Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello guys, a couple of days ago I posted a question about registering the leftover money from transfers or checks the bussiness runs for making payments. Somebody can tell me How do I register the leftover money because everyday I bring leftover money from transfers From the company i work for. For example I recived a transfer from my boss to buy some office expenses , AND I always buy things with transfers AND it always remains cents . How do I register the leftover money specially if the money comes from transfers the company Made.

Solved! Go to Solution.

Hello there, @exaida.

The Petty cash account will be the one to hold those changes. Petty cash account will be the ATM and month on hand when you withdraw. You'll just have to make a transfer from business to petty cash for £20.00, then create an expense transaction in the petty cash as a bank for £19.25. The remaining balance will be left.

Also, if this remaining balance for £.75 will not be returned to the business account, you can just create another Expense transaction for unreturned changes. On the other hand, if holds to be added to the next purchase, just leave the balance as is.

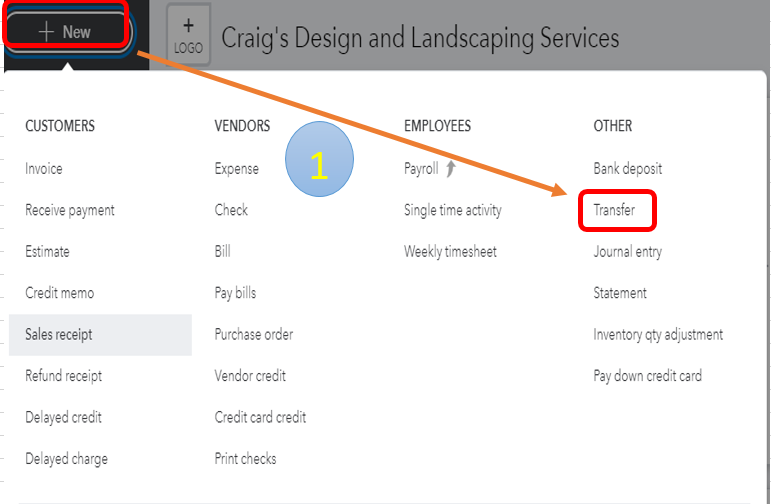

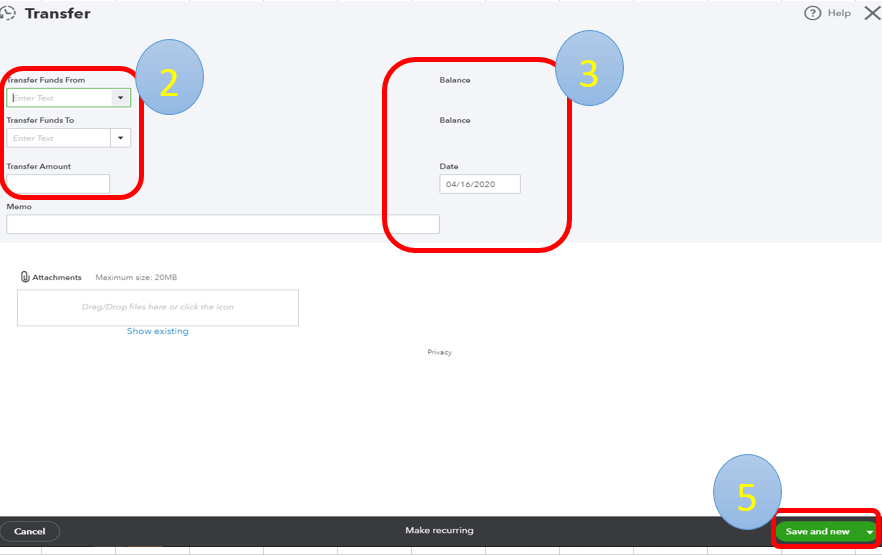

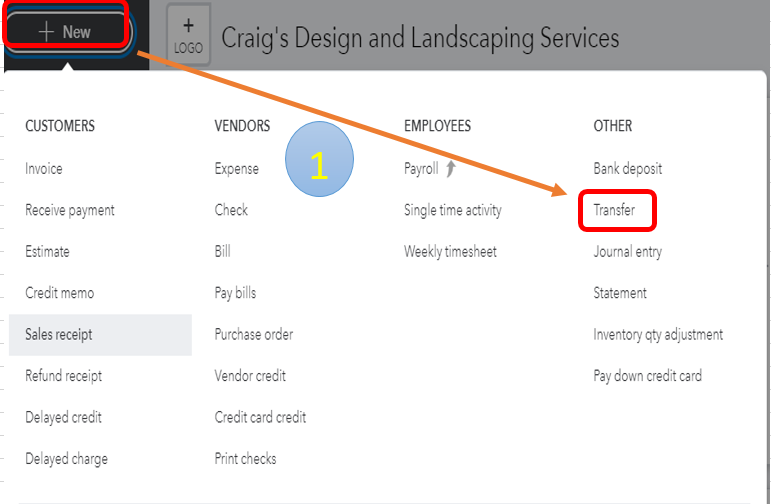

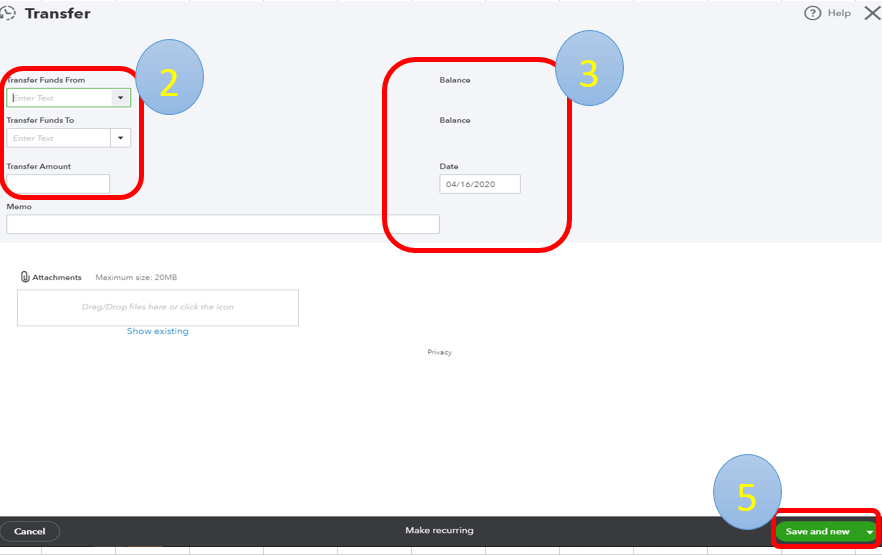

However, if it will be returned, just create a Bank Transfer. I'll guide you how:

Furthermore, here's an article to learn more about how to transfer funds between accounts in QuickBooks Online. This way, you'll be able to track it easily in your register.

Consider reading this handy help article in case you've got other QuickBooks concerns, such as setting up advanced reports, online banking, manage reconciliation, transactions, import and export data lists, etc. This way, you'll have better ways on how to manage your business efficiently and effectively.

Please know that I'm here in case you needed any help. Take care and have an awesome day!

