SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Payments

- :

- Re: Apply Credit to Set of Invoices

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

Looking for some input on an easier way to do this. What's the best way to apply a credit when paying a set of invoices?

The set of ~100 invoices are from one vendor totaling 17k, with a credit of 12k, for a final balance of 5k.

Currently selecting some of the individual invoices to total the 12k credit, but it's taking quite a long time.

Thank you in advance for any detailed input!

Currently using quickbooks pro 2012 - yes we are upgrading asap.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

I have asked about this before and was told that QB will only assign credits to invoices one at a time, trust me Ive tried!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

Hello there, @jlclark137.

There are two options in applying the credits to your bills. Let me guide you through them.

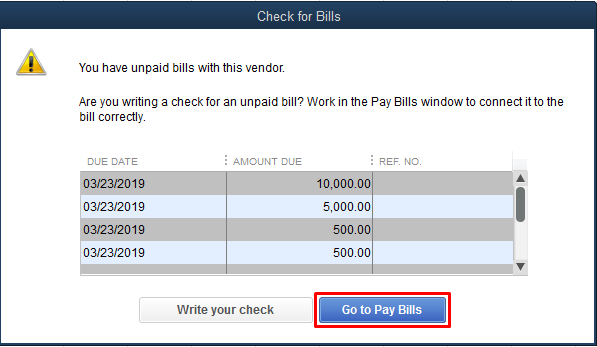

First, you can write a check to pay the bills from your vendor. Then a pop-up will appear notifying you of open bills from your vendors. You can then continue from there to apply the check to the bills. Let me show you how:

- From the Home Page, click on Write Checks.

- Choose the Bank Account.

- Enter the vendor name.

- On the Check for Bills pop-up, click on Go to Pay Bills.

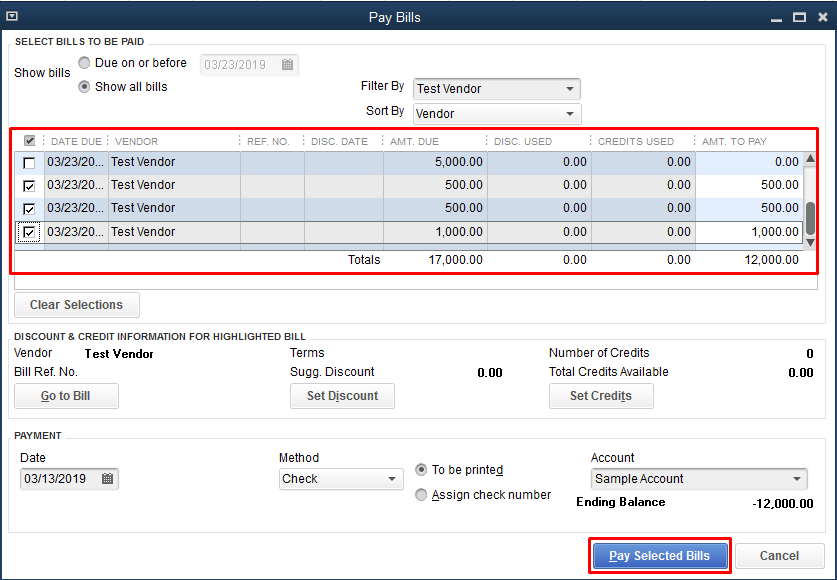

- On the Pay Bills pop-up, select the bills to be paid, totaling to the credit.

- Click on Pay Selected Bills.

- Select Done on the Payment Summary.

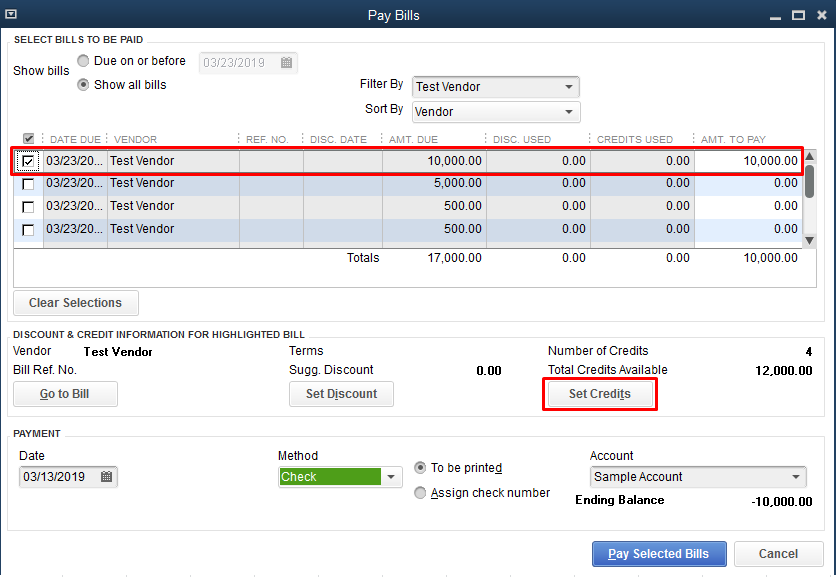

Second, from the Pay Bills page, you can select the bill and click on Set Credits to apply the vendor credit. Note that this process requires you to perform it one at a time. Here's how:

- Click on Pay Bills from the menu bar.

