Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Our previous bookkeeper made payments to a vendor but did not match the invoices paid to the checks. The vendors balance is showing a negative amount. I checked the audit trails for the transactions, and corrected the transactions to reflect the invoices paid. I cannot find where the negative balance comes from, we owe nothing to this vendor. Any suggestions on getting the account to zero?

Hi there, @Angie13,

A negative balance on your vendors account can happen when payable checks were written, but there are no bills created or the original bills got deleted. It's also possible the bill was overpaid.

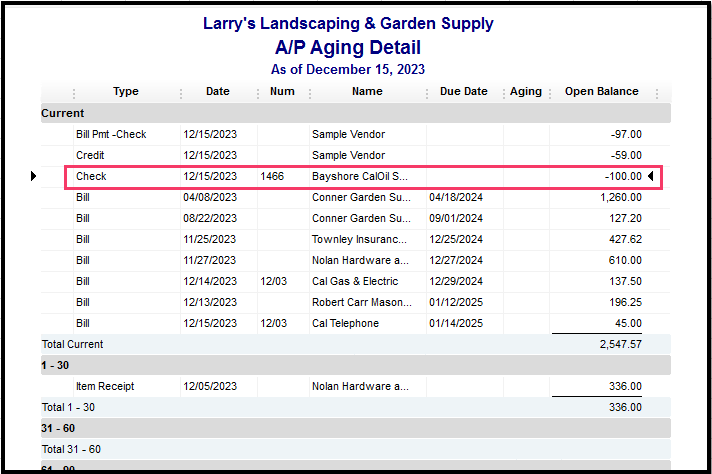

Let's pull up the Accounts Payable Aging Detail report and scan through the report to see negative amounts.

Here's how:

Once done, go back to the Vendor list, the balance will is now zero.

On the other hand, if the bill was overpaid, you have the option to apply the credit to the next transaction.

Should you need some clarifications, please let me know and I'll get back to you.

Same issue but different question. Our company has had several different bookkeepers all using credits from the vendor differently. I have used current credits that I have received since I started doing the books, but there are credit balances hanging out there from 2018 and I cannot find a paper trail or account that these credits are hitting. I have tried to review the audit trails but I do not see anything. Is there report that I can generate for just credits received from the vendor?

Hello Angie13,

Thank you for posting here in the Community. I'm here to assist you with any questions you may have regarding the vendor report in QuickBooks Desktop.

You can try to create a custom report to obtain the available credits within the QuickBooks program.

Here are the steps:

See this screenshot for your visual reference:

The Check Detail report will also show multiple bill credits on your vendors. For the detailed steps, I'm adding the article I recommend on this (scroll down to A report that shows how Bill Credits are applied):

Please don't hesitate to come here with all of your needs concerning the vendor report for the credits. The Community is here to ensure your success.

Thank you, this helps finding the credits. Not sure why but there are credits entered as $0 though.

Hello Angie13,

I'm glad to know the information above helps you with the credit. Allow me to help provide additional information regarding running the report in QuickBooks Desktop.

Available credits should show the amounts on the Open Balance column in the reports. If you're unsure of the results, you can always double-click a transaction in question to view the bills paid and payment amount.

If the information showing is still not correct, you can also try running the Verify and Rebuild Data utility. By running this process, it'll self-identify any data issues and resolve them on your behalf.

For the detailed steps, I'm adding the article I recommend on this:

Verify and Rebuild Data in QuickBooks Desktop.

I look forward to serving you to the best of my ability, so please let me know for any further assistance you need. The Community has your back.

Good Morning. I have a similar situation. My Vendor has a negative balance because a number of credit card payments were entered without entering bill for them to match to. I was told by my accountant years ago that you didn't have to enter a bill that you could just enter the credit card payment by itself because it had all of the correct accounting information to keep the ledger correct. It looks like this was incorrect information since I now have the negative balance in the Vendor Account. Could you tell me if I am understanding this correctly and should I follow the instructions you have provided to clear these transactions off?

Happy Tuesday, @TBSParkin2011.

