Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHere I am again with another QBO question; a complete change from QB's desktop.

I entered 2 vendor credits. Now I want to pay the vendor. I check off all the outstanding bills, then check the vendor credit at the bottom and the credits are being added to the payment! Please help. This is so frustrating.

Solved! Go to Solution.

Hello there, @Lynn918.

The vendor credit will be added to the payment once you check it when paying the bills. If the credit is not yet to be used, I suggest unchecking it. Then only select the outstanding bills to pay.

Also, can you provide screenshots for us to further check your concern? I'd appreciate any information you can add to help determine the main cause of the issue.

Feel free to browse this article for more information about vendor credits: Manage Vendor Credits.

For more references, here are articles to help you track all money you've paid to a vendor for a particular date range:

Let me know if you have other questions about QuickBooks. I'll be right here to help you out. Have a great day.

I can help you apply the credit amount to your open bills, @beiland.

You can include the credit amount when paying your bills. This way, you don't have to create an actual vendor credit and debit or decrease your Accounts Payable.

Here's how:

If you want to track the bills and their respective payments, you can run the Bills and Applied Payments report. Just navigate through the Reports menu, and then refer to the What you Owe section.

I'm still willing to give a guide or two for more tips about handling bills in QuickBooks. You can lean on me always.

Hello, RReneeMac.

I know it's always handy to be able to manage your books just the way you'd like to. I can help go over the functions in QuickBooks Online to apply a credits to a open invoices.

Here's how:

Enter bill details and save.

Press on + New, and tap Vendor Credit.

Enter Credit details and save.

Hit on + New, and Pay Bills.

Filter by specific Vendor and Date Range to find bill.

Feel free to browse this article for more information about vendor credits: Manage Vendor Credits.

Please let me know if you have any issues after following those steps. I’m always here to help. Have a good one!

Hello there, @Lynn918.

The vendor credit will be added to the payment once you check it when paying the bills. If the credit is not yet to be used, I suggest unchecking it. Then only select the outstanding bills to pay.

Also, can you provide screenshots for us to further check your concern? I'd appreciate any information you can add to help determine the main cause of the issue.

Feel free to browse this article for more information about vendor credits: Manage Vendor Credits.

For more references, here are articles to help you track all money you've paid to a vendor for a particular date range:

Let me know if you have other questions about QuickBooks. I'll be right here to help you out. Have a great day.

after I used the vendor credit to the payment, I still see the credit amount in the transaction history. Any way I can remove the credit after being applied to payment. so that I won't confuse myself whether I used the credit or not.

Sarah

We paid a bill twice. Once by check and once by credit card. The credit showed up on the next months bill. I have to record the expense so that our bank account balance is correct. I want to show that as DR to accounts payable. I need to link that credit amt to the open invoice. How do i do this without having an actual credit memo to enter?

I can help you apply the credit amount to your open bills, @beiland.

You can include the credit amount when paying your bills. This way, you don't have to create an actual vendor credit and debit or decrease your Accounts Payable.

Here's how:

If you want to track the bills and their respective payments, you can run the Bills and Applied Payments report. Just navigate through the Reports menu, and then refer to the What you Owe section.

I'm still willing to give a guide or two for more tips about handling bills in QuickBooks. You can lean on me always.

I tried a different way... I created a Credit Memo since the credit memo amt was listed on the current bill. I keyed to credit to COGS account. When I paid the open bill (linking the credit to it) this of course decreased my COGS account and my AP account. I then did a JE to dr my COGS account and CR my AP account to correct the balances. This seems to have worked.

I am having issues applying my Vendor Credit to the two open invoices. See attached. s

Hello, RReneeMac.

I know it's always handy to be able to manage your books just the way you'd like to. I can help go over the functions in QuickBooks Online to apply a credits to a open invoices.

Here's how:

Enter bill details and save.

Press on + New, and tap Vendor Credit.

Enter Credit details and save.

Hit on + New, and Pay Bills.

Filter by specific Vendor and Date Range to find bill.

Feel free to browse this article for more information about vendor credits: Manage Vendor Credits.

Please let me know if you have any issues after following those steps. I’m always here to help. Have a good one!

Thank you - I do understand that part - but after I apply the credits - my only choice is to pay with a check. I would like to do an ACH payment. Is it possible to do that?

Thank you so much for your help.

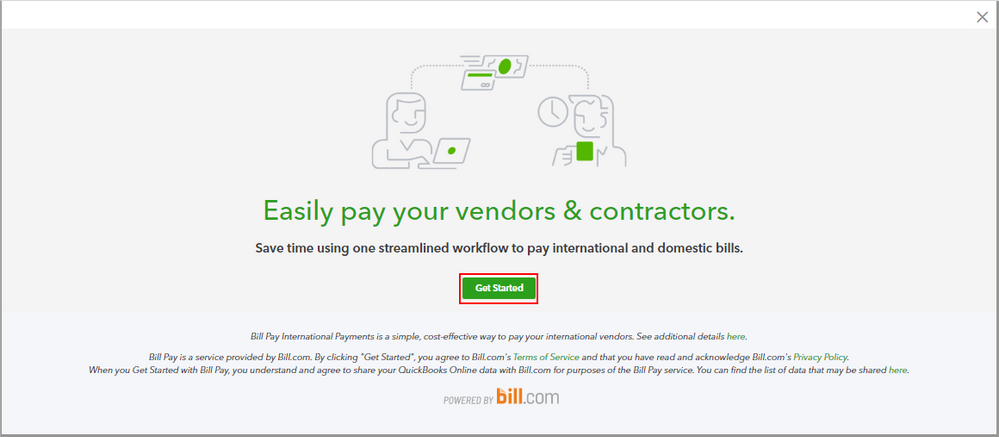

Hello there, @JackieDeFabio. Yes, it's possible to do an ACH payment when paying your vendor bills through Online Bill Pay in QuickBooks Online (QBO). Let me show you how.

You can pay your bills online for a faster transaction in QBO. We work together with Online Bill Pay to let you pay your vendor bills directly from within the system with ACH (bank transfer).

To do this, you'll first have to sign up for Bill Pay. You can either use a direct link or the Bill Pay App. If you'll sign up using a direct link, here's how:

If you opt to sign up using the Bill Pay App, please see this article for the detailed steps: Sign up for Online Bill Pay.

Once you're done, go ahead and make a payment to your vendor in Online Bill Pay. For the step-by-step guide, you can refer to this article: Pay a vendor.

Also, You may want to check out these articles as your reference in case you need to find answers to the frequently asked questions about Online Bill Pay and managing your bills through it in QBO:

Let me know in the comments if there's anything else you need or concerns about paying vendors online and managing expenses in QBO. I'll gladly help. Take care, and have a great day, @JackieDeFabio.

Hi,

Thank you for this information - the part we did yesterday - applying the credits is

what I need written down. I don't think I can remember all the steps we went through.

Thank you.

Thanks for getting back with the Community, JackieDeFabio.

I'm happy to hear Rea_M was able to help with your question about ACH payments for vendor bills.

Detailed steps for applying credits to bills can be found in AileneA's post and also in our Handle vendor credits & refunds article.

Please feel welcome to send a reply here or create a new thread if there's ever any questions. The Community's always here to help. Have an awesome day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here