Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I am trying to find the best way to clear a credit card balance off the balance sheet.

Here's the track of what has happened:

6/15/23 Bill ($100) was created to pay the Owner for Office Supplies they purchased on their credit card. (DR: office supplies, CR: A/P to Owner)

7/15/23 Check written to Owner for the $100 bill above. (DR: A/P to Owner, CR: Cash)

Current (8/3/23) -- July books haven't closed. The credit card balance is still $100 on the balance sheet. What is the best way to zero it out? DR: A/P $100 CC balance, DB: Office Supplies? Am new at quickbooks so detailed advice of process is much appreciated. Thanks!

Solved! Go to Solution.

The expense has been double-booked - once when the cc charge was entered and again when the bill was created/paid to reimburse the owner. Both of those entries booked the office supplies expense. Therefore, you need to create a credit card credit of $100 and assign it to your office supplies expense account (or a journal entry: debit cc liability account, credit office supplies expense). That will zero out the cc liability account and correct the overstated expense.

Hello there. I understand that you're looking for the best way to clear a credit card balance off the balance sheet in QuickBooks given the fact that you're new to QuickBooks Online. No worries, I'm here to make sure that you'll be able to clear out the credit card balance showing.

First off, I'd like to emphasize that creating a bill won't affect the Credit Card account yet (Credit: Accounts Payable, Debit: Expense Account). It's when you create a bill payment transaction that you get to pay the bill using the Credit Card account (Debit: Accounts Payable, Credit: Credit Card).

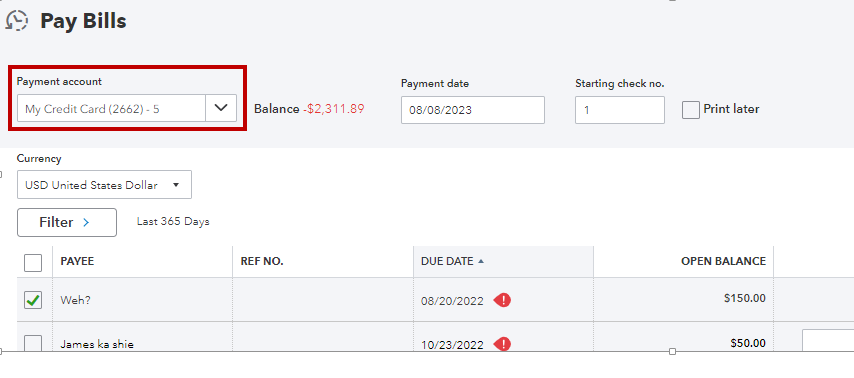

Based on your situation, I'd suggest deleting the Check and creating a Pay bills transaction, making sure that you're using the correct credit card.

After which, we can use the pay down a credit card process to pay off the balance. Feel free to check out this article for the complete step-by-step process: Record your payments to credit cards in QuickBooks Online.

Additionally, here's an article that'll help you know more about the difference between bills, checks, and expenses and when to use them: Learn the difference between bills, checks, and expenses in QuickBooks Online.

I understand that navigating QuickBooks can be challenging, especially when you're new to it. If you have any further questions or need more detailed assistance in managing your bills, please don't hesitate to ask. I'm here to help you through the process. Take care and have a great day ahead.

Am confused with "Based on your situation, I'd suggest deleting the Check and creating a Pay bills transaction, making sure that you're using the correct credit card. "

The check has already be paid to the Owner so I can't delete it. Plus it was reconciled in July already. The company obligation on the credit card should be $0 as we paid the Owner the amount he paid on his credit card. This credit card will not be used going forward. So, in essence we reimbursed/paid the Owner for a business expense he put on his credit card that was used previously on the company's books. I just need to know how to zero out the company's CC liability as we do not owe the Owner or cc any money.

Thanks for getting back in this thread, @g_Quik_Online.

I'd like to ensure we're on the same page, so I can provide you with the correct information about handling credit card balances in QuickBooks Online.

How did you record these transactions in QBO? Is it by creating a bill and writing a check? Or did you record it via a journal entry?

Also, have you linked the bill you created to the written check so it will be zeroed out? It would also be great if you could include some screenshots so I can better understand it.

I'd appreciate any additional details you can provide. I'll be keeping an eye out for your response on this.

It sounds like the company paid both the cc bill and the owner for the same expense, correct? If so, since you already booked the expense (debit office supplies) and recorded the cash payment to the owner (credit cash), and the A/P entries netted to zero, your expenses are overstated from the cc charge (debit office supplies, credit cc liability). If the cc transaction is from a closed period, reverse it with either a journal entry (debit cc liability, credit office supplies) or a credit card credit to office supplies expense. If the company did not pay the cc bill and the owner for the same expense, delete the cc transaction.

Hi Rainflurry, Sorry if I'm being obtuse. The cc was a personal card that was used for company expenses and linked through QB. 3 office supply expenses totaling $100 were made on the card in June. That cc card was then delinked from QB in June. However the company never paid the personal cc down directly so the $100 remains a liability on the company books. After delinking card, a June bill was created by previous accountant to pay the Owner for the office supplies they purchased on the credit card. In July a check written to Owner for the $100 bill.

Current -- July books haven't closed and need to zero out the cc balance. Hope I'm clearer and appreciate your time and advice.

Thanks Kevin.

In June, Expense made in QB for 3 office supplies using a personal cc linked to QB $100. Subsequently, personal cc delinked from QB.

In June, Bill was created to pay/reimburse owner of personal cc. $100 (Bill, Vendor: owner, expense: Office Supplies)

In July, Check was written to pay above bill. $100

Currently, $100 remaining on company books as company did not pay the credit card directly.

Does that make sense?

The expense has been double-booked - once when the cc charge was entered and again when the bill was created/paid to reimburse the owner. Both of those entries booked the office supplies expense. Therefore, you need to create a credit card credit of $100 and assign it to your office supplies expense account (or a journal entry: debit cc liability account, credit office supplies expense). That will zero out the cc liability account and correct the overstated expense.

Thank you again Rainflurry (this is 2nd time w/i last month). Again, much appreciated!

Hello, Rainflurry.

I appreciate you for always sharing your knowledge about QuickBooks. This will definitely help other users as well in the future. Please keep on posting here in the Community.

Stay safe and have a great rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here