Get 50% OFF QuickBooks for 3 months*

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Payments

- :

- Re: Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix t...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

Up to now whenever someone paid a security deposit for services, the previous bookkeeper created an invoice and in services they put "Deposit" as if the deposit itself was a service instead of making it a liability.

Then when the payment showed up in the bank deposits, they just matched the payment to the invoice like they would with any other invoice/payment. So now all our past deposits are tied up in Customer accounts as if they were just paying off an invoice. Many of those deposits as invoice/payments have long ago been reconciled too.

In the past, he resolved this by simply editing a customer's final invoice and applying a credit toward it as a line item, saying that it includes the deposit refund in a line item of that final bill, and now they just have to pay the balance.

Now I have just been asked to refund several security deposits where there is no outstanding balance to apply a credit toward, so that method doesn't work. If I use a credit memo or refund, then it seems to still show we owe them $1,200.00.

So, my questions are as follows:

1) How do I best issue a refund for that security deposit in the above example? Should I use a credit memo in this instance? If so, how do I get the account back to show a $0 balance after I send them a $1,200 check? What do I put in the account to show that I refunded that $1200 to them and they no longer have a credit balance?

2) Do I need to create a "check" in Quickbooks? (Dashboard, + NEW, CHECK) And if so, how do I link that to the credit memo so it stops showing them with that negative balance?

3) When that $1,200 refund check I write out and send to them shows up as cashed in my banking transactions page for me to match to something, do I link it to that to the Credit Memo then or to a "check" I created in Question 2?

4) How can I fix other accounts where the Security Deposits were entered as invoices and payments instead of as liabilities? For example, can I delete those invoices (which say they are a deposit) and change the payment (which is linked to the check deposited in the bank account) to instead be treated as a liability? How would I go about correcting those to be logged correctly as security deposit liabilities instead?

(Sorry, I am relatively new to Quickbooks)

Solved! Go to Solution.

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

Hi ProfessionalChoiceSolutions!

Good to see you again here. Allow me to assist you in tracking the security deposits in QuickBooks Online.

I reviewed this thread and here's what I can suggest.

First, please review the deposit service item that your previous bookkeeper created. If they selected a liability account as an income account, then the bookkeeper was correct. The funds will be posted to the selected liability account when they create an invoice or sales receipt.

Follow these steps on how to verify:

- Go to the Sales menu and select Products and services.

- Find the deposit service item, then click Edit.

- Review the Income account and make sure it is a liability. If not, you can change it, then make sure to select the Also update this account in historical transactions box to update the old transactions with this item.

- Tap Save and close.

Please check this link on how to properly track the advance payments or deposit in QuickBooks Online: Record a retainer or deposit.

Second, you can simply create a check to record the refund affecting the liability account used in the Deposit service item. Go to the + New button, then select Check. From the Category details section, select the liability account, select the customer as the Payee, enter the amount of the refund and other details needed, then tap Save and close.

You don't need a credit memo or refund receipt for this. Creating one will only result in an incorrect balance. This is because the check you created already decreases the liability balance. Since you created one, open the credit memo or refund receipt, click the More at the footer section, then select Delete.

Now, you can pull up the Transaction List by Customer report from the Reports menu. From there, you'll see all transactions for this customer including the refunds you created.

Also, here's the article if you need detailed steps in reconciling your accounts: Reconcile an account in QuickBooks Online.

Please let me know if you have further concerns with this. I'll be happy to help you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

Hello there, ProfessionalChoiceSolutions.

I appreciate you providing us all the information needed with your concerns about the security deposit.

Let me share with you some insights about it.

The funds should be treated as a liability to show that it doesn’t belong to you until it’s used to pay for services.

First, let's create a liability account to track the security deposits.

Here's how:

- Select Accounting on the left pane, then choose the Chart of Accounts.

- Click New.

- Choose Other Current Liabilities from the Account Type drop-down list.

- Select Trust Accounts - Liabilities under the Detail Type drop-down.

- Enter a name for the account (for example, Trust Liabilities) or accept the suggested name.

- Click Save and close.

Next, create a service item that you can use when recording security deposits. Here's how:

- Click the Gear icon and choose Products and Services.

- Select New.

- Choose Service from the Product/Service Information.

- Enter a name for the service item.

- From the Income Account drop-down, choose Trust Liability Account.

- Click Save and close.

When refunding a security deposit, you must first issue a check for the portion to be refunded.

Here's how:

- Click the Plus icon (+) and select Check.

- Enter the check information.

- In the Account details section, select the liability account you use for security deposits from the Account column drop-down list.

- Select Save and close.

Here are some articles for the complete details about security deposits:

The information above should help you with the security deposits.

If you have any other questions or concerns about security deposit, feel free to post them here, night or day. Thank you for your time and have a nice day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

I read through all the links and charging a deposit is showing up fine, but I am having troubles with the refunding.

