Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I clear out an open customer balance? Can I do it with a journal entry? My client says the amounts been paid already and the invoices were voided.

Solved! Go to Solution.

Welcome to the Community space, @vitanovabookkeeping.

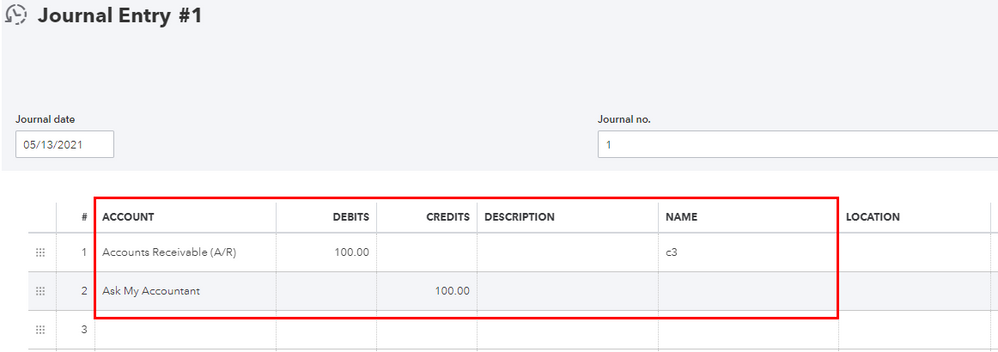

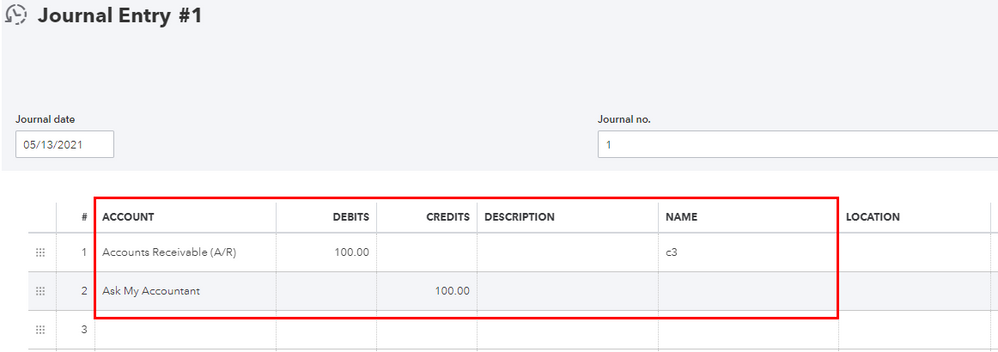

Yes, you can create a Journal Entry (JE) to remove your customer open balance. I'd be glad to walk you through the steps.

Before we begin, you'll want to consult with your accountant or visit our ProAdvisor page to look for one. This way, we can prevent messing up your book.

When you're ready, you can proceed to these steps:

You can also see this article for more details (though the steps is for QuickBooks Desktop (QBDT), the workflow also applies to QBO): Write off customer and vendor balances.

You might also want to check this link for guidance in case you need to link a deposit to an invoice: How to link a deposit to an invoice.

Let me know in your reply if you have any other concerns managing your customers and invoices. I'll be around to help you out. Keep safe!

Welcome to the Community space, @vitanovabookkeeping.

Yes, you can create a Journal Entry (JE) to remove your customer open balance. I'd be glad to walk you through the steps.

Before we begin, you'll want to consult with your accountant or visit our ProAdvisor page to look for one. This way, we can prevent messing up your book.

When you're ready, you can proceed to these steps:

You can also see this article for more details (though the steps is for QuickBooks Desktop (QBDT), the workflow also applies to QBO): Write off customer and vendor balances.

You might also want to check this link for guidance in case you need to link a deposit to an invoice: How to link a deposit to an invoice.

Let me know in your reply if you have any other concerns managing your customers and invoices. I'll be around to help you out. Keep safe!

I can help you in handling that transaction, vitanovabookkeeping.

When you void an invoice, it will no longer exist in your accounting balances as well as your customer balance. However, the invoice number and the items that were added to the transaction will remain.

Take note that there will be no monetary amounts on a voided invoice. Voiding transactions allows you to keep a record of them for any future business reasons. On the other hand, deleting invoices will completely erase them from your books.

To ensure that you can keep track of the services you've provided, you may need to recreate the invoice and receive the customer payment again. Here's how:

In addition, here are some articles that you can read to help manage your invoices in QuickBooks Online:

I'm still here to assist if you have any other questions or follow-up concerns. Just add a comment below and I'll get back to you.

Will this work if the invoices were already paid? I don’t need to collect payment again.

Will this work if the invoice has already been paid? I don’t need to collect the payment again.

Thanks for coming back to this thread, vitanovabookkeeping.

Since the voided invoice has already been paid, you'll have to link the unapplied payment after recreating the transaction. This way, you'll be able to track the services/products you've provided to the customer. Here's how:

I'm also adding this article to help personalize the invoices that you send to your customers: Customize sales forms.

You can always find me here if you need more help in managing your other transactions. Have a great rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here