Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Is there a way to pass along the intuit processing fee to the person paying the invoice?

Hello, Olctreas.

Yes. You can let your client pay the processing fee on your behalf. However, you'll have to create a separate invoice for the processing fee amount.

I would also recommend to reach out to your accountant regarding with this.

Let me know if there's anything that I can help you with.

This doesn't make sense, because if you create a new invoice to have the client pay the processing fee, then there will be another processing fee associated with that invoice.

Thanks for joining this conversation, sdfghjklfghjkl.

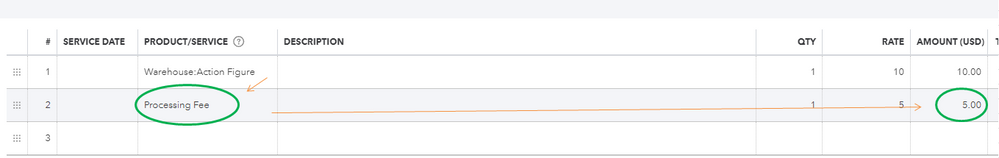

To charge a customer for a processing fee, you can include it as another line item on the invoice instead. This will prevent the system from generating another one.

Here's how:

For additional information, consider checking out this article: How to enter late fees or finance and service charges on invoices.

I'm also sharing this article for future reference: A quick guide to Credit Card processing.

Reach out to me if you have any other issues or concerns. I'm always here to assist. Have a great day!

So their is currently no way to charge the customer for the QB processing fee without having to pay a percentage for the fee also? Will QB consider adding the option of passing the full fee percentage on to the customers who pay by cc?

You might want to have your customer pay the fees outside the invoice, imperialimprinting.

The option to pass the fee for credit card payments is currently unavailable. There are still states in the US that don’t allow this type of transaction.

Receiving the payment externally would avoid from adding percentage on the invoice. You can record this transaction through bank deposit. Here’s how:

Have further questions or need anything else? Visit us again and we'll take care of them.

Has this issue ever been resolved by Quickbooks?

For example, my client owes $5,000; the c/c processing fee is 2.9%, or $145. I want to pass this fee on to my client so I create an invoice for a total of $5,145 (Line 1: Service =$5,000 and Line 2: Credit Card Processing Fee = $145). In this scenario, will I be charged a 2.9% fee on the total of $5,145.00?

Are your running a B2B company?

Hi there, @GBAUM.

As mentioned above, the option to pass the credit card processing fee to your customer is still unavailable. Please be aware that most states do not allow this. With that said, you'll want to ensure that your state approves you can charge your customer for the fees.

For now, you can always check into a third-party app that will integrate with QuickBooks and accomplish this for you.

In case you'd like to use a third-party app, here's where you can find one in QuickBooks Online:

If you'd like, you can submit any thoughts or suggestions you might have to our Product Developers at any time. Our Developers review each feedback request and consider them all for future updates.

To submit a feedback request:

Please let me know if you have any additional questions or concerns. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here