Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI had to redo almost 2 years worth of entry due to some untrustworthy people. My question is this how can I mark old bills that have already been paid as paid without actually printing a check? The money is already gone and these bills are two years old

Thank you for posting here in the Community, @Bigc667.

You can mark your bills as paid by linking your payments or by recording one. Let me guide you through each option.

Usually, bills recorded in QuickBooks can be marked as paid when there are payments entered. If you've previously recorded the payment for the bill, you'll have to link them to mark it as paid.

But if you haven't recorded the payment in QuickBooks, you'll need to enter it. But you don't need to print the checks. Let me show you how:

Once done, your bills will automatically be linked with the bill and mark is as paid.

Please fill me in on how this goes. I'll here in the Community if you need further assistance.

In order for a bill to be marked paid, it has to be actually paid by a transaction - usually a bill payment check.

But you don't have to print the check. Instead, pay the bills and leave the checks marked "to be printed" and then open your bank register and assign the check numbers to match what was originally/actually done in the real world to pay the bills.

Wondering if this relates to my question:

In QuickBooks, I enter vendor invoices as they come in. Then sometimes I discover I can pay the bill, or make a partial payment, through the vendor's website using my checking acct info. After I make the payment (not using QB), how do I mark the invoice I entered in QB as Paid, or partially paid?

paymneHello, @lgc-rcw.

You're correct; it's the same theory. For the bill to reflect paid or partially paid, payment needs to reflect on the invoice. Since you paid this bill through the vendor site, this will need to reflect in QuickBooks as well.

Let's go ahead and link the payment to the invoice with a few simple clicks.

1. On the Homepage, locate Write Checks.

2. Select the account that you used to pay the Vendor bill.

3. Enter the Payee name (vendor).

4. Enter the date and amount on the check.

5. Save and Close.

When completed, it will link up with the bill and mark it as paid (or partially paid).

Let me know how it goes. I'm happy to help any way I can. Have a great day.

I have just taken over an account that has tons of outstanding bills that are not really outstanding. I have reconciled the bank account and have no idea when these bills were paid, bu the vendor shows them paid as well. How do I clear the bills without messing up the bank account?

Hello there, valerie2020.

It's possible that there were already payments or checks created that were not linked to the bill that made it stay as unpaid.

If there are checks created to pay for an existing bill you can use one of the following solutions in this article: Bill shows as unpaid after writing a check in QuickBooks Desktop.

You might also want to check with an accountant to help you the right solution according to your business preference, and we don't mess up your account.

Let me know if you other questions. You take care always!

I want to make a bill as paid without using an account from my quick books ex. someone paid it privately as a favor?

Hello, @Lab Q.

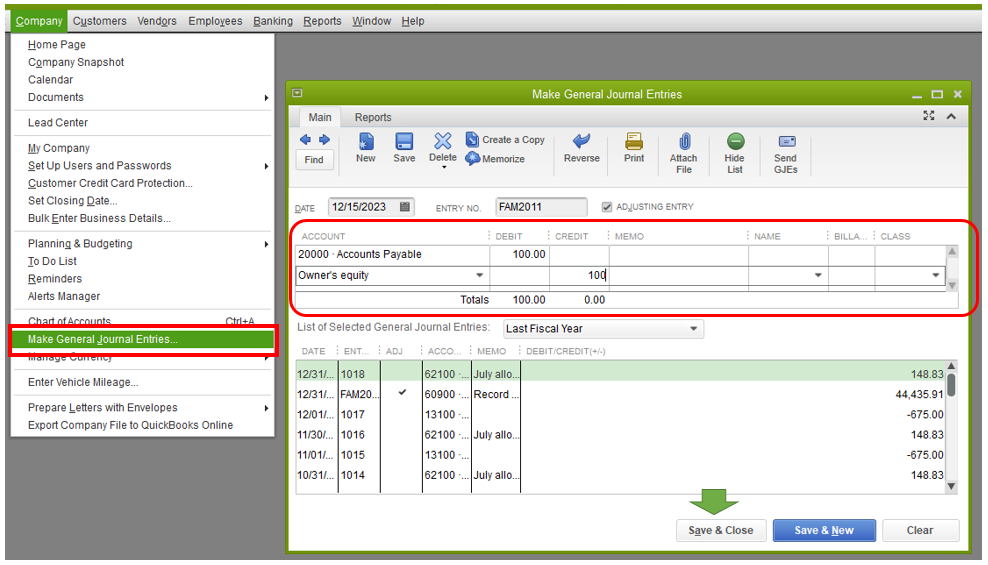

You can create a journal entry or use discounts to write off your vendor balance. I can guide you how to do it.

From the Account field, choose Accounts Payable.

Select Save & Close.

Once completed, you can apply the journal entry to the vendor's balance. Here's how:

I'd also recommend consulting with your accountant so you'd be guided accurately in tracking your expense transactions accurately. You can check this article for more detailed steps in writing off your vendor's balance using discount: Write off vendor balances (Go to Write off customer and vendor balances section).

Know that the Community and I are always here to help you in managing your income and expense transactions. Feel free to leave your comments below. Have a great day ahead!

Hello.

I went through and did all of this, but I went into the last few steps, where I need to click "Set Credits." This button does not show up anywhere. Where is the button located, after you select the bill or bills to be paid?

I tried contacting an agent through phone and messaging, but neither knew what they were doing.