If I create a check to refund the ($1200) deposit, then the check transaction never shows up in the customer's account that I refunded their deposit. I can only see that it was refunded if I go to the Chart of accounts liability account (called "Client Service Deposit").

On the other hand, if I instead create a credit memo for the full amount ($1200) that we are refunding to the customer, it will show up in the customer's account but it leaves their account in a huge negative balance of $1200 as if we still owe them money, when we actually sent them a refund for that full amount and it should now show as $0 because we refunded that.

On another customer who still had a final bill, I tried to instead apply a credit balance to their final bill but appears that it is not subtracting that credit balance out of the liability account (called "Client Service Deposit"), it applies toward a final bill, but the liability account still suggests that full liability amount is still there.

How do I refund their deposit in a way that it will both balance out the chart of accounts and show up in the customer's account that I refunded their deposit back to them without it also leaving the client's account showing a negative balance?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

I read through all the links and charging a deposit is showing up fine, but I am having troubles with the refunding.

If I create a check to refund the ($1200) deposit, then the check transaction never shows up in the customer's account that I refunded their deposit. I can only see that it was refunded if I go to the Chart of accounts liability account (called "Client Service Deposit").

On the other hand, if I instead create a credit memo for the full amount ($1200) that we are refunding to the customer, it will show up in the customer's account but it leaves their account in a huge negative balance of $1200 as if we still owe them money, when we actually sent them a refund for that full amount and it should now show as $0 because we refunded that.

On another customer who still had a final bill, I tried to instead apply a credit balance to their final bill but appears that it is not subtracting that credit balance out of the liability account (called "Client Service Deposit"), it applies toward a final bill, but the liability account still suggests that full liability amount is still there.

How do I refund their deposit in a way that it will both balance out the chart of accounts and show up in the customer's account that I refunded their deposit back to them without it also leaving the client's account showing a negative balance?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

Hello @pvinit,

In QuickBooks Online, you can create a refund receipt with the payment information of your customer base on the original sales transaction. Let me walk you through the steps on how to accomplish this.

- Go to the + New icon.

- Under CUSTOMERS, select Refund receipt.

- On the Customer menu, select the customer you want to refund.

- Fill out all the information using the same details from the original sale.

- Below the Payment Method menu, select the mode of payment used by your customer accordingly.

- Select an account you wish to refund the customer from.

- Click Save and close.

In addition, here's an article you can read to learn more about creating a refund for your customer: How to void or refund payments you process through QuickBooks Online?

However, I'd still recommend contacting your accountant for guidance in handling your customer's refund and for the accuracy of your accounting books. If you haven't yet, you can use this link to find a bookkeeper near you: Business is better with a ProAdvisor.

Lastly, I've also included this helpful article for the steps in creating a document showing all your customer transactions: How to send statements to show customers summaries of their invoices, payments, credits, and balance...

Don't hesitate to post again here if you have other questions or concerns with QuickBooks tasks and navigations. I'm always around happy to help. Stay safe and have a good one!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

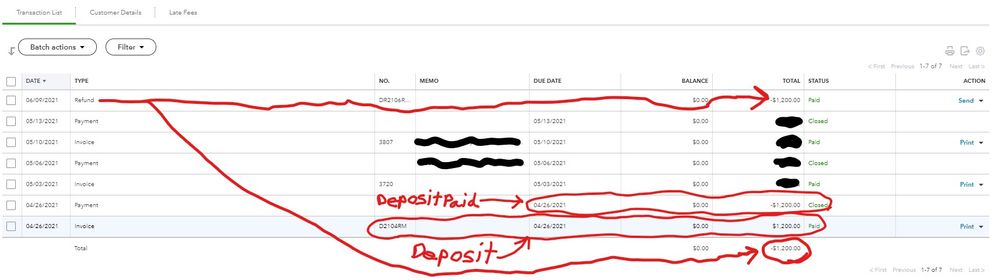

I must be misunderstanding something very basic. No matter if I use Refund, or Credit Memo or whatever else, it still shows there is a negative balance on the account, but since I am refunding that negative balance, it shouldn't show we owe the customer anything. Here is an example of one of the accounts.

You will see that the deposit was paid for $1200 on 4/26/21. We create an invoice for the deposit which puts the $1200 into the liability account. Then the customer payment for the deposit amount is applied toward that invoice.

So now I tried following the steps you gave for a refund receipt, but now it is showing a negative balance on the account, as if we owe the customer another $1,200. It does correctly debit out the liability in the liability account to balance that out correctly in the chart of accounts as seen here:

but now because of that refund receipt it indicates the customer's account says we owe them more money. I need the chart of accounts to work like this (show the decrease), but still have a note about the refund in the customer's account without having it put the customer's account into a negative balance.

