Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHere is my situation. I am a general contractor. One of my subs (Vendor) needed a down payment and I did not have a Bill from them yet. I wrote a check for the down payment in February. Now in March I received the Bill for the full amount. How do I apply the check from February to the Bill I want to enter in March. I also need to add that I used the Items (not expenses) Tab in the Write Checks screen and that I have already billed the Home owner (Customer) for the down payment. [Meaning I can't edit the check and change the expense to accounts payable and the customer job to the vendor because the charge has already been marked as "billed" to the Customer].

Is there a way to do this? Right now I have entered the March Bill in full and added another line item with a negative amount to showcase the down payment.

Solved! Go to Solution.

Hi there, DTetzlaff.

Good to see you here in the Community. I'm by no means an accounting professional, but I do have some insight to provide that can help get you on the right track.

In situations like this, it's still generally recommended that you change the expense to Accounts Payable. This is the ideal way of applying a down payment check to a bill. For additional insight about this, you can check out this article: Record vendor prepayments or deposits for prepaid parts or services

However, please be sure to reach out to an accounting consultant to ensure this method is the best suit for your business. With Intuit's Find-A-ProAdvisor site, you can search for certified professionals in proximity to your ZIP code that can discuss options more personal to your business's needs.

Please let me know if you need further assistance with this, I want to make sure this is taken care of. Have a great day!

Hi there, DTetzlaff.

Good to see you here in the Community. I'm by no means an accounting professional, but I do have some insight to provide that can help get you on the right track.

In situations like this, it's still generally recommended that you change the expense to Accounts Payable. This is the ideal way of applying a down payment check to a bill. For additional insight about this, you can check out this article: Record vendor prepayments or deposits for prepaid parts or services

However, please be sure to reach out to an accounting consultant to ensure this method is the best suit for your business. With Intuit's Find-A-ProAdvisor site, you can search for certified professionals in proximity to your ZIP code that can discuss options more personal to your business's needs.

Please let me know if you need further assistance with this, I want to make sure this is taken care of. Have a great day!

I am going to mark this as an acceptable solution because it will work in the future. It does not answer my question on how to fix what was done in the past. I had special circumstances that this general solution does not address.

Hello there, @DTetzlaff.

I appreciate you for taking your time in getting back to us. I'd like to furnish you with additional information on how to link the check you've entered to a Bill.

There are two options on how you can record vendor prepayments or deposits for prepaid parts or services:

Here's how to record and link your transactions:

That should do it! This will allow you to accurately record your vendor prepayments and link it with a bill.

Stay in touch with us here in the Community if you have other questions about managing vendor prepayments in QuickBooks Desktop. I'm always here to help.

To OP and others. The way I chose to fix having a check printed before a bill entered and needing linked, was noting the original check # and amount down and then deleting it. Go to entered bill and select Pay Bill. This will allow you to re-enter the check with same number and date (you noted) and have them linked. Make sure proper expense account is selected. Hope this can help some others.

This is fine... I was going to do just that. BUT my check was already cleared and account balanced in a previous month... so deleting the check means I have to back out reconciliations. WISH there was a way to point the cleared check to the bill! I didn't catch the problem for a couple of months as the bill came in much later...

I appreciate you looping in the thread, @ecsailing.

You can choose this option if the check has been reconciled.

Next, pay the bill.

When checking your transaction history, this will show the regular check as the payment.

Let me know if you have any questions. I’m always here to help. Enjoy your day!

I have a similar situation. I have a cleared check that I need to link to a bill that is showing up as unpaid. However, when I open the check I don't have the option to change expense accounts like you mentioned above. I've included an image of my cleared check. The check only shows a list of bills paid with this transaction - in this case none. In this case, how can I link this check to an unpaid bill?

Hello, @mechanicalflower.

The check you're trying to update is a bill payment check. You have accidentally deleted the bill associate with it. Let's open your audit trail to check who and when the bill was removed. Then, let's recreate and reapply the bill payment.

Here's how to view your audit trail:

Once completed, let's recreate the bill. Just make sure to enter the same bill date and details.

Now, let's link the bill payment check to the bill. Here's how:

You can refer to this article for more insights about to clear your vendors' open transactions: A paid bill or invoice shows on report or window of open transactions.

Keep me posted if you have other questions about managing your transactions in QuickBooks. I'm always here to help.

