Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

I'm new to QB and I started off with using credit cards to fund the business.

Since the business hasn't made any income yet, I had to pay off the credit card statement with my own personal funds to keep the business running.

How would I set this up in QB?

Solved! Go to Solution.

Good day, tonjunee.

Yes, it doesn't matter if you used cash, a personal credit card, or a check. As referenced by my peer above, you will need to manually create a journal entry to record these transactions.

However, using this method (journal entry) needs the assistance of an accounting professional for the accounts you need to use. Also, your accountant can help and guide on which account to debit and credit. This is to ensure your checking account will not go off.

After that, you can follow the rest of the steps provided in the article. Once done, you can take a look at these resources to help you reconcile the account in QuickBooks Online:

You can get directly in touch with me if you have additional questions with recording personal funds and reconciling an account in QuickBooks. I'd be glad to help.

Hello,

Here is an article about that.

@ MarshallA

I've watched the video, but that doesn't cover how to deal with credit card purchases. It goes off of checking account. It is paying from personal funds, but not credit cards. Or does it really matter?

Also, when I go to pay for business expenses but use my funds to pay off the credit card statement at a later date, how do I reconcile everything?

Good day, tonjunee.

Yes, it doesn't matter if you used cash, a personal credit card, or a check. As referenced by my peer above, you will need to manually create a journal entry to record these transactions.

However, using this method (journal entry) needs the assistance of an accounting professional for the accounts you need to use. Also, your accountant can help and guide on which account to debit and credit. This is to ensure your checking account will not go off.

After that, you can follow the rest of the steps provided in the article. Once done, you can take a look at these resources to help you reconcile the account in QuickBooks Online:

You can get directly in touch with me if you have additional questions with recording personal funds and reconciling an account in QuickBooks. I'd be glad to help.

Hi, I am not able to find where to add a journal entry. I am only able to add transactions. Can you help me navigate to find the journal entry? I also tried to switch to accountant view and I can’t find that either. Am I in a simpler version?

Hello there, Verticalblonde.

I can help you find out the journal entry within your QuickBooks Online account.

All QuickBooks Online versions have an option to create entries. As long as you're using this platform, we can find the journal entry by following the steps below:

For additional reference, you can check and use these article to handle entries in QBO:

On the other hand, if you're using QuickBooks Self-Employed, that could be the reason why we're unable to find the journal entry option. Instead of creating entries, we can post accounts and amounts in the Transaction page.

If still have other concerns or need further clarification, please let me know. I'm always around to help. Hope you have a wonderful weekend!

Is it possible to do everything ourself, including lodging income tax return with quickbook?

Thanks for joining the thread, @MyViaCeNox.

I want to help you further with your concern, but I need to clarify some information from you. Are you using the Full-service Payroll, or is Intuit assisting you to file your tax returns automatically? Also, is this Income tax return related to the employees payroll or for your sales taxes? Any details you can provide will help me sort out the issue better.

To check which subscription you have with us, go to the Account and Settings page. Follow the steps below:

If you're referring to the full-service account, you can turn off the automated tax payment and form filing feature feature to give you more control of making your tax payments and filing forms.

Note: You can't turn this feature off during January to prevent tax filing issues.

On the other hand, filing your sales taxes in QuickBooks Online is a do-it-yourself service. You can see this resource link for more insights: Pay and manage sales tax in QuickBooks.

Please add the additional information below and mention me so I'll get notified. Have a good one!

Hi... is there a way to connect a Personal credit card account to my single proprietor LLCs QB to download transactions as they are exclusively business related? Thank you

Diego Hoic

Thanks for adding your QuickBooks concern here in the QuickBooks Community, Diego.

You can connect accounts you use for both business and personal use in QuickBooks. To do that, follow the steps below:

You can use this article as reference for the process: Connect bank and credit card accounts to QuickBooks Online

Please post here again if you need further help with banking in QuickBooks. I'll be right here if you need further assistance. Have a nice day!

This is really great, thank you. In my case, I then had to pay the credit card using the business account. So what happened is my client paid my business for the reimbursements. I then made a transfer to my personal checking so I could pay the credit card (in hindsight, I should have paid the credit card directly from my business account - but they aren't linked for good reason).