What am I missing here? I've read through every single link sent to me and everything I can read on deposits in the forum here, but I can't seem to do it in a way that doesn't put the customer into a negative balance. Are we doing something critically wrong?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

Hello @ProfessionalChoiceSolutions,

Thank you for sharing the results after following the suggestions above. Base on your scenario, I've also created your transactions based on how you outlined them and I found out the balance you're looking into doesn't have any value at all.

This amount is the resulting total of the list of transactions created for your customer, a refund or a credit, and you do need to worry about this negative balance. Instead, let's pull up one of your sales reports to determine the actual balance of your customer.

Let me show you how:

- Go to Reports.

- Scroll down the page to the Who owes you category of your reports.

- Select Customer Balance Detail or Customer Balance Summary depending on how you wish to review your sales transaction.

On top of that, I've also included this reference helpful with the steps needed to identify how stable is your business's financial status: Create and Manage Reports in QuickBooks Online.

You can always leave a comment below if you have follow-up questions with this or start a new thread if you have any other questions. I'll be here to lend a hand. Stay safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

There has got to be some way to make a refunded security deposit show up in a customer's account ledger without having it incorrectly show they have an ongoing negative balance in their account (suggesting that we owe them money).

This is a problem because imagine the following scenario:

- We refund the deposit, customer shows they have a negative $1200 balance on their account now.

- The customer returns and gets more services from us, but their account claims we owe them $1200, so an employee doesn't take a payment from the customer because they believe we owe them money.

Is there any way I can show in the customer's account that we refunded the deposit, but still have the account balance show at $0? A credit memo shows a negative balance. A Refund receipt shows a negative balance. Am I doing the deposit wrong in the first place?

- We create an invoice for the deposit (and select the Product/Service as "Deposit" so it gets logged into the correct Chart of Accounts, and then charge the rate/amount at $1200

- We take a payment for that invoice. Now the customer shows at a $0 balance until it's time to refund the deposit.

- When the customer terminates service, we refund a check for the $1200 but a credit memo or refund receipt show the customer has a negative balance of $1200.

What can we do differently so Deposits and Deposit Refunds are logged in the customer account as having been paid and refunded without it making the balance out of whack the whole time they're a customer or after they leave?

Critical points as far as I understand it:

- We Need $1200 to show as "Increase" in the "Client Service Deposit" Chart of accounts and as owed by the customer in their account ledger.

- Then $1200 payment made by the customer to pay that deposit and no longer owe anything.

- Then when they leave, we refund them deposit, so we need a $1200 "Decrease" in the "Client Service Deposit" Chart of accounts AND need it to show that we are refunding them that $1200 in their account ledger...without it leaving them with a $1200 negative balance forever afterward. What can be done to fix this?

What am I doing wrong? What can I do better here? I really don't understand, and all the above links and answers still leave the client with a negative balance showing in their account, so I must be setting it up wrong in the first place or something.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

Hi ProfessionalChoiceSolutions!

Good to see you again here. Allow me to assist you in tracking the security deposits in QuickBooks Online.

I reviewed this thread and here's what I can suggest.

First, please review the deposit service item that your previous bookkeeper created. If they selected a liability account as an income account, then the bookkeeper was correct. The funds will be posted to the selected liability account when they create an invoice or sales receipt.

Follow these steps on how to verify:

- Go to the Sales menu and select Products and services.

- Find the deposit service item, then click Edit.

- Review the Income account and make sure it is a liability. If not, you can change it, then make sure to select the Also update this account in historical transactions box to update the old transactions with this item.

- Tap Save and close.

Please check this link on how to properly track the advance payments or deposit in QuickBooks Online: Record a retainer or deposit.

Second, you can simply create a check to record the refund affecting the liability account used in the Deposit service item. Go to the + New button, then select Check. From the Category details section, select the liability account, select the customer as the Payee, enter the amount of the refund and other details needed, then tap Save and close.

You don't need a credit memo or refund receipt for this. Creating one will only result in an incorrect balance. This is because the check you created already decreases the liability balance. Since you created one, open the credit memo or refund receipt, click the More at the footer section, then select Delete.

Now, you can pull up the Transaction List by Customer report from the Reports menu. From there, you'll see all transactions for this customer including the refunds you created.

Also, here's the article if you need detailed steps in reconciling your accounts: Reconcile an account in QuickBooks Online.

Please let me know if you have further concerns with this. I'll be happy to help you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Security Deposits were recorded as invoices/payments rather than liabilities - How do I fix them & refund them?

Thank you Alex!

The deposit service item is set up correctly already.

What you said make sense and will solve my issues here so that the refund is reflected in the chart of accounts properly without leaving a negative balance on the customer's account.

Doing it this way, I can still have the refund reflected in the customer's ledger by issuing a Credit Memo for $0 that has a note/memo stating the deposit was refunded on this day.

Seriously, thank you.