Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am a bookkeeper that has a client that used QB payments back in 2019-2020. Her bank account will reconcile but only if I do not match received payments to deposits because I cannot verify what payments belong to what deposits. QB support said that QB only holds 2 years of statements so there is not a way for me to get those years and the client does not think they saved them. The payment ID shows in the memo for all of the QB payments received but because QB auto recorded the 'receive payment' it appears they are all still sitting in Undeposited Funds with no way to change the account it was deposited to. This has created a massive balance in undeposited funds even though the money was deposited to the bank (I understand this account is a temp hold for transactions until the actual deposit is in the bank). I am concerned since I cannot verify the received payments are accurate and have no way of know which deposit they were apart of that it will create more issues.

When I do match receive payments to deposits as best that I can tell it should go, the bank reconcile ended up having a bunch of accounts receivable which I am assuming is because the 'receive payment' was set to the same bank account but then I couldn't get the account to reconcile. I am at a loss as to how I should get the undeposited funds account to balance and only show the current undeposited funds? The balance sheet for this client is crazy looking because of it.

I understand how important it is to keep your client’s financial records accurate, @Dancz, and we're here to help you with clearing the undeposited funds account and reconciling transactions.

First, you can start by reviewing your client’s bank statements from 2019-2020 via their online bank portal to identify deposits that correspond to payments in the undeposited funds account. Most Banks keep their online bank statements data up to 5 to 7 years before permanently deleting it. Also, using payment IDs displayed in QuickBooks memos can also help match payments to specific deposits.

