Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I hope someone can help me....

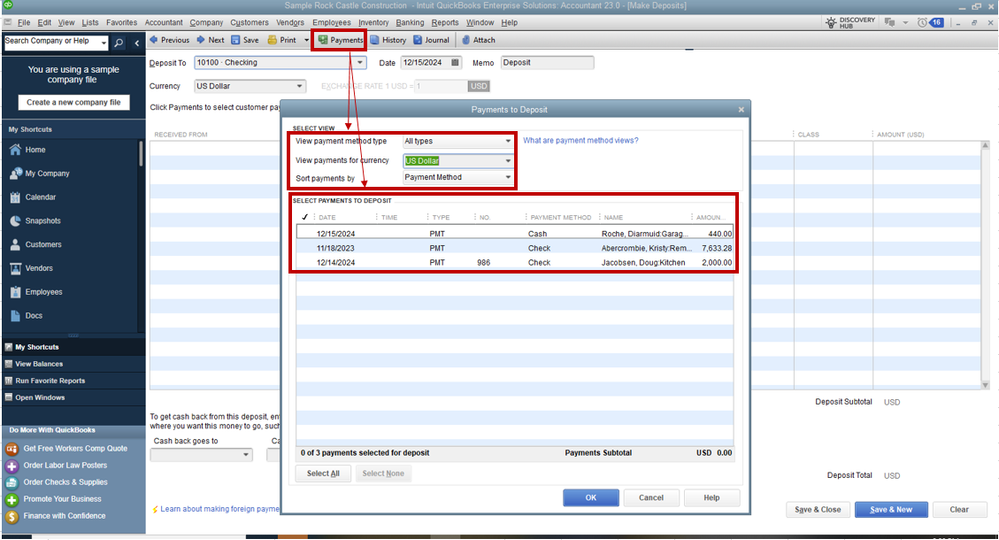

I have Quickbooks Desktop Premier 2020 and I have some invoices that show "PAID", but then when I go into "Make Deposits", they are not shown. See photos

And if I go look at the "Customer Information", it shows the payment. .

When I open up the invoice it shows to be "PAID" -

And the "Payment" shows the payment applied (in full), but yet an open balance.

And when I look at the "Account Receivables" the invoice number isn't shown like others....it shows PMT.

I use to use Quickbooks Merchant services, but now I am charging credit cards from another company and so when I enter in "payment type", I just click "check". I have done this with other invoices, applied payments, and I can see the funds in the undeposited account.

I haven't a clue what is going on...HELP!!

Why do they only allow a person to post one screen shot when they allow 9MB and the one below (and others I have are under 200kb. Argh.

I appreciate you for adding a visual representation of your concern, Labman. I can share some solutions to deposit your invoice payment accordingly.

Based on the screenshot, it's clear that the payment has been posted under the Undeposited Funds account. Thus, the transactions should show up when making deposits.

Since this isn't happening in your case, I suggest running the verify and rebuild tool to check for any data damage that might be causing this issue.

To verify your company data:

Check out this article for a step-by-step guide on rebuilding your company file data: Verify and Rebuild Data in QuickBooks Desktop.

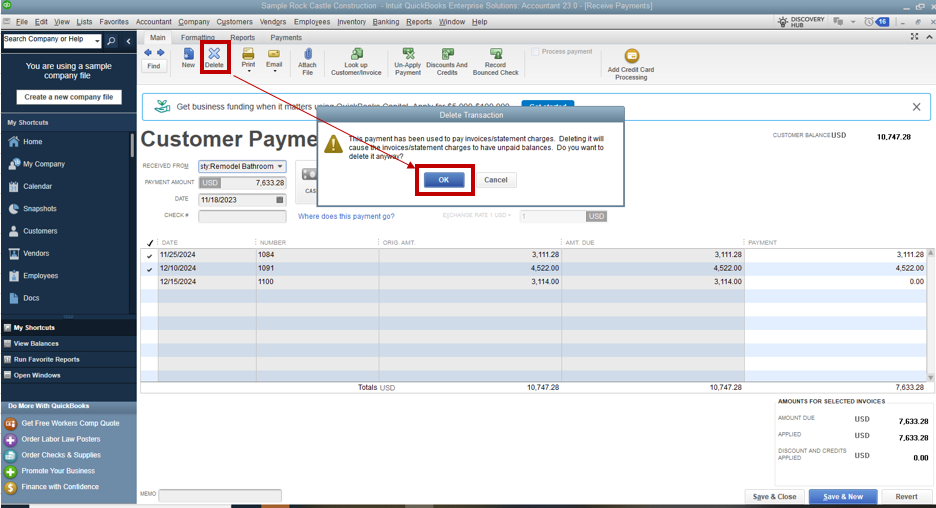

After that, record a deposit to see the result. If the same thing happens, I suggest deleting and recreating the invoice payment to isolate the issue.

