Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI created 3 invoices and received payments through Quickbooks payments which deposited into my business checking account. When my bank transactions imported from my business checking account, it shows the 3 deposits related to those invoices. Being as the payments were already applied to the invoices, the deposits have nowhere to be assigned to and in effect are duplicates. If I delete the deposits from my banking "chart of accounts" then I will have a mismatch in the bank balance in quickbooks. Deleting the quickbooks payments and applying the deposits instead seems to be the most logical step... but I receive an error message every time: "This transaction has been deposited. If you want to change or delete it, you must edit the deposit it appears on and remove it first." There are no deposits for a quickbooks payment as far as I can tell. At this point I have resolved to letting the deposits sit in A/R unassigned, which is really hurting my organization. Any help would be greatly appreciated, thanks.

Welcome to the Community, @jd34mx. Thanks for being so detailed with your concern. I'm here to help you rectify the transactions sitting in A/R unassigned.

As an insight, the invoices are marked as paid after your customers send the payment using QuickBooks Online Payments.

Since only open invoices will show on the Banking page, we can match the bank transaction to the payments instead. Here's how:

If these transactions were added and categorized as A/R, we can undo them first to move them back to the For review tab. Then, let's exclude them to avoid duplicate entry. Here's how:

Once done, go back to the For review tab and select the transaction again. Then, select Exclude.

Also, if it's a single existing entry in QBO, it won't match to multiple bank entries. You can check out this article for the detailed steps on how to handle this situation by combining multiple transactions to a single record: Record and make Bank Deposits in QuickBooks Online.

Let me know if you have additional questions. We're always delighted to help you some more.

Thank you for the quick reply Katherine! I went through those steps and I hadn't set that the payments were going to the correct account, I also unassigned the deposits from A/R..... This still however leaves me in the same boat unfortunately: I really wanted to avoid excluding those deposits from the bank account as it would have a mismatch between my actual bank balance and my quickbook balance. Is there a workaround for this? Also now that I have the correct account setup will this avoid this problem in the future or will I have to exclude every deposit like this if I continue to us quickbooks payments? Thanks!

Allow me to share some information about the flows of payments and deposits in QuickBooks Online, @jd34mx.

If the invoice is paid through Merchant Service (QuickBooks Payments), the payment will be posted to the Undeposited Funds temporarily, and not directly to your bank account where the merchant deposits the money.

The Undeposited Funds is an internal account that QuickBooks uses to hold payments. It's designed to work with the receive payments and bank deposit features to complete the invoicing process.

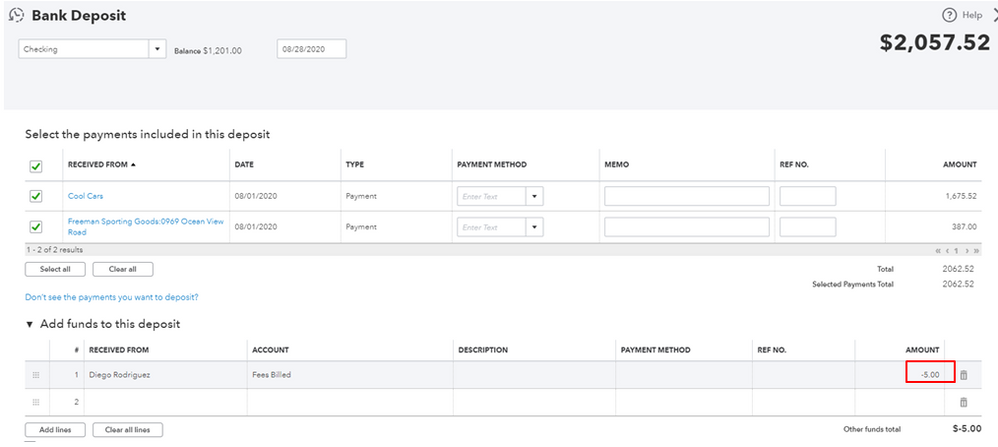

This means if your bank recorded a single deposit, you should do the same in QuickBooks. You'll want to create a Bank Deposit then add the fees from there. This way, it will match your actual bank. Here’s how:

You can read these articles for more insight about the process:

I’ve also added this reference to guide you thoroughly on how to match, add, or view multiple matches: Categorize and match the online bank transactions in QuickBooks Online.

Don’t hesitate to get back on this page if you have other questions. We’re always here to lend a hand. Keep safe.

