Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I was overpaid in 2019 and I mailed a check in Aug 2020. I cannot figure out how to get rid of the credit when I open receive payments. I posted check to accts rec. I have tried so many things that I am now confused. HELP PLEASE

Hi there, dbcj.

I'll help you zero out the available credits.

You're already on the right track. To complete the process of issuing a refund, you'll have to link the check to the overpayment. I'll show you how:

To learn more about this topic, you can read this article: Give your customer a credit or refund.

Additionally, I encourage visiting our Customer Transaction Workflow Guide to help track your sales and receivables in QuickBooks Desktop.

If I can be of any further help, please don't hesitate to visit this thread again. I'll be right here to assist you again.

But there is not a check there. It wants to apply credit to open invoices. Maybe I must start from the very beginning.

Thanks for going through the steps shared by my colleague above, @dbcj.

I have some steps that we can perform to isolate this issue. I recommend running the Verify Rebuild tool. This scans your company file for issues and self-resolves them. I’d be glad to guide you how in your QuickBooks Desktop (QBDT) software.

To Verify:

To Rebuild:

I've got you this article for more detailed steps: Verify and Rebuild Data in QuickBooks Desktop.

Let me also add this link that you can read for guidance in depositing those payments: Record and make bank deposits in QuickBooks Desktop.

Keep me in the loop if you have any other concerns or questions managing your invoices and credits. I'll be around ready to help you. Keep safe!

I did the Verify and Rebuild. Said no problems. I think I need help from the very first step. Maybe I did not write or post the check properly. Take me to the very beginning. I need to get this done.

I did Verify and Rebuild. Said no problems. I tried the first response again, but still no check in available credits. I think we need to start with the very first step. Maybe I did not write or post the check properly.

Hello there, dbcj.

I appreciate your efforts in trying to fix the issue and sharing the result. Let’s perform another one to get rid of the credit.

We’ll have to review your transactions. Then, make sure the check is posted to the Accounts Receivable account and the right customer. This way, you’ll be able to link the credit to the check.