To clear things up, you'll have to enter a Bill for your Vendor so you can match the payments to prevent a negative balance. You can follow my colleague's @MaryLandT steps they've provided.

If you hit any bumps along the way, don't hesitate and leave me a Reply so I can further assist you!

I have the same issue where vendors show a credit balance from a payment not applied to a bill. These credits were created several years ago so I'm hesitant to do anything to them as I do not want to modify previous years books. How can I zero the vendor balances in 2020, even though the credit is from 2016?

Thank you for chiming in on the thread, HHSSam. I will be delighted to show you how to write off the vendor's balance. There are two options to do this. You could either create a General Journal Entry to write off the amount or use discounts to write off small amounts. Here's how:

The next process would be to add the journal entry to the existing debits or credits.

For more information on how to use discounts to write off small amounts or general journal entries for customers or vendors, I encourage you to check out this article.

As far as your books, I suggest working with a bookkeeper or an accountant to find out to this entry will affect your previous books. If you do not have a bookkeeper or accountant, no worries, we provide a ProAdvisor program. Simply enter your zip code and connect with experts within your area. They do offer a free consultation if you are interested.

Please let me know if you have any more questions regarding your vendor balance. I'll be around to assist you. Take care.

I tried the fix to create a bill and received an error message

You cannot use more than one

A/R A/P Account in same transaction.

My vendors payable is showing 90 accounts in negative and I need to get this cleared up. Using QB2023

Hello

I would like to create a negative balance for a Vendor, because their statement is negative and When I get payment from the Vendor, I want to assign to that negative balance. What are the ways to that. I cannot choose A/R because it is not customer. It is a Vendor.

Hi there.

Let me help you create a negative balance for your vendor in QuickBooks Desktop. Please note that it's advised to refer to your accountant when dealing with balance adjustments to ensure correct financial information.

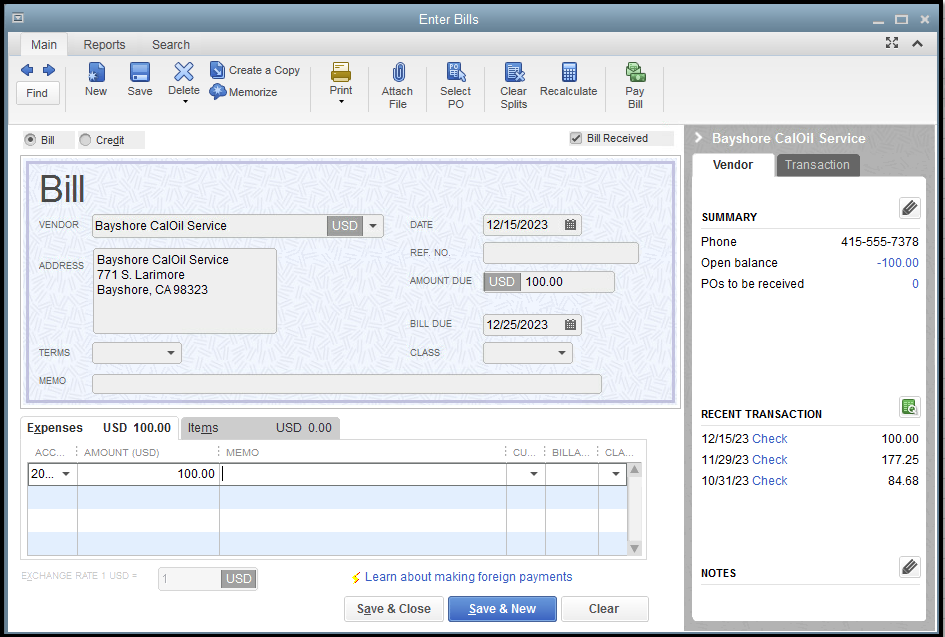

You can create a check transaction for that vendor and choose Accounts Payable account.

Furthermore, you can consider adjusting the current balance for your vendor in QuickBooks Desktop.

If you have additional concerns besides creating a negative balance for your vendor, feel free to reply below. I'm always here to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here