Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a question on how to properly record transactions from a fuel card. I am leased onto a trucking company. For fuel, we take an $ advance from the current job and it is placed on a Fuel card. Then at the truck stops the fuel card is used as payment, this allows for discounts at certain stops. Then once we receive our settlement check the fuel advance has already been deducted from our pay. The fuel card can't be used unless money is already on it so it is not a Credit Card in traditional sense. So my question is should I set up the Fuel card as a Credit Card in QB, using the advance as a payment to the card and the fuel receipts as the charges? Or should I set it up as a bank account?

Solved! Go to Solution.

Hello there, @sharrington55.

I appreciate you providing details and posting here today. I can help you record the fuel card in QuickBooks Desktop.

You can set up and use a credit card account to help you keep track of the charges and the payments made for the expense. Here's how:

Next, the fuel receipts should be entered as a credit card charges. Here's how to do it:

Lastly, you'll have to write a check for the payment. For in-depth information, please refer to this article: Set up, use, and pay credit card accounts.

If you're using QuickBooks Self-Employed (QBSE), you don't have the option to add a bank or a credit card account. In order for the transactions to be recorded, you'll have to manually add and categorize them.

That should get you on the right track, sharrington55.

If there's anything else you need, just add a comment below. I'm still here to help you more. Have a good one!

Hello there, @sharrington55.

I appreciate you providing details and posting here today. I can help you record the fuel card in QuickBooks Desktop.

You can set up and use a credit card account to help you keep track of the charges and the payments made for the expense. Here's how:

Next, the fuel receipts should be entered as a credit card charges. Here's how to do it:

Lastly, you'll have to write a check for the payment. For in-depth information, please refer to this article: Set up, use, and pay credit card accounts.

If you're using QuickBooks Self-Employed (QBSE), you don't have the option to add a bank or a credit card account. In order for the transactions to be recorded, you'll have to manually add and categorize them.

That should get you on the right track, sharrington55.

If there's anything else you need, just add a comment below. I'm still here to help you more. Have a good one!

I have a fuel card also, and my customer pre-pays me for each load say 1000.00 and I also use the card to make fuel purchases. How do I handle the pre-payment amounts? or do I just upload via csv the fuel costs and then transfer the funds that are left into our business checking account.

Thank you for joining the thread, @land7784. And I'm here to help handle your pre-payment amounts.

You have two options to record customer's pre-payments in QuickBooks Desktop.

First, you can utilize the remain as available credit option when receiving the payments. However, it creates negative Accounts Receivable (AR). Here's how:

Your second option is to upfront deposits or retainers. Below is the step by step process:

Step 1: Set up a liability account for upfront deposits or retainers

Step 2: Create an upfront deposit item

Step 3: Record upfront deposits or retainers you receive

Step 4: Create invoices

Step 5: Apply upfront deposits or retainers to invoices

For the detailed steps and information on every step, feel free to check out this article: Manage upfront deposits or retainers.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day.

Humm.. not sure that answers my questions

so the fuel card is loaded with half the proceeds of the job up front say 1000.00 then my husband uses part of the 1000. to purchase gas say 200.00, which leaves 800.00 then once the load is deliver he gets the second payment of $1000. and now there is a total of 1800 on the card, then I transfer say $1400 to my business checking account to pay other business expenses. So any given week or at the end of every load I will be moving money into the checking account. So essentially they the gas is prepaid expenses, thought of using the csv to upload the expenses which would show a credit and off set the expense created for the gas and just move the remaining into checking to pay other bills

I am using quickbooks online for my fuel card, how do I record the advance?

I appreciate you for joining this thread, land7784.

I can help provide insights on how to record this in QuickBooks Online. You may want to create a Liability account or an Asset account wherein you can deposit the Fuel advance. You can follow the steps I outlined below in creating a Liability account:

The moment you pay the fuel expense, you may create a Journal Entry either to apply on a Bill or directly on the Expense account. Here's how:

Here's an article about you can read about tracking your expenses for your reference.

Let me know if you need more help with recording fuel advance. I'll be around for you.

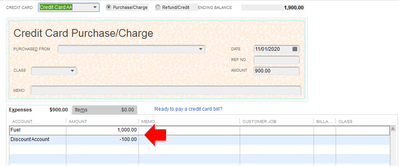

I am using Quickbooks Desktop Pro Plus 2020 for my fuel card, how do I record the Fuel discount?

Good day, Edgar Jr.

Thanks for joining us here! You can add a discount line when you record the fuel purchase. Let me show you how.

Post again if you have more questions. Stay safe!

Fuel discount? it is an income account?

Ok. But in which category do I place a discount account? income?

I also would like to know what account to use for the discount.

Hi everyone:

I feel very identified with this situation. I do the accounting for my Transportation Company and I have doubt when receiving payments. The payments for loads we run every day are deposited by the Factoring Company directly on the EFS Card, once we have money on the card we use it to put fuel at the truck stop, (and always maintaining a minimum balance of $ 1000 on the EFS card) we transfer the rest to the regular checking account. My questions are the following:

Should I register the EFS card as a Checking or Credit Card account in the chart of accounts?

How can I avoid doubling the Income amount? Initially it is received from the factoring company to EFS Card and after the drivers used for for fuel the remaining balance is transferred to the company's checking account at the end of the day. Also, every driver has an EFS card with the same scenery.

I use Quickbooks Online.

I would greatly appreciate your help.

This is a response for sharrington55. We are in the same situation. This is what I did. I set up the fuel card as a bank account. I also set up a Fuel Advance account as an Other Current Asset. When we receive a fuel advance, I do a Transfer Funds from the Fuel Advance account to the Fuel Card. When we receive our settlement, I show the Line Haul Income, Fuel Surcharge, etc and also show a line as a negative for Fuel Advance. This way you are showing your income correctly to match your 1099. When I do the deposit for the settlement, everything gets deposited to the Fuel Card. Then I do a Transfer Funds for the amount you put in your checking account. And last, I do a journal entry once a month (you could do daily, weekly, etc) with a debit to the Fuel expense account and a credit to the Fuel Card. This keeps the balance on the card correct. I don't have Quickbooks online though. I hope this helps out any other truckers out there!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here