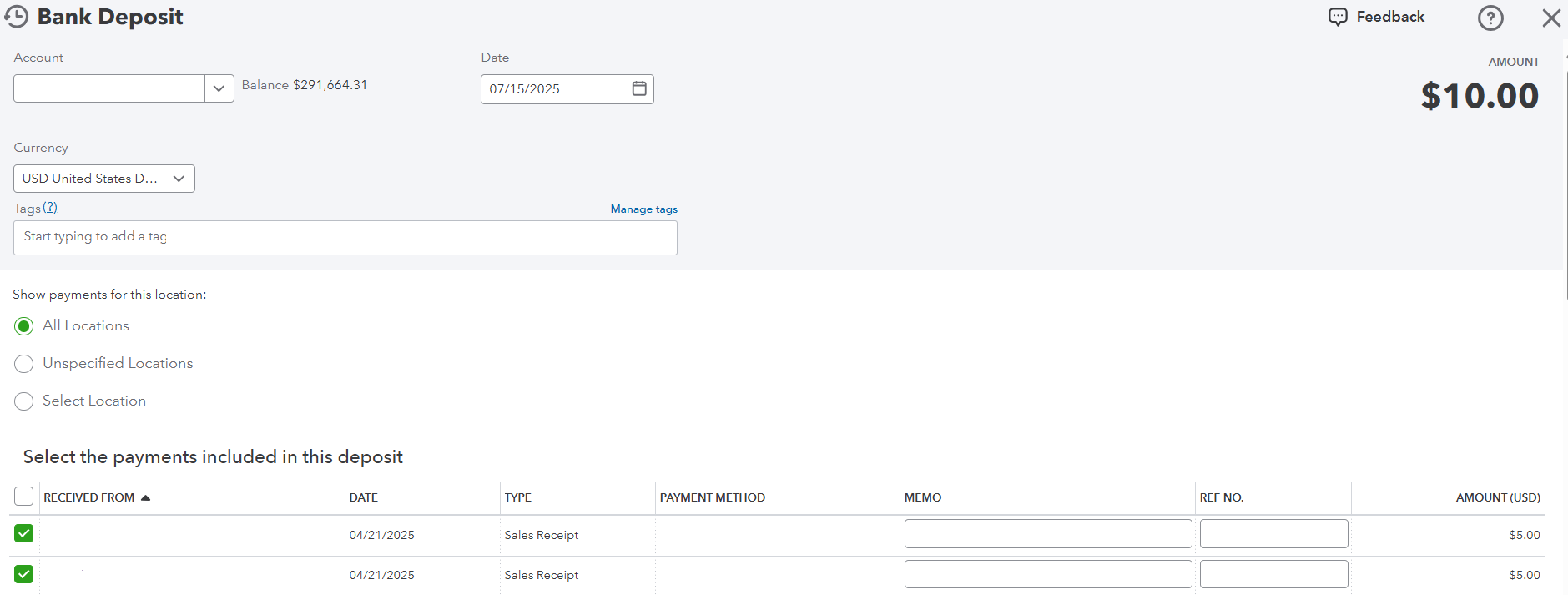

Once you’ve matched the payments to deposits, you can use the Bank Deposit feature to transfer them from undeposited funds to the correct bank account. Here's how:

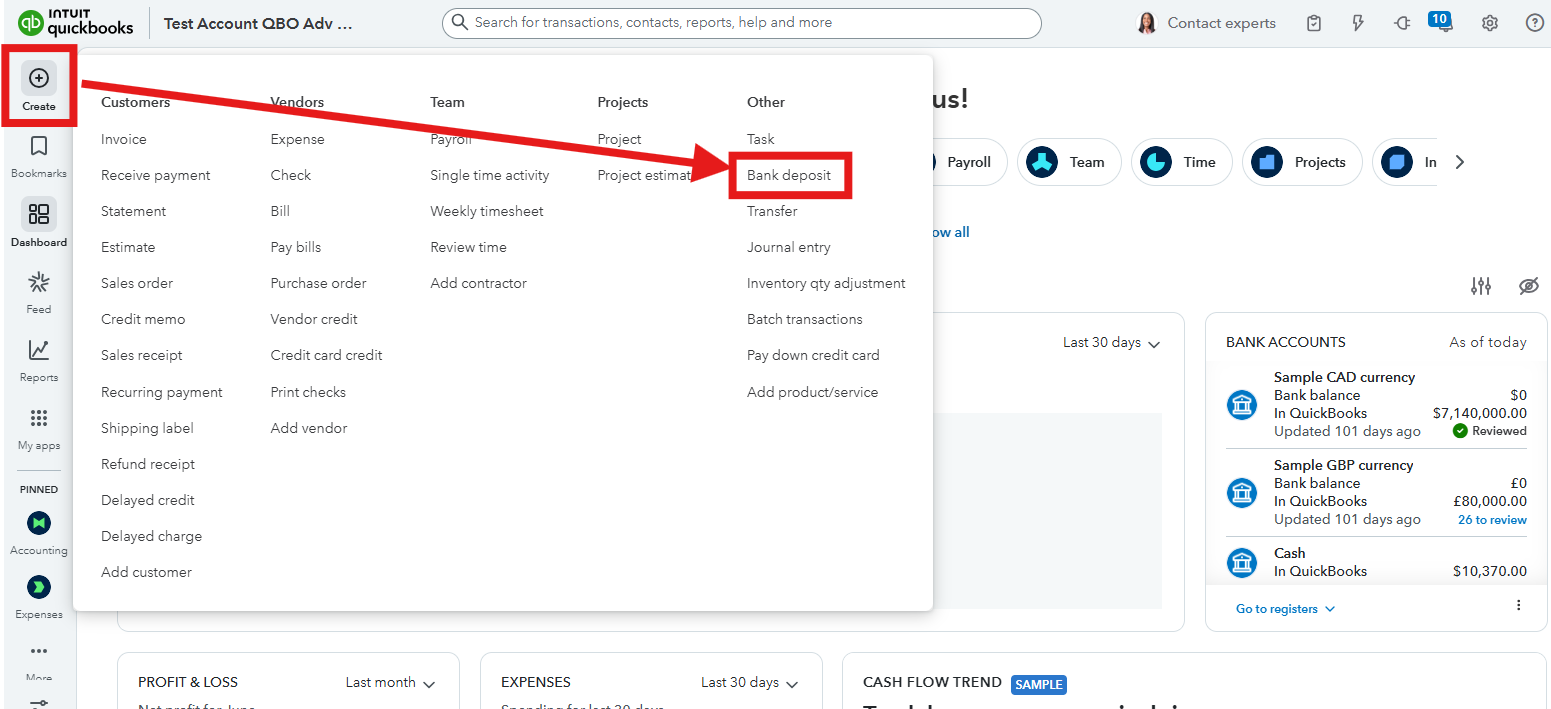

1. Go to Create and select Bank Deposit.

2. Select the payments that correspond to the deposits.

3. Then click Save and close.

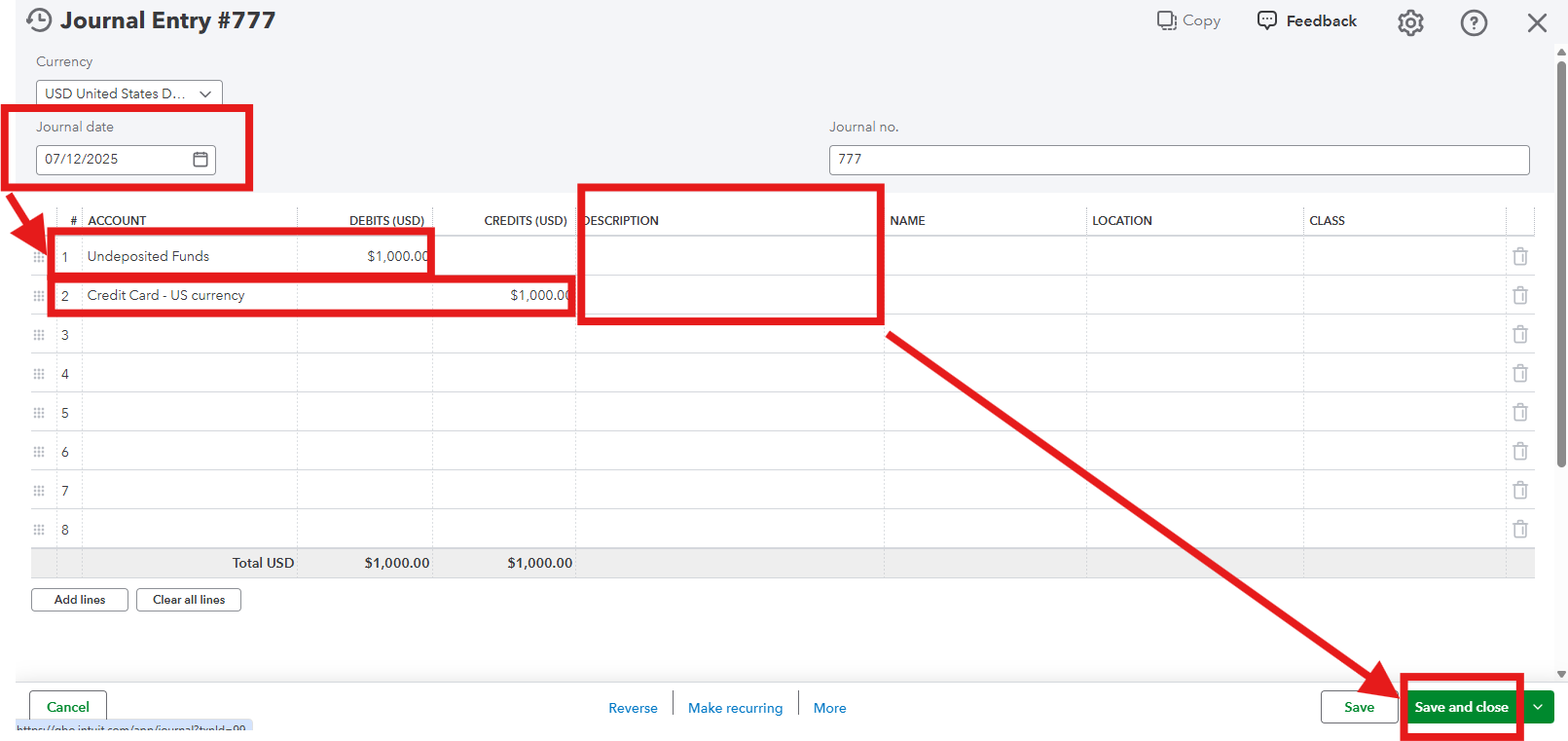

For payments that can’t be matched to any deposits, applying a Journal Entry will allow you to reflect them accurately in the accounts. This helps clear the balance in undeposited funds for payments that don’t align directly with bank deposits. Here's how:

It's also worth noting to ensure the amounts in Debit and Credit are equal to keep the books balanced.