- Enter the vendor name.

- Select the bill you want to apply the credit to.

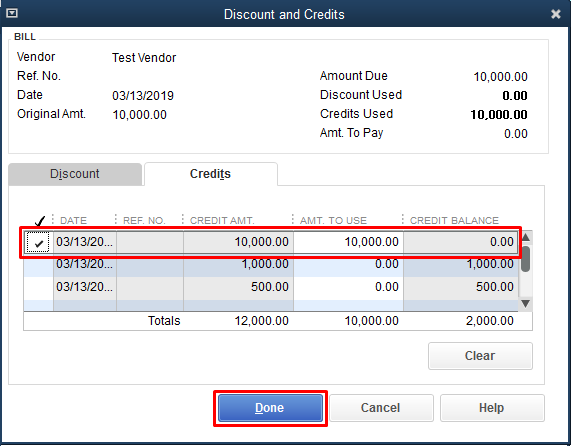

- Click on Set Credits.

- Select the corresponding credit.

- Click on Done.

- Perform step 6 & 7 until all credits are applied.

- Click on Pay Selected Bills.

Please get back to me if you have any questions with creating checks, or you have other concerns, don't hesitate to reach out to us. We'll be here to help you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

How can I change the credit set date so that it matches the payment date rather than the invoice date to which it is being applied. If I applied the credit to the example invoice, the credit "date" matches the invoice date and is not able to be changed. This causes issues when an invoice is being paid in a period that is different than the original invoice date because the "payment" with credit gets recorded in the wrong period.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

I understand and value your time, @fortresssara.

I have the information you need about changing the credit set date in QuickBooks Desktop (QBDT).

We can't change the credit set date to match the payment date on the invoice. The credit date will remain unchanged, even if the bill date is adjusted.

I'll be providing you with these articles to help you manage vendor transactions:

Fill me in if you have additional questions about bills or have other QuickBooks-related concerns by leaving a comment below. I'm always here to help. Take care always.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

Not that helpful...anyone else?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

Hello @fortresssara. Let me provide additional insights into changing the date of a credit created for your invoice in QuickBooks Desktop (QBDT).

We're unable to track the credit set date in QBDT. Applying a credit memo to an invoice is similar to recording a customer payment.

When making a payment, you have the option to apply for credit. The program doesn't record the original date when the credit was applied. It only captures the payment date. To keep track of the original credit set date, you'll want to manually enter this information in the Memo field.

You can check out this article to further guide you on how to create a credit memo or refund check in QuickBooks Desktop: Apply a credit to an invoice.

Moreover, you may consider checking this article on how to receive payments for an invoice in QuickBooks Desktop: Record an invoice payment

Feel free to reach us if you have any questions about managing customer payments in QuickBooks Desktop. I'm here to help. Take care.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

You don't choose the date, it is based on which accounting method (cash or accrual) you use. On cash basis, the credit will hit your financial statements as of the date that it is applied to the bill. On accrual basis, the credit will hit your financial statements as of the credit date.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

I have a credit that is more than any one invoice in a group of invoices that I need to pay. How do I get QB to apply that credit??? Using QB Pro Plus 2022 for desktop.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Apply Credit to Set of Invoices

Yes, arcataanimal. You can apply the vendor credits to more than one bill. Let me show you how to do it.

You can follow these steps to apply a credit that is more than any one bill in QuickBooks Desktop (QBDT).

Here's how:

- Go to the Pay Bills window.

- Choose the vendor whose bills you want to pay, in the Pay Bills window.

- In the Bills Pay section, you will see the list of outstanding bills for the selected vendor.

- Look for the Set Credits section. If there is a credit available, it will be displayed here.

- Select the credits you want to apply by checking the box next to the credit.

- The Amount to Pay field will automatically adjust to reflect the credit being applied.

- If the total credit amount is more than the total of the selected bills, the remaining credit will stay on the vendor's account and can be used to pay future bills.

- Once you've selected the bills and applied the credits, click Pay Selected Bills to complete the transaction.

Once done, this will allow you to use the full credit amount to pay off the selected bills, even if the credit is more than any single bill.

I've provided this page for more information about the complete method of how to enter a vendor refund.

I'm still here to lend a hand. Please notify us by adding a comment below. Have a fantastic day ahead.