Hi @IamjuViel,

Thanks for your reply. However, this still doesn't solve the issue. There are no credits that show up for the vendor when I go to pay bills. The original bill wasn't deleted. I believe what happened is that a check was used to pay the bill from the Write Checks window instead of from Pay Bills, so the check was never linked to the bill and it's still showing up as open. The check has since cleared the bank and has been reconciled - so I need to link the cleared check to the bill. However, I do not have the option to change the expense account on the check, as mentioned above.

Thanks again for your help.

Hi there, @mechanicalflower.

Thanks for actively responding. I appreciate you for following the steps provided by my colleague, @IntuitLily, and @IamjuViel.

Looking at your screenshot, it looked like the bill associated with it was deleted. Since this isn't true to you, you should see an open bill for this in the Pay bill section.

Now, let's check the box for the unpaid bills to show the available credits as shown in the screenshot below:

Then, use it to pay the bill as shown in the screenshot below:

This will now link the cleared checks to your bill, and marked as paid.

For future reference, read through these links to learn more about bill payments in QuickBooks Desktop:

Know that we're always delighted to help in any way we can if you have more questions. Stay safe.

Mark the post that answers your question by clicking on "Accept as solution".

Hi @katherinejoyceO,

Thank you for your reply. Unfortunately in my case there are no credits available for this vendor.

Thanks for getting back to us, @mechanicalflower.

Let's run the Transaction Detail Report to see the available credit of your vendors and customers.

The Open Balance column is where you can see the unapplied or remaining credit of your clients.

Once done, you can follow the steps outlined by my colleague @IntuitLily on how to link the check to the bill.

Also, I'm adding this article on how to create, modify, and print checks. It provides steps and figures that will guide through the steps.

Keep in touch with me here should you need any additional assistance, I'm always around to lend a hand. Have a good one.

Thank you so much for working with me on this, @JoesemM.

I followed the steps you outlined, but there are still no credits showing up for this vendor. I attached a screenshot of the resulting report, with notes that will hopefully give you a clearer idea of what might be going on.

Thanks again for your help.

Welcome back to the Community, @mechanicalflower.

I appreciate you for following all the resolution steps provided by my peers and sharing the result.

