Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe sent an invoice for $1665.00 to a customer 1/9/23. The invoice was paid on 2/26/23. The customer disputed the payment & they won the dispute. The funds were withdrawn from our account automatically on 3/30/23.

In our Invoice section, the account is showing with a Red ! as Disputed. I've been trying to clear this out. I've entered a Refund Receipt to the customer and matched the 3/30/23 Withdrawal to that refund receipt. The original payment is matched to the original invoice. Customer shows 0 balance. But Red! is still showing.

I tried to unmatch the original payment from the original invoice - that cleared the Red!, but then the payment did come through & was just hanging there.

How do I resolve this and clear the dispute properly through the system?

Solved! Go to Solution.

Hi there, @kpike. I can understand how frustrating it can be to see that red dispute flag appear repeatedly. I'm here to assist you with information on how to remove it.

Since the dispute flag is attached to your payments, we need to unmatch the original payment from the invoice and create a new receive payment to match with the original invoice. Here are the steps to follow:

Firstly, unmatch the original payment:

Next, create a new receive payment:

It would be best to contact your accountant to solve this issue if you don't want to remove any of the transactions.

If the red dispute flag continues to show, I recommend contacting our Customer Support Team to investigate this issue further.

Additionally, you'll find it helpful to read this article on how to personalize your sales forms: Customize invoices, estimates, and sales receipts in QuickBooks Online.

Let me know if you have additional concerns about your disputed payments. I'm always here to lend a helping hand.

I've got the steps to help you handle disputed payments, @kpike.

In QuickBooks Online (QBO), a disputed payment is referred to as a chargeback. A chargeback is when a transaction you processed gets disputed, and the money goes back to the payer.

In QBO, we can handle disputed charges by processing a Refund. Seeing as you've already created the Refund receipt and unmatched the original payment from an Invoice, we can create a check or an expense transaction affecting Account Receivable.

Here's how:

Then, we can link the Expense or the Check to the original payment by recording a Received payment.

Afterward, the invoice will re-open. We can send it to your customer if you still want to accumulate the payment, or we write off bad debt if it's uncollectible.

For future reference in handling disputed payments in QBO, read this article: Handle chargebacks and retrieval requests for QuickBooks Payments.

If you have further concerns about managing payments in QBO, know that you're always welcome to leave a comment. Keep safe!

I did the steps as suggested and I am still showing a red dispute. Can you tell what I have done wrong?

Thanks for following the suggested steps above, @kpike. Allow me to elaborate or clarify things regarding the red dispute status on the invoice.

Since the customer balance is already zero, the payment has been made. Overall, it's recorded properly. The Dispute status will still appear to indicate and provide a historical record that the invoice has been disputed. It's system-generated to ensure that there's a clear audit trail and that the status of the invoice reflects its complete payment history, including any past disputes.

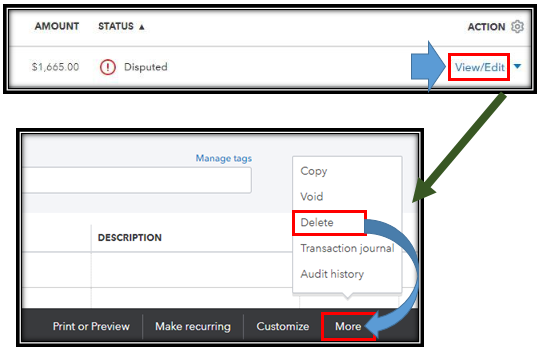

Though we don't have the option to alter the status, we can delete the invoice transaction and recreate it as a workaround. To do so, click the View/Edit button to open the invoice. At the bottom of the page, tap More then Delete. See the screenshot below for a visual guide.

You can utilize the Audit log to review the details of the invoice that you need to recreate.

Moreover, I'm adding this guide if you want to personalize and add specific info to your sales forms: Customize invoices, estimates, and sales receipts in QuickBooks Online.

If you have further questions about managing customer payments in QuickBooks Online, let me know by leaving a comment below. I'll be around to offer assistance.

I'm getting most of this. This issue that I'm now having is matching the unapplied payment to a new check or expense.

Whenever I create a new Check or Expense, I'm not able to connect it to the unapplied payment on the customers account. I'm trying to think it through - the money is there coming IN to us. A check or expense is an OUT. How can I get them to match? Do it like a credit?

Thank you for getting back to the thread, @kpike.

Let me help you match the check to the unapplied payments in QuickBooks Online (QBO).

I recommend, creating a dummy invoice and receiving payment to write off the unapplied payment and link it to the check.

Here's how:

After that, we have to receive payment to zero out the unapplied payment.

Here's how:

Then make sure that the check you created is the same customer name as the unapplied payment.

I will also include a helpful article that guides you through the process of running a report: Run reports in QuickBooks Online.

Please keep us posted if you need additional assistance in matching the check to unapplied payments. We're always here to help you out.

