Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi - I have recently taken over the books for a retail chain. They have years of unapplied payments to vendors so their aging summary looks very bad. I am trying to go in a apply all of the payments but the issue is that some of the payments were posted to other AP accounts. They used to have the main AP with two sub accounts AP Suppliers and AP General.

The system won't let me go back to the previous years to make changes as the years have been closed. Any suggestions as to how I can clear these books up?

Thanks,

Kim

Hello there, KimRussel.

Thank you for reaching out to us here in the Community. I'm here to provide some suggestions about making the changes from closed books.

In QuickBooks Desktop, you're able to create a closing date password to restrict accessing data from the prior accounting period. To make changes, you must know the password and should have appropriate permissions to make the changes.

For more insights, I'm adding the article I recommend on this:

Close your books in QuickBooks Desktop.

You can also try to write off customer and vendor balances by creating General Journal Entry. For the detailed steps, please visit this article:

Write off customer and vendor balances.

Please feel free to get in touch with me here for any additional questions. The Community always has your back.

@AlcaeusF wrote:

@AlcaeusF wrote:Hello there, KimRussel.

Thank you for reaching out to us here in the Community. I'm here to provide some suggestions about making the changes from closed books.

In QuickBooks Desktop, you're able to create a closing date password to restrict accessing data from the prior accounting period. To make changes, you must know the password and should have appropriate permissions to make the changes.

For more insights, I'm adding the article I recommend on this:

Close your books in QuickBooks Desktop.

You can also try to write off customer and vendor balances by creating General Journal Entry. For the detailed steps, please visit this article:

Write off customer and vendor balances.

Please feel free to get in touch with me here for any additional questions. The Community always has your back.

Hello there, KimRussel.

Thank you for reaching out to us here in the Community. I'm here to provide some suggestions about making the changes from closed books.

In QuickBooks Desktop, you're able to create a closing date password to restrict accessing data from the prior accounting period. To make changes, you must know the password and should have appropriate permissions to make the changes.

For more insights, I'm adding the article I recommend on this:

Close your books in QuickBooks Desktop.

You can also try to write off customer and vendor balances by creating General Journal Entry. For the detailed steps, please visit this article:

Write off customer and vendor balances.

Please feel free to get in touch with me here for any additional questions. The Community always has your back.

@AlcaeusF wrote:Hello there, KimRussel.

Thank you for reaching out to us here in the Community. I'm here to provide some suggestions about making the changes from closed books.

In QuickBooks Desktop, you're able to create a closing date password to restrict accessing data from the prior accounting period. To make changes, you must know the password and should have appropriate permissions to make the changes.

For more insights, I'm adding the article I recommend on this:

Close your books in QuickBooks Desktop.

You can also try to write off customer and vendor balances by creating General Journal Entry. For the detailed steps, please visit this article:

Write off customer and vendor balances.

Please feel free to get in touch with me here for any additional questions. The Community always has your back.

@AlcaeusF wrote:Hello there, KimRussel.

Thank you for reaching out to us here in the Community. I'm here to provide some suggestions about making the changes from closed books.

In QuickBooks Desktop, you're able to create a closing date password to restrict accessing data from the prior accounting period. To make changes, you must know the password and should have appropriate permissions to make the changes.

For more insights, I'm adding the article I recommend on this:

Close your books in QuickBooks Desktop.

You can also try to write off customer and vendor balances by creating General Journal Entry. For the detailed steps, please visit this article:

Write off customer and vendor balances.

Please feel free to get in touch with me here for any additional questions. The Community always has your back.

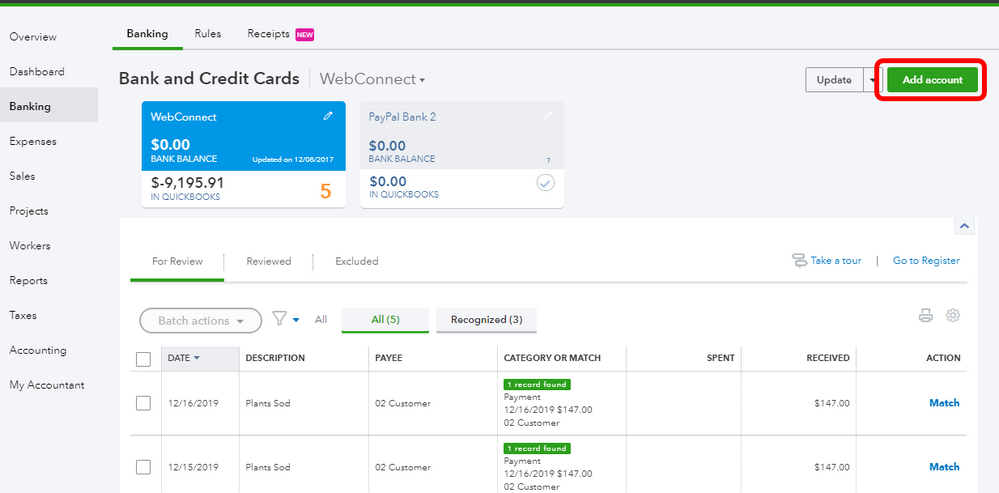

I appreciate the screenshot you've provided, luther253.

