Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI submitted a payment yesterday to the wrong contractor (July 3rd) . I tried to void the payment today (July 4th) via Quickbooks online however it said it could not be voided because the payment has already been processed. When I logged into my bank account however, the money has NOT been taken out of our account yet. How do I stop this?

If I cannot stop this, how do you advise I request the return from the contractor? I don't want to tax them on this return payment. Should I request a direct deposit? Zelle? Venmo? Or can I request the return via QB? I just want to make sure it's recorded correctly where not either individual is taxed on the transaction. Also, how do I avoid this payment from being included on their 1099 tax form, Quickbooks?

I can help correct the payment posted to the wrong contractor, piano3more. I'll share some details about deleting a contractor's direct deposit in QuickBooks Online (QBO).

The offload time for ACH processing of your Direct Deposit (DD) happens at exactly 5:00 p.m. Pacific time, two banking days before the scheduled pay date. Otherwise, we'll not be able to stop or reverse the transactions from posting to the contractor's account.

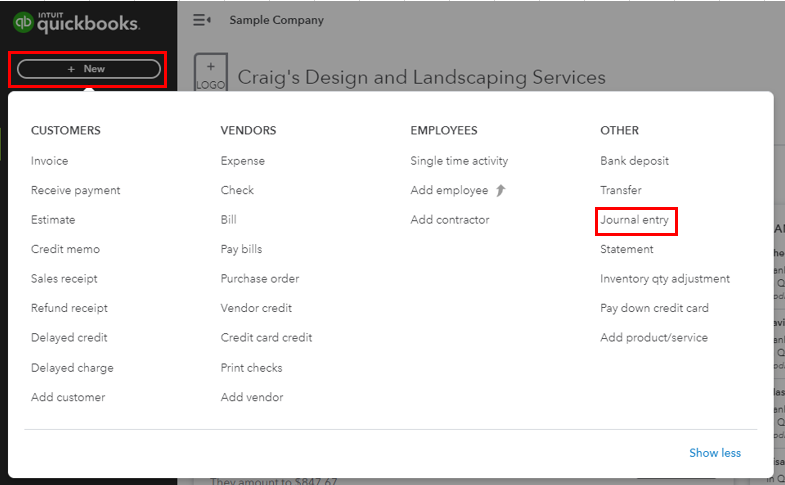

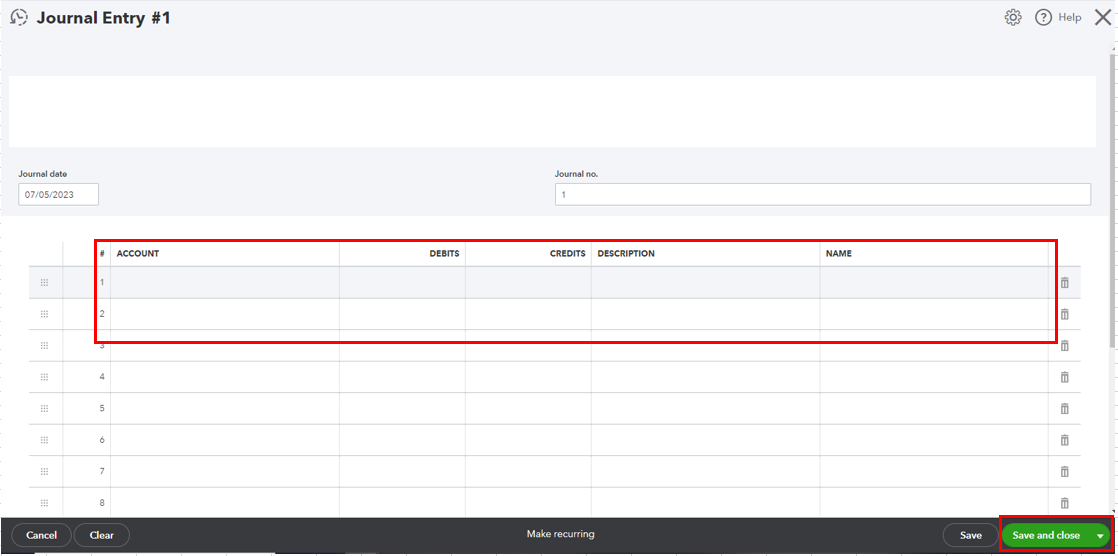

That said, we can create a journal entry to offset the contractor's direct deposit transaction amount. I'll guide you on how to do it.

Moreover, you can make an internal agreement with your contractor to facilitate the return of the funds once they have received the payment. You can initiate a direct deposit reversal within 5 business days from the date of payment.

Before proceeding, let me share information on when to perform the reversal.

Please be aware that a direct deposit reversal fee of $75 will be incurred, regardless of whether or not the funds are successfully recovered.

You'll get an email letting you know the request is accepted. If something is missing, your request will be sent back to you by email with instructions.

Additionally, you’ll receive an email once the request is accepted. The funds from your contractor will be taken out and will be credited back to you. This process takes up to 14 banking days from the day your request has been accepted. Once the payment is canceled, it'll not reflect on your contractor's 1099.

For more details on this process, check the following article: Reverse a direct deposit. It includes information on the things you need to do before and after the reversal request.

