Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHere's the scenario:

1. Invoice created and sent to John Smith, LLC for $100

2. John Smith,LLC pays me $150

3. John Smith, LLC says that we can keep the extra $50 for a future invoice

This is where I am not sure the next steps.

In Option 1:

1. Make receive payment for $100.

2. Make Credit Memo to Client for $50

Problem: When the I go to make a deposit - I cannot attach a credit memo, so it will only attach the $100. How do I match to the other $50?

In Option 2:

1. Make Receive Payment for $150.

2. Match to the Deposit of $150

3. It allows me to save the extra $50 as a credit

Problem: It is showing a negative $50 in my A/R on cash basis.

How would I make sure that I have the credit for a future invoice - if that invoice is not created for a year, and also not have negative A/R showing up on my Balance Sheet in Cash Basis?

Solved! Go to Solution.

Thanks for getting back to the thread, @Trudye.

I'll conform with others and share information that could help clarify things for you.

To help you properly handle an overpayment from a customer in QuickBooks Desktop Enterprise, you could follow these steps:

Option 1: Create a Credit Memo

Option 2: Apply the Overpayment to Future Invoices

Furthermore, the A/R is negative because it is a balance that will be cleared if applied to an invoice.

You may visit this article for tips about handling your QBDT reports: Customize reports in QuickBooks Desktop.

Please don't hesitate to reach out to us if you need assistance with QuickBooks-related concerns. Have a nice day!

Hello there, Trudye. Thank you for sharing detailed information about your overpayment issue. I'm here to lend a hand on how QuickBooks handles this.

QuickBooks Desktop will ask if you want to retain the credit or refund the customer. The overpayment is negative A/R which is why it's showing negative on your balance sheet. If you choose to leave the credit for future use, here are the steps you can perform:

However, if you choose to refund a customer, please follow the process below:

To learn more about the process, read this article: Give your customer a credit or refund.

I also encourage visiting our Customer Transaction Workflow Guide to help track your sales and receivables in QuickBooks Desktop.

If I can be of any assistance, please don't hesitate to visit this thread again. I'll be right here to assist you again.

Ok - so with the example - when they pay me..

I am supposed to receive payment for 150, and then second step is follow your list to make a credit memo?

Because I am not able to do a normal receive payment for 100 and then your steps for 50 and have it match to the bank deposit I make in QB.

Thanks for getting back to the thread, @Trudye.

I'll conform with others and share information that could help clarify things for you.

To help you properly handle an overpayment from a customer in QuickBooks Desktop Enterprise, you could follow these steps:

Option 1: Create a Credit Memo

Option 2: Apply the Overpayment to Future Invoices

Furthermore, the A/R is negative because it is a balance that will be cleared if applied to an invoice.

You may visit this article for tips about handling your QBDT reports: Customize reports in QuickBooks Desktop.

Please don't hesitate to reach out to us if you need assistance with QuickBooks-related concerns. Have a nice day!

I have a similar situation with an older transaction.

Invoice was $100, payment $125.

I created a credit memo and generated a check for the credit memo.

Now, the customer account shows a negative balance of 25. The check did not zero the credit memo.

I'm not sure how to resolve the balance? Thank you, Jennifer

Hi there, jennifer.

I can share some info to properly handle customers' overpayment and resolve the balance issue in QuickBooks Desktop.

Since you've already recorded a $125 invoice payment, you don't need to create a credit memo to match it with a refund check. If you've already created the check and credit memo, you can delete them and process a refund check directly through the invoice payment. This will allow you to link the refund check to the payment and resolve the balance issue.

Here's how:

I've added this article for more information about creating a credit memo or refund check in QuickBooks Desktop: Give your customer a credit or refund in QuickBooks Desktop for Windows.

If you also need to void or refund a customer payment, use this link as a reference: Void or refund customer payments in QuickBooks Desktop.

Don't hesitate to leave a comment below for any follow-up questions about customer payments and invoices. I'll always do my best to assist you.

What can you do if overpayment was from 5 years ago? It seems like if I try to apply a credit to a current invoice it wants to apply the credit on the date of the overpayment. We have had audited financials we can make any prior period adjustments. What would be my options?

Thanks for joining the thread, cwdecm. I'll guide you to the best support that can help you with your overpayment.

Since the overpayment was made five years ago and you've already made adjustments for prior periods, I would suggest seeking advice from your accountant on how to handle this situation in QuickBooks. They will be able to guide you on correctly applying the overpayment to ensure that your records remain accurate.