Let me help you go over to your QuickBooks Online account and have those transactions matched and reconciled.

As referenced by my peer above, you must know the password to match the unapplied transactions and deposits in QuickBooks Online. If you don't remember the password for the closed books, you can change the closing date password.

Here's how:

After that, you can match the unapplied transactions and deposits. Here's a helpful article that you might find helpful: Assign, categorize, edit, and add your downloaded banking transactions.

Also, these articles are good references:

For additional help, you can reach out to our QuickBooks Online Support. To reach us, please follow these steps:

If you need more help matching and reconciling your transactions in QuickBooks, please let me know. I'll be around to help. Have a good one.

@luther253 wrote:

@AlcaeusF wrote:Hello there, KimRussel.

Thank you for reaching out to us here in the Community. I'm here to provide some suggestions about making the changes from closed books.

In QuickBooks Desktop, you're able to create a closing date password to restrict accessing data from the prior accounting period. To make changes, you must know the password and should have appropriate permissions to make the changes.

For more insights, I'm adding the article I recommend on this:

Close your books in QuickBooks Desktop.

You can also try to write off customer and vendor balances by creating General Journal Entry. For the detailed steps, please visit this article:

Write off customer and vendor balances.

Please feel free to get in touch with me here for any additional questions. The Community always has your back.

@AlcaeusF wrote:Hello there, KimRussel.

Thank you for reaching out to us here in the Community. I'm here to provide some suggestions about making the changes from closed books.

In QuickBooks Desktop, you're able to create a closing date password to restrict accessing data from the prior accounting period. To make changes, you must know the password and should have appropriate permissions to make the changes.

For more insights, I'm adding the article I recommend on this:

Close your books in QuickBooks Desktop.

You can also try to write off customer and vendor balances by creating General Journal Entry. For the detailed steps, please visit this article:

Write off customer and vendor balances.

Please feel free to get in touch with me here for any additional questions. The Community always has your back.

@AlcaeusF wrote:Hello there, KimRussel.

Thank you for reaching out to us here in the Community. I'm here to provide some suggestions about making the changes from closed books.

In QuickBooks Desktop, you're able to create a closing date password to restrict accessing data from the prior accounting period. To make changes, you must know the password and should have appropriate permissions to make the changes.

For more insights, I'm adding the article I recommend on this:

Close your books in QuickBooks Desktop.

You can also try to write off customer and vendor balances by creating General Journal Entry. For the detailed steps, please visit this article:

Write off customer and vendor balances.

Please feel free to get in touch with me here for any additional questions. The Community always has your back.

Thanks for getting back to us, luther253.

You can run the account register and compare it to your bank statements. Once you've identified the missing transactions, simply download them into QuickBooks Online (QBO). I'm here to guide you on this.

There are two options to bring them in.

First is to connect your bank account and manually add the bank transactions.

Then, you can now assign, categorize, edit, and add your downloaded banking transactions.

Second is to manually upload these transactions using a WebConnect file.

Once the account register and bank balance have matched, you can now start reconciling.

Let me know on how it goes. I'll be here if you need additional support about the bank connection in QuickBooks Online or if you need anything else.

@PreciousB wrote:Thanks for getting back to us, luther253.

You can run the account register and compare it to your bank statements. Once you've identified the missing transactions, simply download them into QuickBooks Online (QBO). I'm here to guide you on this.

There are two options to bring them in.

First is to connect your bank account and manually add the bank transactions.

- Choose Banking, on the left pane.

- On the Banking page, select Add Account.

- Search and select your financial institution from the list.

- Enter your Login credentials for the financial institution's website and select Continue.

- Complete the security verification steps your financial institution requires and select Securely connect.

- Hit the bank emblem for the account you want to connect.

- Choose the Account type drop-down menu to choose either a Bank or Credit Card account.

- If you haven't already created the account, you can select +Add new to create a new account.

- Select Connect.

Here's a relevant article for the detailed steps: How to add and connect bank and credit card accounts.

Once done, you can now assign, categorize, edit, and add your downloaded banking transactions.