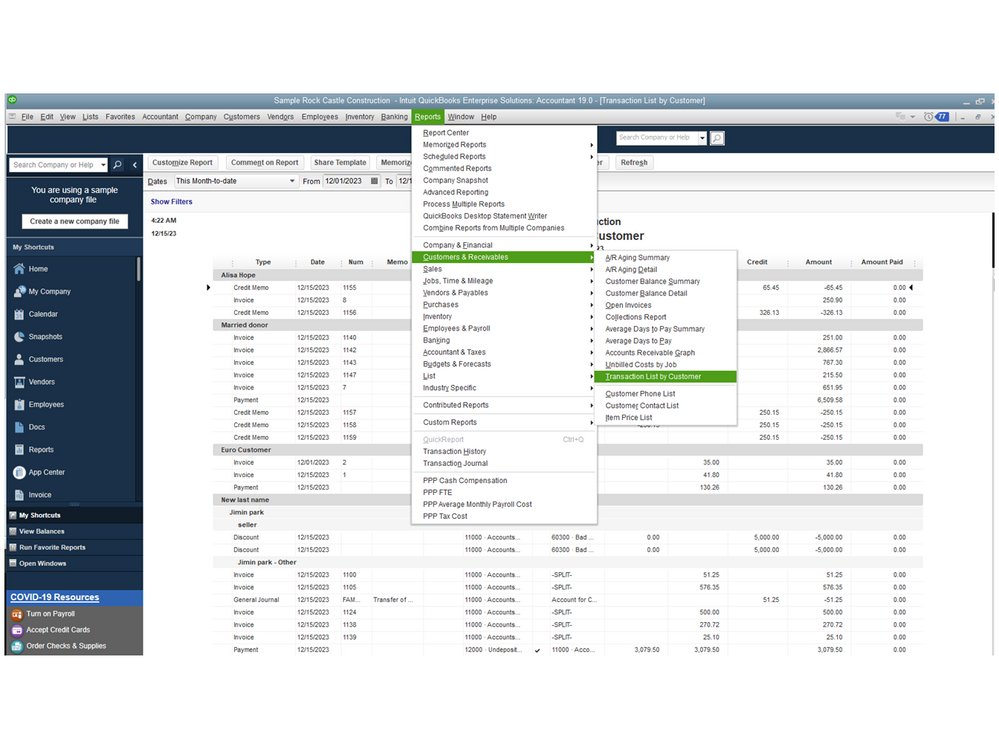

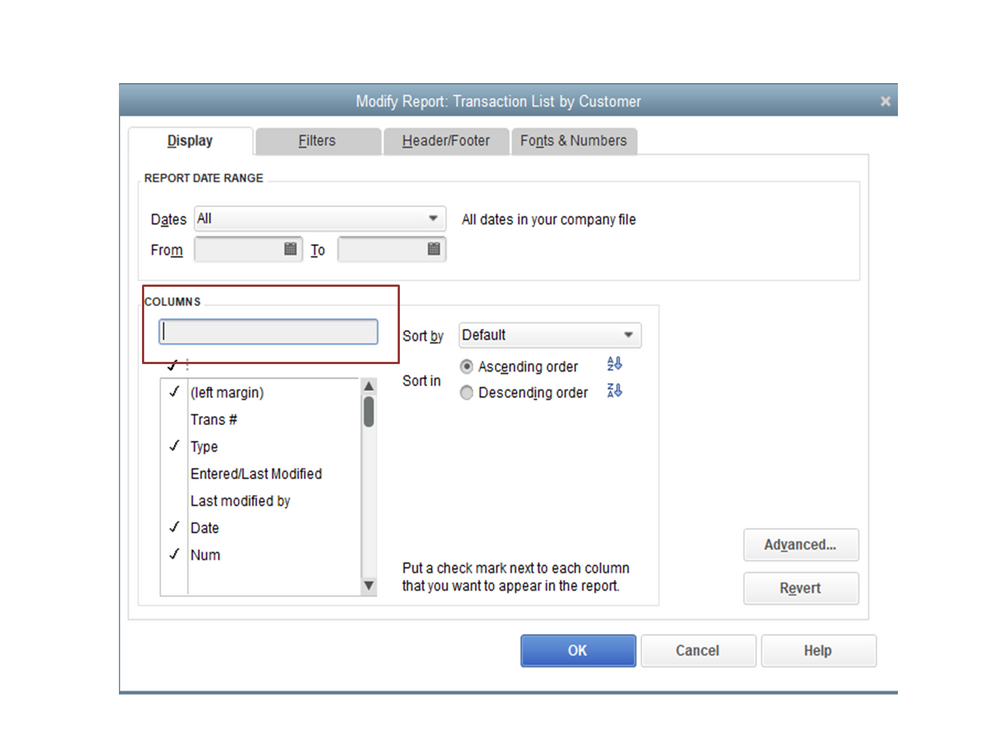

To start, run the Transaction List by Customer. This will display all the sale entries recorded in your company. Doing so will help us identify the category type used for the check and where it’s posted to. I’ll help and guide you on how to build the report.

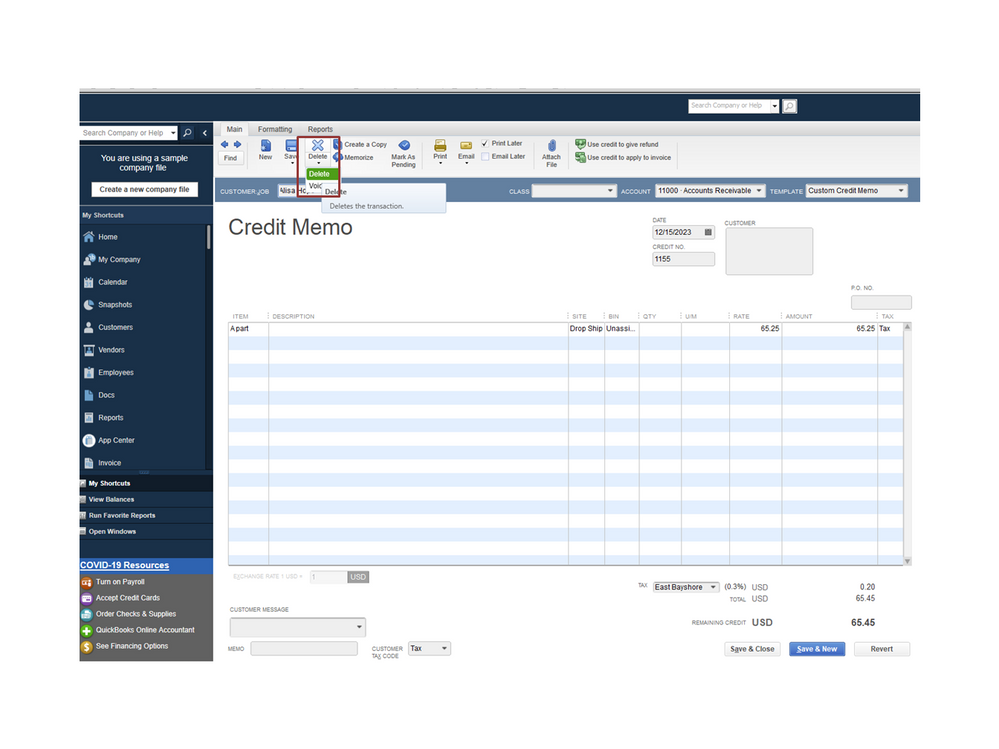

On the Transaction List by Customer page, look for the check you created and navigate to the Account column. If it’s the incorrect one, double-click on the entry to open the Credit Memo page and change the category type to Accounts Receivable.

If it shows the correct one, go back to the report and find the credit memo you’re working on. Next, check if it’s linked to the correct customer. If it’s incorrect, void/delete it and create a new one and link it to the right client.

I’m adding a link to help you in the future. It contains articles and resources to help you easily perform any tasks in QuickBooks. Click on the topic to view the complete details of the article: Self-help guide.

Feel free to visit the Community again if you have other concerns or questions. I’ll get back to answer them for you. Have a good one.

When I checked in acct rec, I had check and 2 attempts at credit memo. I deleted incorrect entries and was able to follow first instructions and I think it is now correct. Thank you to all.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here