Welcome back, @exaida.

I'm glad that the solution worked for you. Please know that I'm just a reply away in case you needed any help in the future.

Also, you may consider checking out these sites to learn more about QuickBooks.

Don't hesitate to get back here in the Community if you've got more QuickBooks concerns. Take care and have a great day ahead!

Hello there, @exaida.

The Petty cash account will be the one to hold those changes. Petty cash account will be the ATM and month on hand when you withdraw. You'll just have to make a transfer from business to petty cash for £20.00, then create an expense transaction in the petty cash as a bank for £19.25. The remaining balance will be left.

Also, if this remaining balance for £.75 will not be returned to the business account, you can just create another Expense transaction for unreturned changes. On the other hand, if holds to be added to the next purchase, just leave the balance as is.

However, if it will be returned, just create a Bank Transfer. I'll guide you how:

Furthermore, here's an article to learn more about how to transfer funds between accounts in QuickBooks Online. This way, you'll be able to track it easily in your register.

Consider reading this handy help article in case you've got other QuickBooks concerns, such as setting up advanced reports, online banking, manage reconciliation, transactions, import and export data lists, etc. This way, you'll have better ways on how to manage your business efficiently and effectively.

Please know that I'm here in case you needed any help. Take care and have an awesome day!

Excellent Solution.

Welcome back, @exaida.

I'm glad that the solution worked for you. Please know that I'm just a reply away in case you needed any help in the future.

Also, you may consider checking out these sites to learn more about QuickBooks.

Don't hesitate to get back here in the Community if you've got more QuickBooks concerns. Take care and have a great day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here