If you have clarification on the process or additional concerns, let me know by tapping the Reply button. I'll get back to you as soon as possible. Have a good one!

I called my bank this morning and they said they can still stop the payment. They are waiving any fees. You mentioned a $75 fee that QB charges. If my bank is able to stop the ACH business to business transaction, why is QB charging a $75 fee? All I need for QB to do now is to recognize the payment didn't happen and to NOT record it in the contractor's 1099. A reminder, we are talking about a contractor, not an employee so there is no "paycheck". Please advise.

Chiming in on this thread to share additional information about voiding a contractor payment in QuickBooks Online, @piano3more.

The $75 charge is only applicable when you requested a direct deposit reversal to get the money back. Since your bank initiates the cancellation, you will no longer need to reverse the deposit. Thus, QBO will no longer charge any fees.

Once the cancellation is successful, you can now void the direct deposit payment in QBO. Here's how:

If you're unable to delete the payment in QBO, utilize the Journal Entry to offset a contractor's direct deposit transaction amount.

Also, you don't need to worry about posting the payment to your contractor's 1099 since the direct deposit was unprocessed and canceled by your bank.

Furthermore, QBO helps you prepare and file your 1099s seamlessly, using the details you already have in your account. For more information, I suggest reading this article: Get answers to your 1099 questions.

Let me know whenever you have additional queries about paying your contractors. The Community is always open to lend you a helping hand. Be safe and have a wonderful rest of the day!

Thank you for your help JaeAnn C however QBO will not allow me to void or delete the transaction. The journal entry will not offset a contractor's direct deposit transaction amount for their 1099. Please advise. It's important that QBO doesn't include this returned transaction as part of the contractor's revenue when submitting taxes.

Hello piano3more,

Thank you for reaching back out and providing that update. Since there is still an issue, I recommend calling us in to do a screen share to do some testing to figure out what is causing this. Here's how to connect with us:

Let me know how the conversation goes, and if you have any other questions, know that we are here to help. See you soon.

I am having the same issue. Quickbooks failed a payment due to reaching our company limit, even though there were more than sufficient funds in our linked bank account. I was able to increase the limit but now the failed payment can't be deleted. The contractor was paid half of what they are owed and now I need to pay the remaining amount but I can't remove/delete/void/edit the failed payment.

I have been on with support and although very nice - I still do not have a solution. If Quickbooks fails a direct deposit, why would they show that it was paid???

I charge the company I am supporting by the hour and now have wasted several hours that I cannot bill for. I am trying to get the books closed for year-end. This doesn't appear to be a new issue, we need a solution.

Believe it or not, this issue still has not been resolved. I have spent hours with multiple customer service agents and no one seems to have a clue on what to do. They are very nice, but no solution. I've been trying to fix this for months. It's very frustrating. I think I just have to give up and not send the contractor a 1099 from QB since QB can't seem to fix this.

Let me route you the right support so that they can cater to your needs, LBradC and piano3more.

As much as I'd like to help you with deleting your failed payments, it's best to contact our online team support. This way, they can pull up your account and use their tools and expertise to help you further with your concern.

Here's how:

Please let me know if you have further concerns aside from deleting your failed payments by replying to the comment section. We're always here for you.

I called customer support last week. They couldn't figure it out and they told me they would call me back later again that day. Its' been 5 business days since and still no call back or email. Please advise.

Hi, @piano3more.

I can imagine the hurdle you’ve been through when trying to find a resolution to your concern about mistaken payments for contractors. This isn’t the kind of experience that we’d like you to have.

I understand that you've already reached out to them, but I recommend contacting our Customer Support Team again. You can ask them for updates and have them check your account further to find a possible resolution.

Once settled, you can have those 1099s printed in the future. Refer to this article for the detailed step-by-step process: Print your 1099 and 1096 forms.

If you have any other questions about your contractors, please feel free to leave a comment below. I'll get back here as soon as possible to help you again. Keep safe always.

Astoundingly, this issue has still not been resolved by Quickbooks. I am having the same problem of not being able to delete or void a failed Contractor Direct Deposit Payment. How do I make it not reflect in their 1099, creating a journal entry will make sure it is not reflected in their 1099, or How do Quickbooks make sure of this?

How can Quickbooks be so unresponsive on not updating their system to facilitate their use on this long going issue?

I can see how this scenario affects your business processes, @aayush_rm. I'm here to share information and some recommendations to help fix a failed contractor direct deposit payment.

It's correct that the option to delete or void a processed direct deposit payment is unavailable. With that said, you have to create a journal entry to offset the direct deposit transaction in the system. For reference, check out this article: Void or cancel contractor payments.

Before doing so, I suggest reaching out to your accountant to get additional advice on what account to use in the credits and debits columns.

Also, to ensure that the journal entry won't reflect on your contractor's 1099 form, make sure that the contractor's name is not attached to it.

Then, to get the money back, you can request a direct deposit reversal request. For detailed guidance, check this article: Reverse a direct deposit in QuickBooks Payroll.

You can also send invites to your contractors to create their QuickBooks Self-Employed (QBSE) account so they can manage their contractor profile and track payments received.

You can leave a reply below if you have other concerns managing your contractor's direct deposit payments. This thread is always open to ensure you'll be assisted immediately.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here