You can also find one by following the steps below:

I'll be sharing these resources that will guide you in tracking customer transactions and how to clear out your customer and vendor balances in QuickBooks:

You're always welcome to tag my name in the comment section below if you have other questions about overpayments. I'm always here to help. Take care.

I have the same issue except, Quickbooks Desktop has made an invoice for the overpayment and applied the overpayment to the invoice that QB created. I have already refunded the overpayment and sent a check to the customer. When I uncheck the invoice QB made, it askes me about creating a credit or giving a refund...again.

I've got your back in handling the overpayment accordingly in QuickBooks Desktop (QBDT), Robin. To address this matter accurately, I'll help you account the check to Accounts Receivable and link it to the available credits via Receive Payments.

If the invoice mentioned is erroneous, we can delete it in the system. In doing so, the linked overpayment will be unapplied. Here's how:

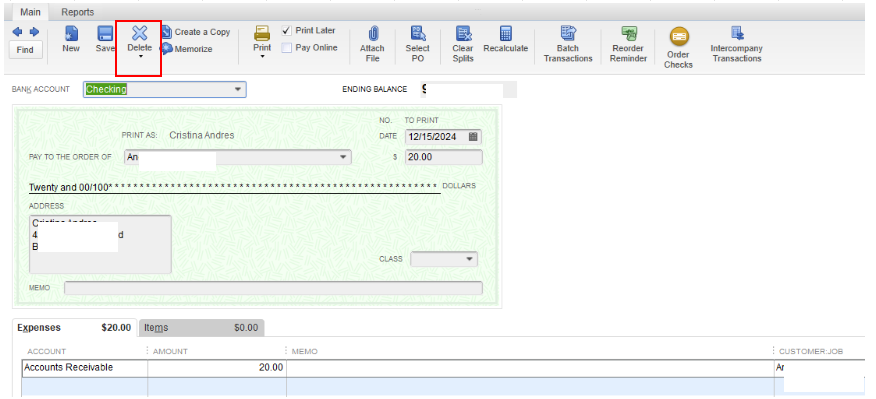

Following that, let's edit the associated account on the check and change it to Accounts Receivable:

Finally, let's link the check and the credit by utilizing the Receive Payments feature:

To learn more about handling customer refunds, kindly check this link: Give your customer a credit or refund in QuickBooks Desktop.

You may also review this article to help you once you need to pull up and organize your reports according to your preferred displayed information: Customize reports in QuickBooks Desktop.

If you have additional queries about customer refunds or need help managing other transactions and data, drop by again on this thread. I'll be around the clock to assist you promptly.

I did exactly that, and it clears the credit balance from the payment, however the check I wrote is still showing in my note balance.

Duplicate checks may have caused discrepancies on your note balances, Jaramillo. Let's further verify your transactions.

If you have already applied a refund for the invoice payment, you won't need to create a new check transaction. You'll have to modify the account of the refund check affecting Accounts Receivable (A/R) to avoid duplicates and discrepancies on your note balances.

Please refer to the screenshots below:

To delete or void the duplicate check, here's how:

However, if these checks aren't showing as duplicates on your end, you can share screenshots in this thread and hide all confidential details. This way, I can provide a proper workaround to your concern.

Moreover, I'm sharing this guide to help you keep track of your overall transactions: Customize reports in QuickBooks Desktop.

Make sure to reply below for any additional queries when handling customer invoices and payments. Stay safe.

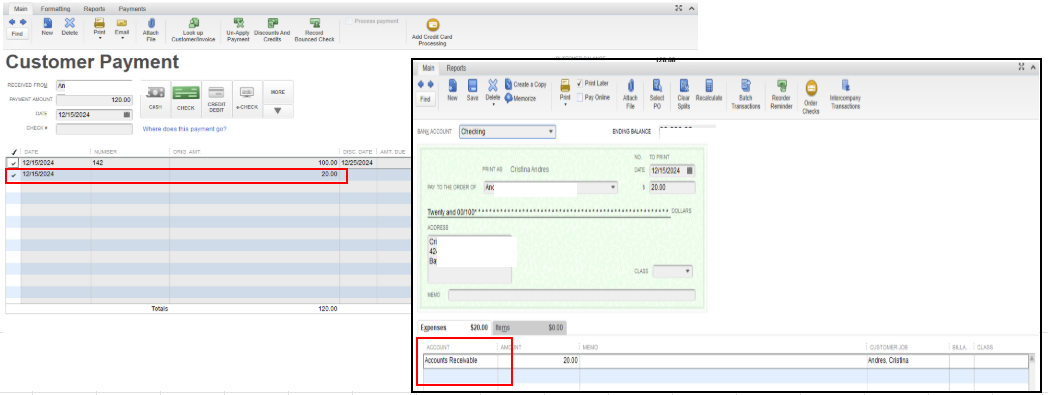

Ok these are my screenshots

This is what I see in the customer account:

This is how the check was written

[Screenshot removed]

Is the problem that the money was put in undeposited funds when it was posted on the customer account.