Any suggestions on how to log this?

Hi there, @sigep739. I'm glad to help you with recording your expenses in QuickBooks Online (QBO).

In your case, you can enter the transactions manually. When you use a business account to pay for a personal expense, you need to record the personal expense in QuickBooks. Then, enter the reimbursement.

Here's how:

To record the reimbursement:

For additional resources, you can open this article: Pay for personal expenses from a business credit card or bank account.

Otherwise, you can learn more about recording business expenses you made with personal funds through this link: Pay for business expenses with personal funds.

On top of this, you can always consult your accountant for additional assistance in recording the entries and picking the correct categories.

Let me know if you have any additional questions. I'm always here to help. Have a good one!

Thanks... but just to clarify - this was not a personal expense. This was reimbursement of a business expense that was placed on a personal credit card.

Am I making sense? HA! I know this is confusing. Would the process still be the same?

Hello there, sigep739.

Thanks for letting us know that this is a reimbursement of a business expense and paid using a personal credit card. This information will guide us on how to track the transaction in QuickBooks Online (QBO).

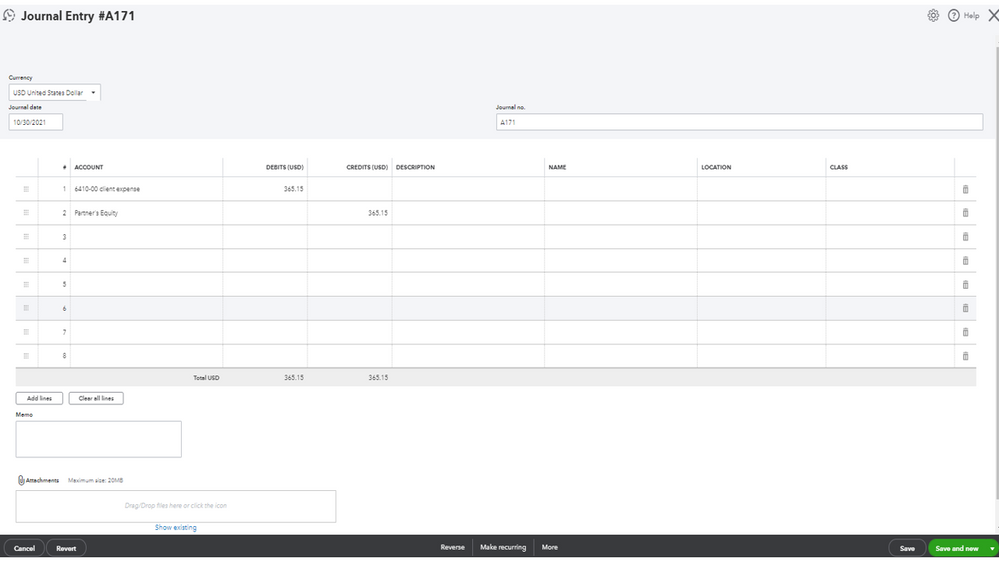

Let’s create a journal entry to record the business expense paid via personal funds. Then reimburse the transaction using a check or expense.

Here’s how:

For the reimbursement, follow the instructions in this article: Pay for business expenses with personal funds. Make sure to proceed directly to Step 2: Decide how you want to reimburse the money and choose the option that best fits your scenario.

Since your client paid for your business, I suggest creating a billable expense to track it in QBO. Check this guide for detailed instructions: Enter billable expenses.

You may also want to consult an accountant. They can provide other options on how to input the transaction into the account.

I want to ensure you can easily handle any accounting tasks in the company. That’s why I’m adding a link that lets you access your self-help articles: QBO guide. These resources contain topics about taxes, payroll, banking, account management, sales, and expense related-activities.

Drop a comment below if you need assistance with managing client-paid expenses. I’ll be glad to help you. Have a great rest of the day.

yes it is possible

My question is: How do I categorize reimbursement to my personal credit card on my business bank account? Basically I used my personal card for business expenses then paid it bank using funds from my business account. I have categorized it on my personal credit card as a business expense in QuickBooks but how do I categorize it in QuickBooks in my business bank account?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here