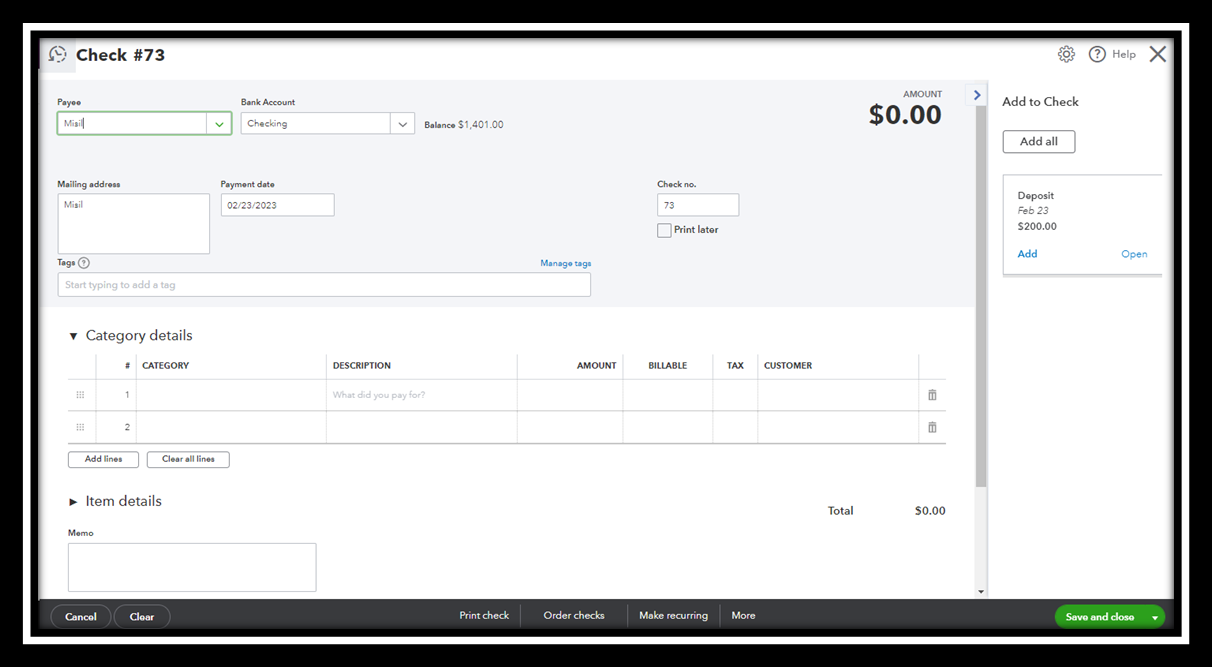

I'd recommend creating a bank deposit and linking it to the check. Let me show you how:

To link the deposit to the check, follow the steps below:

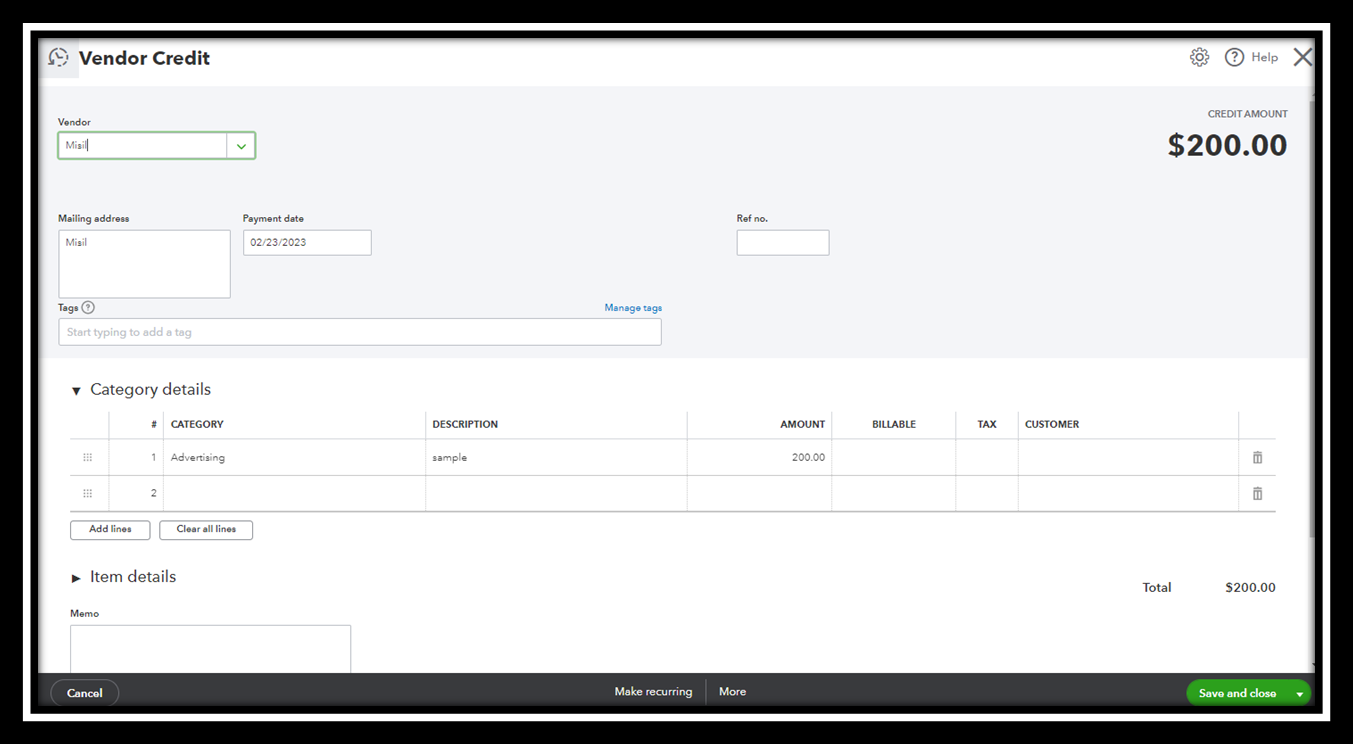

Once done, please make a vendor credit so you can use it on future bills from that vendor. Go as follows:

Don't forget to reconcile your account by the end of the month. This is so that you can keep track of your business's real-life transactions and find any mishaps. It also has instructions for editing reconciliations that have already been done.

Additionally, you may open this article to view details on how to run a particular report that will reflect all payments made to vendors: Run a report with vendor totals.

Please let me know if you have additional questions or concerns about handling overpayments in QBO. I'll be here every step of the way. Keep safe!

Thank you. Do I need to add a deposit if the vendor did not refund the amount back to us? They have added the overpayment amount to a future invoice.

Hello there, @flower00.

Let me join the thread and provide clarifications about vendor credits in QuickBooks Online (QBO).

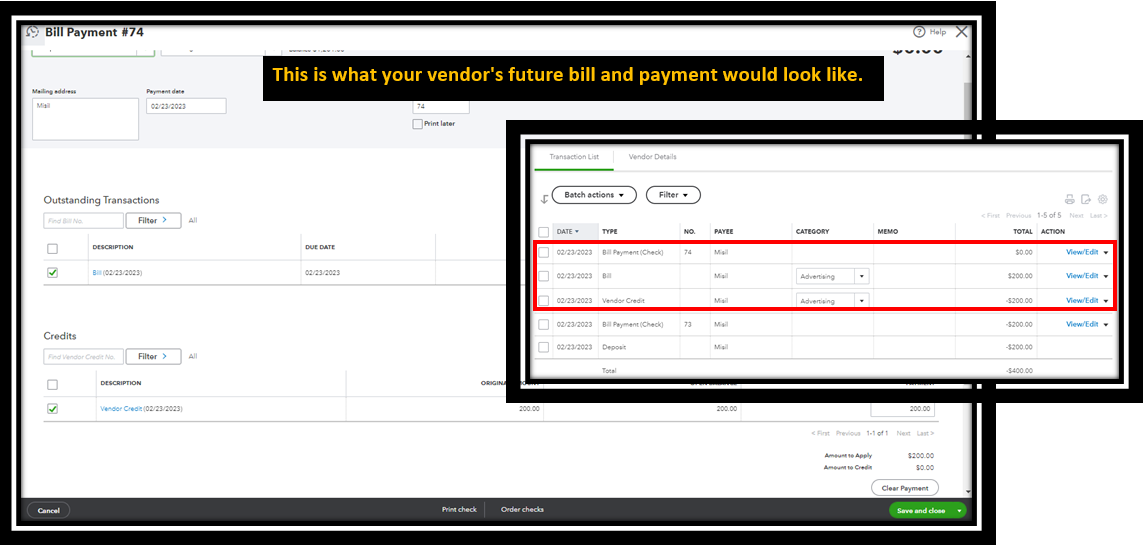

You'll be glad to know that there's no need for you to create a deposit or vendor credit, as the credit will automatically show on the vendor's balance. And once you pay a future bill, you'll just have to simply apply the credit.

For more information about refunding a vendor, check out this article: Enter vendor credits and refunds in QuickBooks Online.

For future reference, visit our Expenses and vendors page for more insights about entering expenses, paying bills, writing checks, and managing suppliers.

If there's anything else you need, please feel free to leave a reply below. We're always around to help. Take care and stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here