Thanks in advance.

Hello there, @kresgekr.

Let me help you locate the Credit when creating a vendor credit in QuickBooks Desktop.

You can easily enter vendor credits in QuickBooks Desktop to later use them against the next bill you receive

Here’s how.

Please see the screenshots below.

For your future reference, you can use this article if you wanted to pay bills online. Using this feature, you can pay your vendor bills directly in QuickBooks Desktop. Then, QuickBooks automatically records your payment so you have an accurate record. Use Online Bill Pay In QuickBooks Desktop.

Let me know if you need further assistance with vendor credit. I am here to help. Take care.

I'm in a similar situation. I have taken over an account. My new boss had paid some bills with a credit card that does not get reconciled in QB. How do I mark the bills as paid? I don't want the customer to be credited. I just simply want the bills to show as paid without messing with the bank account, since it was paid with a credit card that is not even in QB.

I can help you manage these bills in QuickBooks, @Esther2021.

Since the credit card isn’t connected to QuickBooks Desktop, you have the option to create a Journal entry to keep track of their business transactions.

You can use the Account Payables (A/P) account to settle the bills in the program. Here are the steps to do it:

After this process, you'll want to create a bill payment to link the journal entry and the bill. You can also contact an accountant for additional advice. They can help ensure everything is constructed.

To see the complete list of workflows and other supplier-related transactions, visit Account Payable Workflow to learn more.

Feel free to get back to this page if you have any other questions or concerns besides these bills. The Community team is always here to help. Have a good one!

Hi, will this affect the balance of the bank account? or just mark the supplier bill as a paid? I am in the same situation, have supplier bills paid already directly from the bank account but were never marked as paid in QB.

I want just to mark as paid, without messing with the bank account.

Welcome to the Community, @FB2418.

I'd be glad to help you today.

It will not affect the bank accounts outside QuickBooks if you mark a bill as paid. However, it will affect any bank account inside QuickBooks since a bill is a posting transaction. As a workaround, you can set up and use a clearing account to avoid any effects on the account. Also, you can mark the supplier bill as paid.

Let me show you how to mark the supplier bill as paid:

Please feel free to review this article for more details: How to set up a clearing account.

ust hit the Reply button if you have further questions. Stay safe and have a nice day!

Hi

I am having similar situation that want mark my bill as paid since its paid thru managers credit card. I want to see the bill as marked instead of out standing bill. with connection this-

To see the action column under, do i need to activate Bank feeds.

I don't see option of action column in QB desktop.

I see this as below options only.

If i go Banking tab-Bank feeds- then drop list menu

set up..

Participating..

Import...

change bank feeds mode.

Hello, hva.

If you want to make your bills as paid, you can manually record a bill payment. However, if your bill payments are posted to a bank or credit card account and wanted to match it to the outstanding bills, you'll have to connect through online banking. You can use this link on what you need to have to get started with using bank feeds. Once you are all set you can see the ACTION column where you have the option to match the bank downloaded transaction to the ones you recorded in QuickBooks.

You can also get an overview of your vendor transaction by running reports. It will help you see if bills are correctly paid and review if there are duplicates that can mess up your books.

I'll be around to help if you have other questions. Take care!

Hi

Thank you for your quick response!

I want manually mark on the bill as "Paid" so that the bill does not show as "out standing" in the books

My bills are not posted to a bank or credit card account.

Please advise

Greetings, @hva.

Thank you for reaching out to us. I'd be glad to help you today with marking bills paid.

Here's how you can do it:

Let me also guide you on how to get started with Bank Feeds for QuickBooks Desktop.

Just reply to the thread if you have further questions. Have a great day!

What do you do if your vendor shows a balance due on the A/P Aging report, but it's non on your bill pay. I can't figure out on how to get rid of that.

Thanks for visiting us here, @KerriV.

I'll share some information about the A/P Aging report. You'll need to have a bill to apply for a credit or payment. This way, no vendor balance will be posted on the aging report.

To begin with, you'll want to pull up a vendor quick report to further investigate. Here's how:

If found, create a bill and then apply for the credit. Just go to Vendors, Pay Bills, and then click the Set Credits button. If you're unable to find a credit, it's possible that the bill transaction is damaged.

To resolve data damage, refer to this guide: Verify and Rebuild Data in QuickBooks Desktop.

If you need help with other vendor-related tasks, feel free to browse this link. It has our general vendor topics with articles:

I'll be right here if you still have questions or concerns with vendor transactions. Don't hesitate to reply. Take care and have a great day ahead.

I have almost the exact same issue as Lab Q. My client (General Contractor) has open bills to pay. The owner of their project (my client's client) paid the invoice. It did not go through my clients accounts and will not. I need to show the bill as paid as it has been paid to the vendor. What would the offsetting account be for the Accounts Payable? I had read somewhere (and now can't find) to do A/P-debit-vendor & A/R-credit-project, then to go into the orginial bill as mark as paid with the credit and the debit both checked. This does show the bill as paid. I noticed yesterday that when I got into receive payment for the project, there are a bunch of credits at the bottom. What did I do wrong? How do I fix this?

Welcome to the Community, FLB2021.

To properly identify which accounts you should use, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find an Accountant. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Here's how it works:

Once you've found an accountant, they can be contacted through their Send a message form:

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

If there's any additional questions, I'm just a post away. Have an awesome day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here