Thanks Madelyn. This seems to be getting farther away from my problem. The basic problem is that quickbooks has recorded BOTH "Quickbooks payments" & bank deposits for each invoice and has to my knowledge no way of matching them up together. The steps you mentioned don't work as there are no open invoices, the payment has already been applied via Quickbooks payments. If I go to create another bank deposit, I get the message that "payment doesn't have an open invoice to go with it.....We'll save this as a credit" Which is probably a bigger problem as it will now show that I have been paid twice for the same client. I also cannot apply "undeposited funds" to a bank deposit. Back to my original problem, it seems the only solution is to exclude them from the bank account, however this will leave me with a mismatch in balances from quickbooks to my actual bank account. I isolated one invoice and grouped them together in one image so you get the idea of the problem.

Hi there, jd34mx.

After reading over your thread, I was able to figure out what seems to be going on. Payments made to you via Merchant Services don't require a deposit because they're auto-assigned. Below I'm including a helpful link that breaks down Payments made through the Merchant Service Center and much more helpful information.

I'm also including some helpful information on undeposited funds and how to utilize them. I would recommend reaching out to an accountant regarding the deposits you already have in place to see how you should handle them. If you don't have one yet, I highly recommend a ProAdvisor, they know all the ins-and-outs of the QuickBooks Product and are certified accountants.

If you have any other questions or concerns, feel free to post below anytime. Thank you and have a nice afternoon.

Ok that didn't solve it. Still I was having a completely different issue. I did figure it out however. It all goes back to the tip @katherinejoyceO gave me so thank you! So for future reference if anyone ever has the problem of deposits not syncing with Quick books payments this may be how to solve it:

Whew!

THANK YOU for finding this solution! The same thing happened to me (switched payment deposit accounts) and was having a hell of a time trying to figure out where to match the bank deposits!

Unfortunately, changing the Chart of Accounts settings to reflect may bank account did not fix the issue... payments are received & post to Undeposited Funds. Then, when the deposit is automatically posted by QBO, the payment remains in Undeposited Funds... HELP!

Hi there, @rrichtx77386. I'd be happy to share some details on how to handle payments in QuickBooks Online (QBO).

I can see that you're trying to set up where to record payments and process fees. The transactions before you've set up the correct account will be found in the Undeposited funds. If it's the case, you can go to the affected invoice and click on the hyperlinked amount below the PAID text at the upper-right side of the page. Then, change the Undeposited funds into the correct account.

However, if you've got this issue after setting up the payments to its proper account, you may want to review the settings again.

If the account you've assigned isn't in the settings, you may change it. If it's there, I'd recommend contacting our Customer Care team. They have the tools to verify your account, check further what has caused this issue, and fix it. You may also request to do a screen share to have documentation of the issue.

For more information about the process, you can check out this article: Choose where to record payments and processing fees for QuickBooks Payments. It contains the step-by-step process of setting up payments transactions to the correct account.

Moreover, I've included this reference that you can use in the future when you're ready to assess your business' profits: Categorize and match online bank transactions in QuickBooks Online. You can also review the articles here for the next steps, such as reconciliation or undoing reconciliation.

I'll be around if you have any follow-up questions about payments or other concerns about QBO processes. Don't hesitate to let me know in the comment section. Take care and have a great day!

Thank you for your reply. All of my settings are correct. Electronic payments post to the Undeposited Funds Register. The corresponding deposits post to the correct bank account register, but they do not clear the payments from the undeposited funds.

YESS!!! I have been trying to solve this forever. Thank you for laying out the solution.

Bless. You.

I have never been helped by Quickbooks or seen anyone else helped. I always spend hours and eventually figure it out on my own. We should all always come back and post instructions for other people after we solve our own problems

Thank you so much for this thread! I have been over this with QB services and they have no idea what I am talking about even though it seems like a simple concept! They really need to fix this problem in their programming.

I have contacted Customer Care multiple times over this very issue. Not only do they not understand the problem but they are very slow, bounce from customer care to online support to tech and back again. They have never solved this issue. This is a programming problem where QBs does not recognize their own deposit to the bank even after the Account has been corrected. Customer Care is NOT aware of what this is and they do not know how to fix it.

I'm beyond grateful you kept pressing on this issue. I kept reading the thread responses and thinking "That''s not it! That's not the fix I need" - Well you figured it out and saved our business a lot of headache. I have about $83K in excluded transactions to now match up. Off to the mines I go....

Thanks for joining the Community and getting involved with this thread, pioneerplumbing.

I'm happy to hear my colleagues and/or other users were able to help you figure out how to unexclude transactions and match them.

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

Please feel welcome to send a reply here, or create a new thread, if there's every any questions. Have a wonderful Wednesday!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here