Second is to manually upload these transactions using a WebConnect file.

Once the account register and bank balance have matched, you can start reconciling.

Let me know on how it goes. I'll be here if you need additional support about bank connection in QuickBooks Online or if you need anything else.

@PreciousB wrote:Thanks for getting back to us, luther253.

You can run the account register and compare it to your bank statements. Once you've identified the missing transactions, simply download them into QuickBooks Online (QBO). I'm here to guide you on this.

There are two options to bring them in.

First is to connect your bank account and manually add the bank transactions.

- Choose Banking, on the left pane.

- On the Banking page, select Add Account.

- Search and select your financial institution from the list.

- Enter your Login credentials for the financial institution's website and select Continue.

- Complete the security verification steps your financial institution requires and select Securely connect.

- Hit the bank emblem for the account you want to connect.

- Choose the Account type drop-down menu to choose either a Bank or Credit Card account.

- If you haven't already created the account, you can select +Add new to create a new account.

- Select Connect.

Here's a relevant article for the detailed steps: How to add and connect bank and credit card accounts.

Once done, you can now assign, categorize, edit, and add your downloaded banking transactions.

Second is to manually upload these transactions using a WebConnect file.

Once the account register and bank balance have matched, you can start reconciling.

Let me know on how it goes. I'll be here if you need additional support about bank connection in QuickBooks Online or if you need anything else.

@PreciousB wrote:Thanks for getting back to us, luther253.

You can run the account register and compare it to your bank statements. Once you've identified the missing transactions, simply download them into QuickBooks Online (QBO). I'm here to guide you on this.

There are two options to bring them in.

First is to connect your bank account and manually add the bank transactions.

- Choose Banking, on the left pane.

- On the Banking page, select Add Account.

- Search and select your financial institution from the list.

- Enter your Login credentials for the financial institution's website and select Continue.

- Complete the security verification steps your financial institution requires and select Securely connect.

- Hit the bank emblem for the account you want to connect.

- Choose the Account type drop-down menu to choose either a Bank or Credit Card account.

- If you haven't already created the account, you can select +Add new to create a new account.

- Select Connect.

Here's a relevant article for the detailed steps: How to add and connect bank and credit card accounts.

Once done, you can now assign, categorize, edit, and add your downloaded banking transactions.

Second is to manually upload these transactions using a WebConnect file.

Once the account register and bank balance have matched, you can start reconciling.

Let me know on how it goes. I'll be here if you need additional support about bank connection in QuickBooks Online or if you need anything else.

The following steps will help you resolve Unapplied cash payment income on your Profit and Loss report.

Step 1: Run the Open Invoices report

To run the open invoices report:

From the left menu, select Reports.

In the Find report by name field, enter Open Invoices.

Set the report period, then select Run report.

In the Transaction Type column, locate a transaction listed as a Payment.

If that Payment transaction matches an open invoice, go to Step 2. If you don’t see a matching open invoice, go directly to Step 3.

Step 2: If the Payment transaction matches an open invoice

If that payment matches an open invoice, follow these steps.

Select the Payment date to open.

Under Outstanding Transactions, check the open invoice.

Select Save and close.

Step 3: If the Payment transaction doesn’t match an open invoice

If the payment doesn’t match an open invoice, you’ll need to create the transaction. Follow these steps:

Select the Plus icon (+) on the Toolbar.

Under Customers, select Invoice.

Fill out the form with the same customer, amount and date as the payment.

Select Save and send.

Go back to the Open Invoices report.

Find the unapplied payment, then select the date to open.

Under Outstanding Transactions, check the open invoice.

Select Save and send.

Check your Open invoices report to see if there are any more transactions listed as a Payment. If there are, repeat step 2 for each one.

Now run your Profit and Loss report again. You should no longer see the Unapplied cash payment income.

Regards,

Adrian

Hosted QuickBooks Consultant

Hi luther253,

We're here to help you with any questions you have. Please keep up posted.

Hoping you find strength with each new day.

Good to have you back, luther253.

Let's match those transactions first. Then, add those that need to be added in QuickBook Online.

Once done, you can reconcile them in a yearly basis. You can find the detailed steps on how to reconcile accounts in this article.

Keep us posted for additional questions. We're here to help you out.

I'm here to ease your confusion, Luther253.

You can either manually enter the missing transactions or import them using the WebConnect feature. Although, you still have to check with your bank if they can provide you the transactions from January 2016 to May 23, 2016.

Once all transactions are entered/imported, you can go through with the reconciliation process. Just refer to the article provided by GlinetteC.

Please know we're just here if you have other concerns. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here