Then when we wrote the check, we put it from Accounts Receivable.

Thank you for providing a screenshot. You can update the posting account for the payment to ensure it aligns with the check, Jaramillo562.

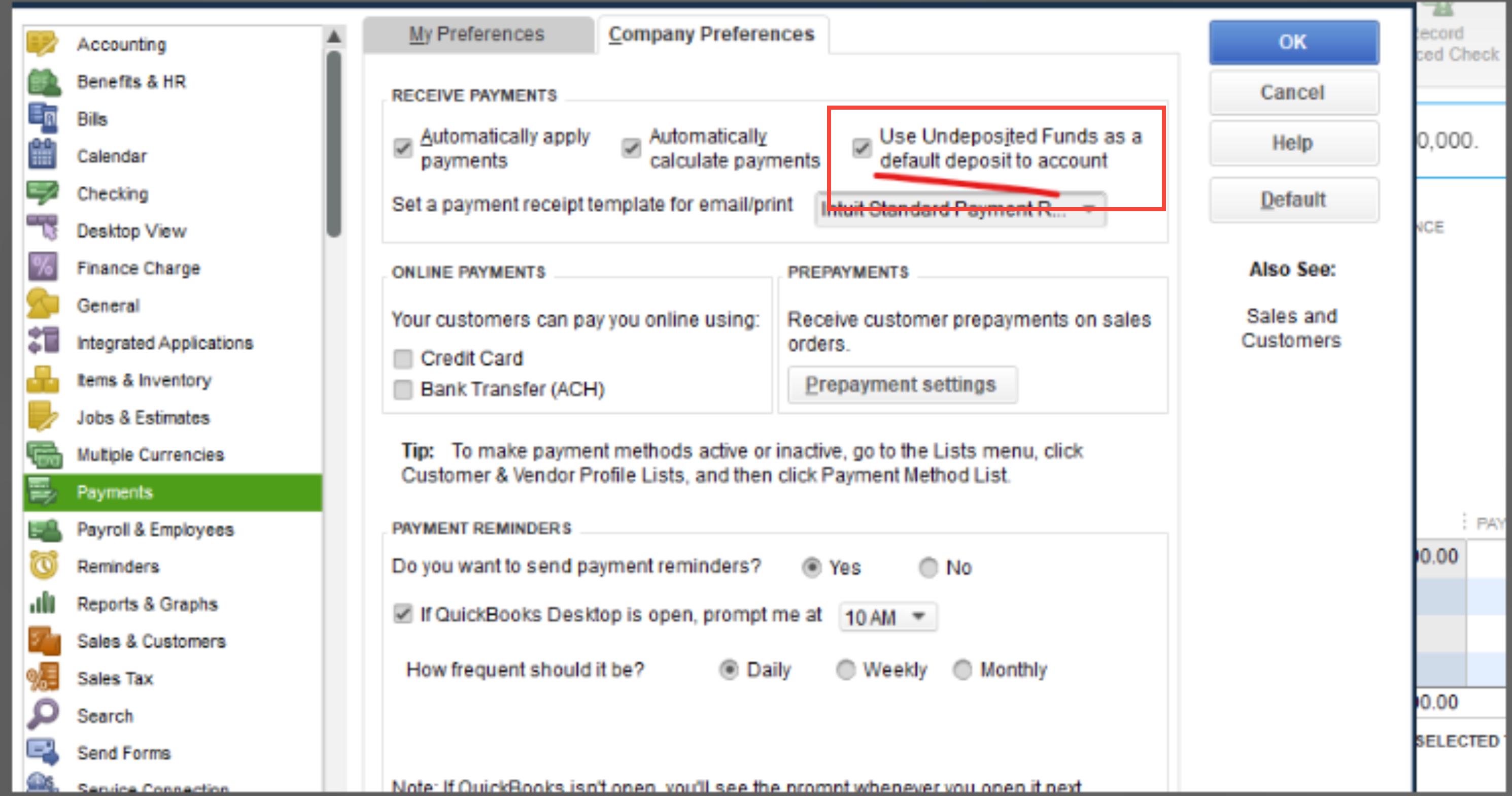

To do this, you first need to turn off the Use Undeposited Funds as a default deposit to the account. Here's how:

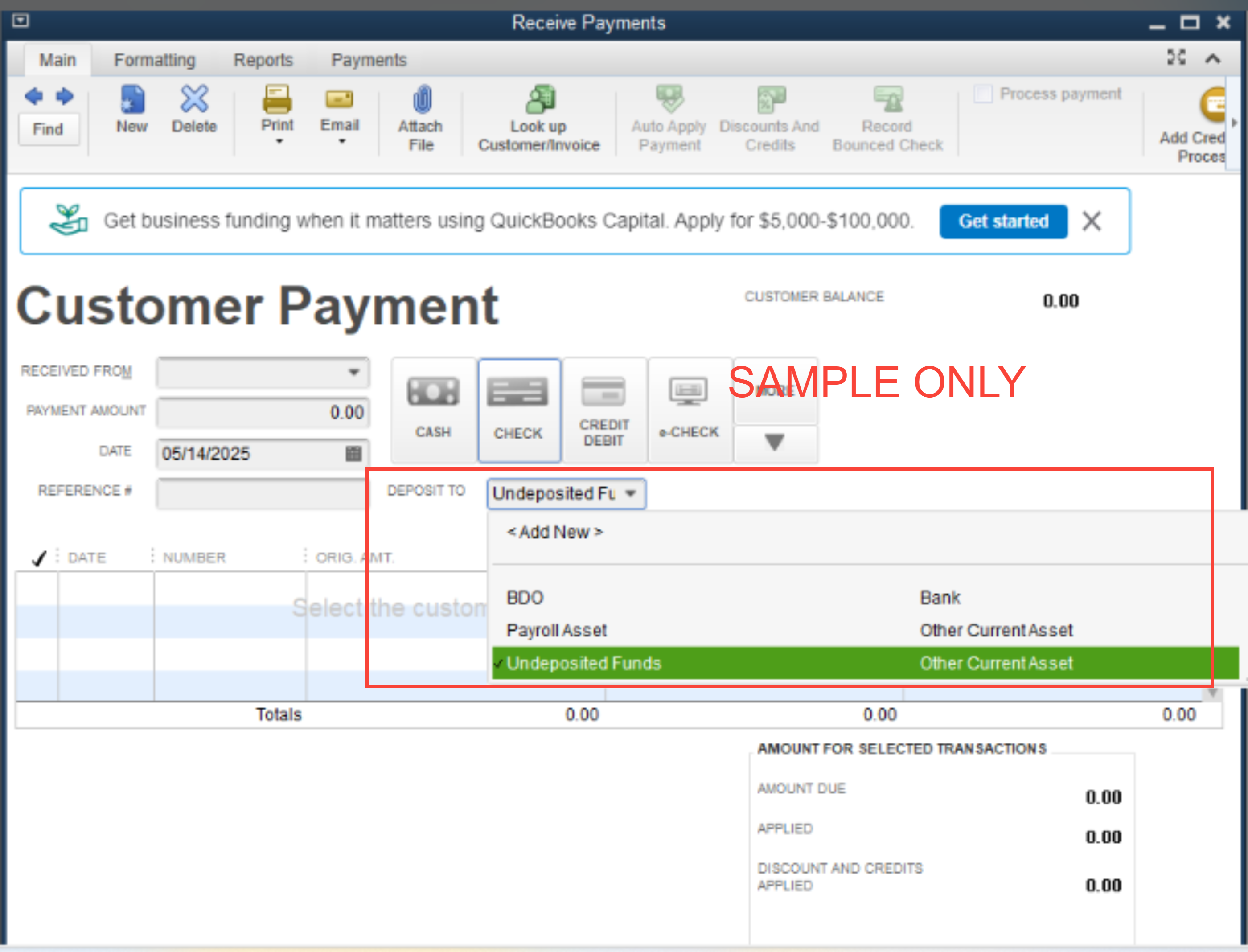

Then, open the customer's payment and change the posting account by clicking the 'Deposit to' dropdown, select the account you've selected in the check, then Save it. Please refer to the sample screenshot:

You can use the Check Detail Report or the Transaction Detail by Account report to view a report detailing checks and payments and customize them: Customize reports.

Please check the balance for this customer and let us know if you have other questions or concerns about correcting balances and payments. We're here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here