Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI have a vendor that has payment terms that is 12% 30; 10% 60; NET 61. So this means if we pay within 30 days of the invoice date we get a 12% discount, if we pay within 60 days of the invoice date we will get a 10% discount and then if we do not pay early all is due 61 days of the invoice date. The way I have it set up in QuickBooks, it does not calculate correctly. Please advise how to set this term up correctly to calculate correctly.

Welcome to the Community, @CPM3.

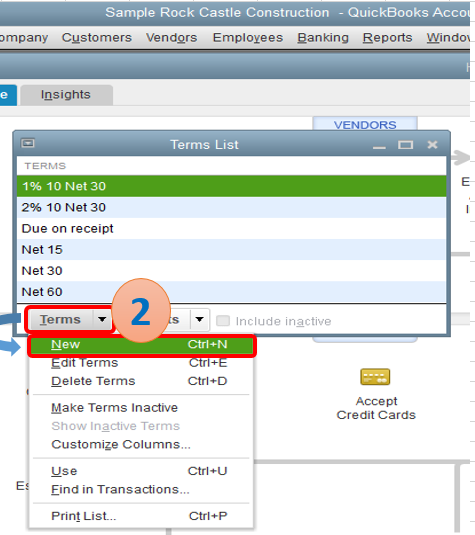

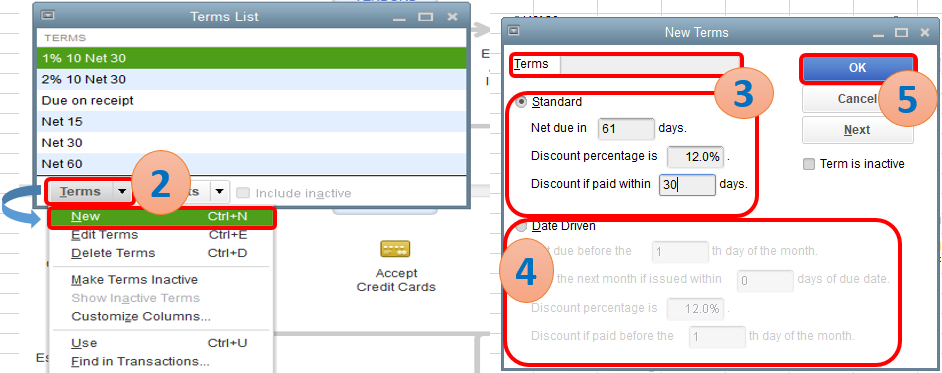

I can get this taken care of and fix your concern. I'll be glad to guide you on how to set up net terms for your vendor payments in QuickBooks Desktop. Here's how:

Also, please take note that the terms you've set up is a single condition hence can only be used once.

Consider checking out this article in case you wanted to apply net terms from the invoice payments you receive form your customers: Setting up Net Terms in QuickBooks Desktop.

Furthermore, you'll also want to customize your vendor reports in QuickBooks Desktop. This way, you'll be able to see where you're company stands in terms of expenses and payables.

Don't hesitate to read this awesome help article if you've got more QuickBooks concerns, such as importing and exporting data, managing inventory, and projects, track income and expenses, setting up payments and connecting to third-party apps, online banking and many more to keep your business up and running smoothly.

Please know that I'll just be around here in the Community if you needed any help. Have a good one and take care always!

Setting up the terms is all well and good, but the discount is taken off of the entire bill, freight charges included. Freight for 95% of our vendors is NOT included in the early payment discount terms. How do we apply the discount to the products only?

Hey there, @BH20211.

Thanks for following along with the thread. I hope you're enjoying the day so far.

If you aren't interested in using terms, some of users have found it beneficial to use a discount item and include it to the invoice. I've included the steps to add a discount item below.

For additional information about item types and using discount items, check out Create items in QuickBooks Desktop.

Also, if you wanted to upgrade to Enterprise, we have a price level feature. When using price level, QuickBooks automatically changes the prices of items on sales forms according to rules you create. Each price rule can contain multiple conditions that must be met before QuickBooks Desktop changes the sales price. For example, if you want a specific group of customers (the first condition) to receive a discount, but only when they buy specific items (the second condition), set up a price rule with these two conditions. Conditions can be created based on customer, item, sales rep, date range, and class.

You can learn more details in Use Advanced Pricing.

Let me know if you have any questions or concerns. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here