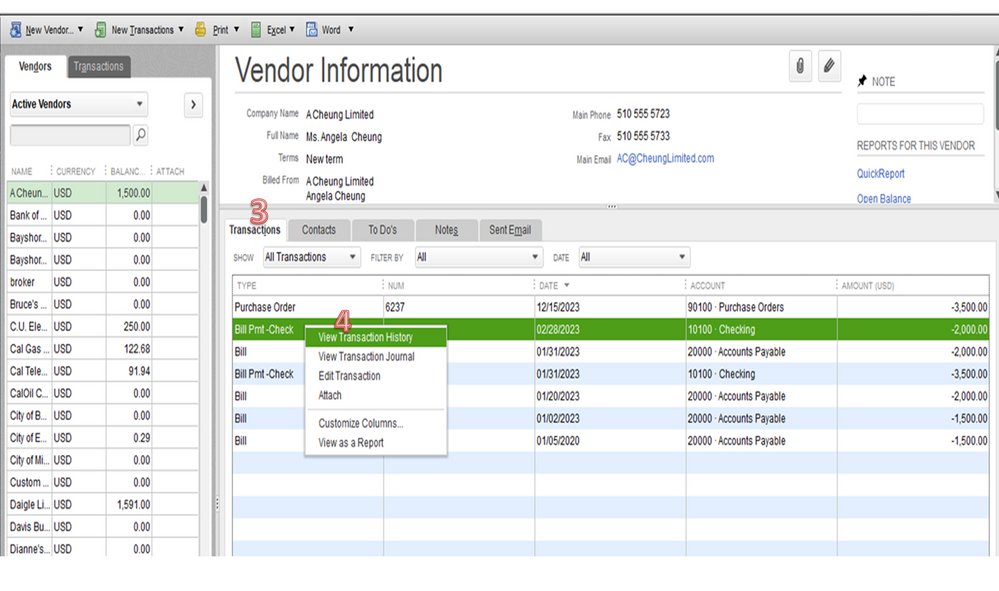

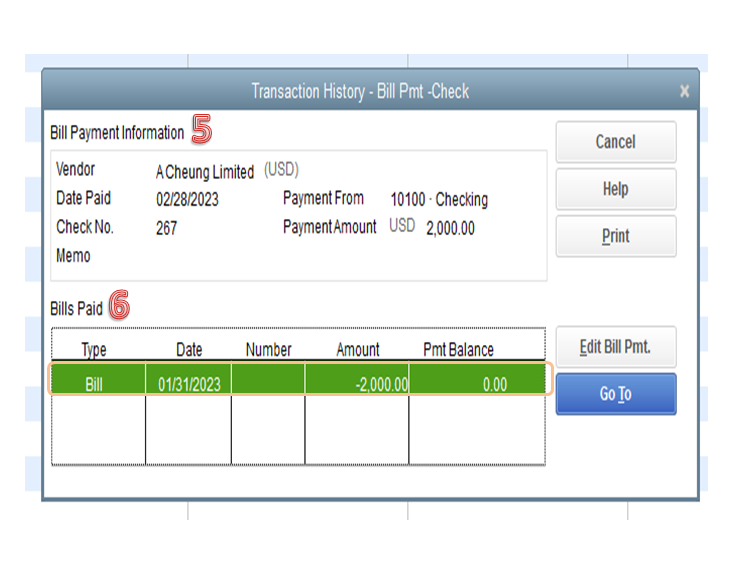

You should be able to see the Total Credits Available for the transaction. Let’s view the transaction history for the bill payment check.

This is to check which transaction it’s applied to. With just a few clicks you can perform this task.

If the entry showing in the Transaction History window is incorrect, void the bill payment check to unlink it. The following guide provides detailed information when to remove a bill or payment check: Void or delete a bill or bill payment check.

Once don, recreate the transaction and apply it to the right bill. If none of these suggestions work, I recommend you get in touch with our Technical Support Team.

They can access your company file and transactions in a secure space. Aside from that, our specialists have tools to help perform in-depth troubleshooting.

Once the resolution is available, they’ll guide you through the process on how to resolve the issue. Here's how to contact them:

You can bookmark the Fixing Accounts Payable Errors in QuickBooks article for future reference. It contains tips on how to resolve account payable issues.

Please know the Community has your back. If you have any other concerns, post a comment below. I’ll pop right back in to assist further. Have a good one.

You are awesome! This is perfect!

Here is my response to this common problem:

Attaching a bill to a payment after reconciliation (DESKTOP)

The need for this procedure arises when a payment has been entered and reconciled before it is attached to a bill. The payment is reconciled but the bill is not so the bill persists in the Pay Bills list after the corresponding payment has been entered. The bill appear unders “Home > Pay Bills.” The payment appears under the vendor’s name under “Vendor Information”

Thank you for this clear explanation. It was perfect!

I am having this same issue right now. I was behind on entering bills so I just wrote a check and put it to a "clearing account". Same as you, the original check is now cleared and here is what I did.

Even though you have reconciled, you are replacing the exact amount of the check with one that is linked with the bills and it has cleared, so it will not effect your reconciled bank account at all.

I hope this helps. I have been doing this all day trying to play catch up :-)

This is the best method. Thank you for your clear and accurate response. I have used this method with success several times now.

Good morning. I had this same issue and was able to correct it to reflect the paid amount to the vendor. I made a deposit payment in March, did not receive the bill until July.

Right Click and select to edit the transaction

Make sure the date of the bill is before the payment.

In the column, "Account", change to Account Payable

In the column, "Customer Job", make sure the vendor is reflected.

That is how i did it and it worked and showed a zero balance.

Hope this helps.

I have several vendors that checks were written for, in the write checks app. They do appear as credits on the unpaid report, along with the actual invoice. When I try to attempt to pay the open invoice, in pay bills, this credit does not appear in the set credits??

Thanks for joining this thread, @sweetsue1010. Let me share some information about credits in QuickBooks.

Let's make sure to select your Accounts Payable account for your deposit so you can successfully record your vendor's credit. This way, it'll be also recorded as an available credit to be applied as payments for your bills.

Here's how:

Then, link the deposit to your vendor's credit:

Once done, you can now successfully pay your bills with the vendor's credit you just recorded. For more information, you may check out this article: Record a Vendor Refund in QuickBooks Desktop.

Additionally, let me share this relevant resource you can utilize for your future tasks about recording your vendor's credit: Transfer and Apply Credit from one Vendor to Another in QuickBooks Desktop.

Feel free to comment below if you have further questions about paying bills and recording credits in QuickBooks. I'm always around to help. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here