Once these adjustments are made, you can begin reconciling the account, ensuring all cleared deposits align with the bank register. Address any discrepancies during reconciliation and review the balance sheet to confirm that the undeposited funds account now reflects only current undeposited transactions.

If additional guidance and clarification is needed, please don't hesitate to reach out. The Community space is available 24/7.

Thank you for your response. Would adding the journal entry from undeposited funds to the bank that the 'received payments' went into create an increase on the QB bank balance? If the 'received payment' is not matched to the banks downloaded deposit I was under the impression that it would create a double entry of income. The received payments I cannot match came from Quickbooks payments. The QB payment ID's are in the received payment so I have assumed that meant the money was truly deposited. I can verify that I received the batch deposit from Intuit however I cannot verify the specific invoices the batch payment deposit included due to not having it saved and Intuit saying they only keep 2 years of data. I want to make sure my QB balance continues to match the bank balance.

Thanks for getting back to us with more details, Dancz. Yes, adding a journal entry from Undeposited Funds to the bank account will increase QuickBooks Online's (QBO) bank balance.

If the actual deposit is already recorded in QBO, adding a journal entry creates a duplicate deposit, inflating the bank balance unnecessarily. This happens because the journal entry would account for the same funds already recorded.

You're also correct that the Received Payments in QBO are already recognized as income in QBO when applied to invoices. If these payments are later tied to a deposit or journal entry that incorrectly adds income again, it will result in a double entry of income.

Since the Received Payments you’re working with came from QuickBooks Payments, the best method is to use the Bank Deposit feature to move them from Undeposited Funds to the correct bank account. To do so, here’s how:

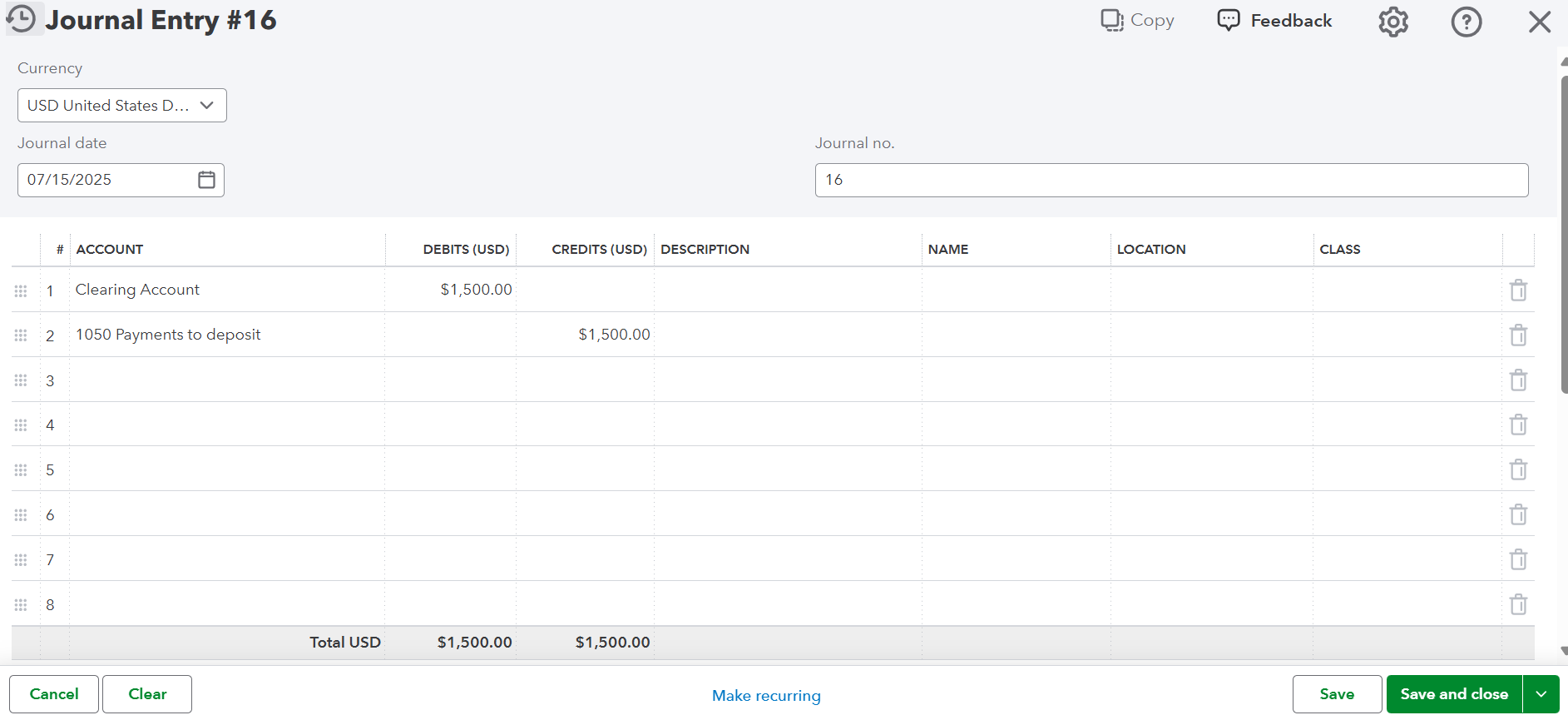

Alternatively, if you can't match payments to batch deposits due to missing invoice details, you can use a clearing account as a temporary placeholder to move payments to the bank account via journal entries. To complete this process, follow the steps below:

Afterward, you can reconcile your account to ensure all deposits align with the bank register. Moreover, I still recommend collaborating with your accountant, as they can provide expert guidance on the most effective approach to address and resolve this matter.

If you have other questions feel free to comment them below.

What do you mean by clearing account? I am not sure what the account that would need to be in order to do the journal entries you recommended as an alternative.

Ignore my question on clearing account. I did not see the hyper link to the explanation for it in my first read through of your response. Thank you

I do not see how using a clearing account clears the issue up. Since bank accounts are on the balance sheet this still makes the business seem like there is more income that what was actually received does it not? In that regard it would almost be pointless to do a journal entry out of undeposited funds. Would the clearing account bank be inactivated after the journal entries are done so it doesn't show on the balance sheet? My goal was to make sure the 'receive payments' do not make it seem like the company is still expecting money to be put in the bank itself since the money was deposited a long time ago.

You're correct, @Dancz. You don't need to create a clearing account to clear the undeposited funds (UF). You only need to deposit the funds into the correct bank account. I'll explain how QuickBooks Payments work below.

To answer your question, clearing an account won't affect or add more income since it only transfers the funds from Undeposited funds to the clearing account.

To begin with, if you're using QuickBooks Payments, you don't need to do anything. QuickBooks Payments will automatically receive the payments and place them in Undeposited Funds. It will also automatically create a Bank Deposit to clear the funds from Undeposited Funds.

If you see payments in the UF, they are likely manually created invoices or payments added by your client. Ask your client to verify the payments from Undeposited Funds. If these are manually created entries or valid payments or if you're not not sure which correct bank account to deposit to, request their bank statement as your basis to match those payments to the right bank.

Let me know in the comments below if you have any other questions about QuickBooks.

Your suggestion does not work. The issue starts in 2019 and QB payments no longer has the statements nor are the receive payments matched to their deposits. I have no way of verifying the matches. If something gets matched and it matches to a deposit in the wrong month it messes up the reconcile. I don't know how to balance undeposited funds without creating an increase in the bank account or a different account. The client did not save the QB statements from back then. I only have the bank statements which is only good for verifying the deposit itself. Also it is important to note that in the deposit tab under sales, it looks like it was never used as it has the 'Get Started' button. I watched a video that said that this screen should show the deposits and what receive payments were included in those deposits. I have ran through so many option trying to find a solution that doesn't cause other issues.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here