It sounds to me like most of the QB employees are confusing more than helping you. There is no need to create new anything. According to your screenshots, you have the invoice showing as paid, the payment showing as closed, and the refund showing paid. That should be everything. Can you just delete the disputed payment? Or, you can leave it for your records but you already have a refund receipt. It doesn't appear the disputed payment is needed. If the customer's A/R balance is $0, you should be able to delete it.

That's initially what I was thinking - just enter the refund receipt and match it. Then it's zero.

The issue was the Red Dispute flag that kept popping up to the top of the clients invoice screen. No matter what I do - if I create a new invoice and match that payment, then the red dispute pops back up. The dispute flag is attached to the payment.

I'm not sure I want to delete them - I would like a record of it. But it's getting pretty frustrating to do something that seems like it should be simple.

Hi there, @kpike. I can understand how frustrating it can be to see that red dispute flag appear repeatedly. I'm here to assist you with information on how to remove it.

Since the dispute flag is attached to your payments, we need to unmatch the original payment from the invoice and create a new receive payment to match with the original invoice. Here are the steps to follow:

Firstly, unmatch the original payment:

Next, create a new receive payment:

It would be best to contact your accountant to solve this issue if you don't want to remove any of the transactions.

If the red dispute flag continues to show, I recommend contacting our Customer Support Team to investigate this issue further.

Additionally, you'll find it helpful to read this article on how to personalize your sales forms: Customize invoices, estimates, and sales receipts in QuickBooks Online.

Let me know if you have additional concerns about your disputed payments. I'm always here to lend a helping hand.

I realize this is almost a year old but I am still struggling and the support center cannot help.

I tried to follow the steps in this resolution, however the payment cannot be deleted. The payment has already been deposited. We lost the dispute and Intuit has withdrawn the deposit. The deposit was in a previous month and has already been reconciled.

The invoice is still showing paid. I need to un-apply the payment to two invoices so I can add the invoices as bad debt write offs.

Any thoughts?

Welcome to the Community space. In QuickBooks Online (QBO), payments can only be unapplied or deleted from invoices if you haven't deposited them yet. I'll point you in the right direction to help sort this out as soon as possible, Eddie.

To delete a deposit, these are the steps:

Once done, you'll want to remove the payment using these steps:

To account for the returned payments, refer to the recommendation provided by Erika_K in this thread. Since the transactions are from the previous month, which you already reconciled, you'll have to undo and redo your reconciliation to ensure that your books are accurate and up-to-date.

Also, I recommend working with an accountant to ensure your books remain accurate after making changes. They can also provide more insights on how to deal with situations like this and what are the effective ways to handle them. If you don't have an accountant, I can help you find one. Feel free to visit this page: Find a QuickBooks ProAdvisor.

Once you're done with the paid invoices and you're ready to write off bad debt, feel free to check this article for further guidelines: Write off bad debt in QuickBooks Online.

Moreover, we're providing these articles to help you keep track of transactions inside your company:

I encourage you to post here again if you have other questions about the program or need assistance handling invoices or payments inside QuickBooks. I'll make sure to be around to extend a helping hand. Keep safe.

Technically you should see a reversed disputed payment show up on your bank feed in some way. Always double check to make sure QuickBooks had not created any refund receipts automatically. If it hasn't you can:

QuickBooks Merchant -

1. Refund/Chargeback batched out by itself, create a refund receipt (make sure it is not processing a refund so leave the check box to process unchecked), select correct bank account for it to come out of and then it should match your bank feed transaction.

2. If it is part of a Merchant Batch, you will need to create a refund receipt to go into account "undeposited funds" and then go into the left corner +new, create a deposit slip with all items on that batch selected including the refund receipt and total should match the bank feed merchant deposit.

Just to be clear, in QuickBooks Online, deposits can be confusing, you first create the deposit slip in the +new > bank deposit and make sure it goes into the correct bank account with correct deposit date, then you go bank to the bank feed and select "match" option to match it to deposit you just created. If you accidentally put deposit in wrong bank account just go back into the deposit slip and change to the correct bank and hit save.

Also, with disputed payments, most companies now require work orders/contracts to be signed by their customers so that it can be provided as proof that they had authorization to run charge the customer and the amount they were authorized for.

You may also want to create a company credit card authorization form which can also be submitted as "proof" in a dispute. In most merchant services you can find an area in their system to upload documents by a certain date and then the bank will let you know within a certain amount of days their decision.

Yes! I had a signed contract, 3 months of unpaid invoices and a CC Auth letter with her signature. We still lost the dispute with no explanation.

Returned status Fix

This is usually what I do, however I'm struggling to do this because there's only one payment for this day, and something has to be checked. Every time I have done this I have multiple payments that day so I can uncheck, however not this time with only one payment.

My problem with disputed checked and people don't recognize my business name because my bank account name is my LLC and not my DBA. So every customer will repay.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here