When you're ready to deposit the payment, follow these steps:

You may review the resources from this article for more tips on managing customer payments and bank deposits in our system: Record and make bank deposits in QuickBooks Desktop.

I'm also including this material to learn more about the various methods of tracking customer transactions in QBDT: Get started with customer transaction workflows in QuickBooks Desktop.

On the other hand, you can add multiple screenshots to your post. To do this, click on the Insert Photos menu to proceed.

If you have follow-up questions about invoice payments and deposits, let me know by leaving a comment below. I'm just a few clicks away to help you again. Keep safe!

Hi...thanks for trying to help me out. Before I posted my problem, I did verify and rebuild the data...did not change anything.

Thanks for showing me how to add more screen shots...here you go.

As you can see, it appears that the payments have been made, but they are not showing up in the "Make Deposits"...and I don't get why the payment shows that there is a current balance.

Thanks for the additional information and screenshots, @Labman. Let me chime in and address these concerns.

Since you already verified and rebuilt your data to no avail, have you tried deleting and recreating the invoice payment to sort this out?

If not yet, I suggest you do so. Please know that only current transactions in your undeposited funds account appear on the Bank Deposit window.

Regarding the balance shown, various factors may have affected it. This includes outstanding invoices, credits, or other transactions linked to the customer account. It's a good practice to review the customer's account. This way, you'll know why a current balance is showing as such.

On the other hand, if everything is in place and clear, I highly recommend contacting our support team for further assistance. They can conduct thorough investigations and provide more solutions.

Before that, take a glimpse at our support hours so you’ll receive responses quickly. Then, you can follow the steps below to connect with us:

I’m adding these guides to keep your books matched, balanced, and accurate:

Don’t hesitate to leave a comment if you have any other questions or concerns besides payments. We're always here to help, @Labman. Take care!

Hello - Thanks for contributing.

This isn't just one invoice/payment...there are a few that this has happened, and I'm really perplexed as to why these particular ones aren't showing up in the undeposited account.

There are no prior outstanding balances, credits, links to other accounts, etc. All of my transactions are a single invoice with a single payment.

I wish you didn't have to go through all the hurdles with your invoice payments in QuickBooks Desktop (QBDT).

Since the issue remains even after performing all possible troubleshooting to rectify this, I strongly advise contacting our QuickBooks Desktop Support team if you haven't done it yet. A live representative can securely access your account and conduct a thorough investigation to identify the root cause of the payments not appearing in the undeposited account. They can be reached while using QuickBooks. Here's how:

Be sure to review their support hours so you'll know when agents are available. In the event you're unable to reach out to Intuit through your books, you can get in touch through our website.

Moreover, you may visit this workflow to learn the different ways you can track and organize your cash flow, sales, receivables, and profitability: Customer transaction workflows in QuickBooks Desktop.

Keep me in the loop by leaving a comment below if you need further assistance managing invoice payments or have any additional banking questions. I'll be available to offer the assistance you need.

Thanks.....

How does one view all historical deposits made from the undeposited account?

My goal is to get you back to the business quickly, @Labman. By pulling up a quick report for undeposited funds under the register, it will QuickBooks Desktop show deposits made from undeposited account.

When you want to view all your activities on your transaction, the Quick Report is the best option to pull up. It is a significant report that will let you access your list in the Chart of Accounts for just one account.

Follow the steps below:

1. Open your QuickBooks Desktop account.

2. Navigate to the List menu.

3. Choose the Chart of accounts tab.

4. Click the Undeposited Funds account.

5. At the bottom, press the Report filter option and click the Quick Report 12000 undeposited funds.

Furthermore, you can save your customization settings for easy access to the report in the future. Most reporting tools provide options to save customizations or create templates. See this page for your guide: Create, access, and modify memorized reports.

Let me know if you need more insight into handling your deposits. I'll assist you along the way.

How big is your company file size?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here