Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I setup The Workforce Time Sheets app to identify holidays, and then map that to QBO Elite Payroll so hours worked on holidays flows into the QBO Payroll "Reg Holiday-Worked" column?

Hello there, @LeeWhite12341. Thank you for joining the Community today. I would be happy to assist you in setting up your Workforce Time Sheets and mapping your payroll items correctly.

By mapping payroll items by employee, you can assign a default payroll item for each type of hours that your employees track. This means that for every type of hour your employee tracks, such as regular time, overtime, double-time, and any paid time off codes that you have set up, there will be one specific payroll item assigned to those hours in QuickBooks.

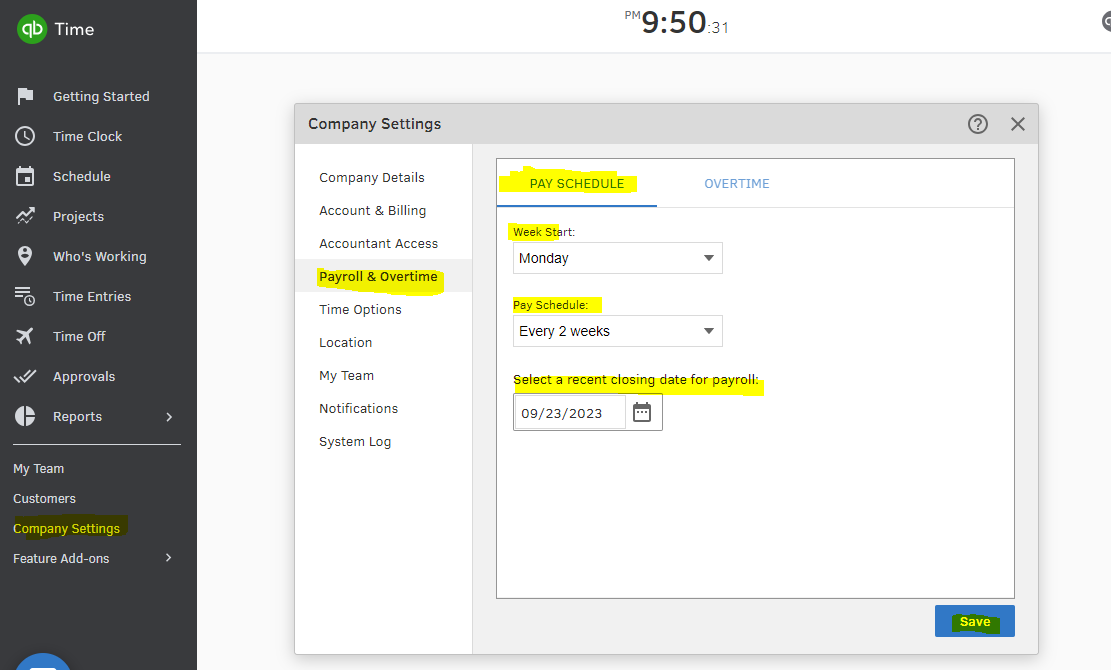

To set up pay period and overtime settings, follow the steps below:

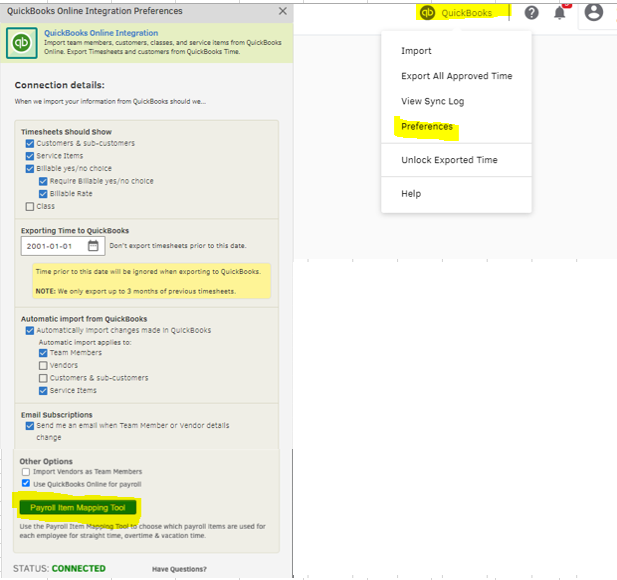

Then, double-check the mapping and make any necessary adjustments to ensure that time transfers to payroll and is linked to the correct pay rates.

Here's how:

For more information about the process above, see these articles:

Additionally, I will share these resources with you that will assist you in submitting time and troubleshooting any issues you may encounter while using the QuickBooks Workforce app:

Feel free to return here anytime if you have any further questions about the process or if you have any other concerns regarding QuickBooks Time. I will be available to provide you with further assistance. Take care.

I don't believe that was the answer to the question. Is there a place in the payroll software that is a calendar that you mark on it the holidays that your company pays its employees for so that Quickbooks will automatically add 8 hours of Holiday pay for each employee when the pay period comes up with a marked holiday.

I appreciate you for joining the thread, richmorley. I want to ensure that your suggestion about automatically adding holiday pay hours using a calendar in QuickBooks Payroll gets the attention it deserves.

The option to mark a calendar within QuickBooks Payroll to add hours for the holiday pay isn't available. It is important to note that setting up a holiday pay needs to be done manually in QuickBooks Payroll.

In the meantime, I recommend sending feedback to our Product Engineers. This will help our engineers understand how they can enhance existing features and create new ones to better serve our customers.

Here's how:

Moreover, you can refer to this article to see information on how to create a payroll summary report to view what you've paid out: Create a payroll summary report.

Don't hesitate to leave a reply in this thread if you need help setting up holiday pay in QuickBooks. I'm always here to help you.

Has this feature been added?

Hi there, Lindsay.

QuickBooks (QB) currently doesn't have the feature to automatically add hours for holiday pay for each employee. However, I have an alternative way for you to add it.

In our system, holiday hours are treated as overtime, even if they don’t technically qualify. What we can do is manually create an overtime rule and name it as a holiday. Follow the steps below:

After that, add a rule for the setting you just created. For the detailed process, you can refer to Steps 6 to 9 under the Set up overtime customizations section in this article: Customize overtime calculations in QuickBooks Time.

Please note that this rule will only apply on a specific date that you set up. For other holidays, you'll need to create another rule.

You can also add your feedback, which our Product Development Team will review and consider for inclusion in future product updates. Please follow the steps outlined by one of our team @GenmarieM to submit your feedback.

I'll add this material for guidance in tracking, editing, and submitting your timesheets in QB Time: Track and submit your time in QuickBooks Time web.

You can add any related questions when carrying out various business tasks in QB by leaving a comment below. The Community team is ready to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here