Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThere are two ways on how to apply invoice discounts for early payments in QuickBooks Online, @charrison.

The first option is to create a line item. Here's how:

The second one is to add a discount to an invoice as a whole. Here are the steps how:

For more information, please check out this article: Add a discount to an invoice in QuickBooks Online.

On the other hand, if you mean you want to specify the said option in the Terms section of an invoice, I recommend visiting our blogs to keep up with the latest news and product updates. All announcements are laid down there so you can check them from time to time:

You can customize your invoices to get the details and formats you need the most. Also, you can run the Invoices and Received Payments report to keep track of all the payments you’ve received and the invoices that go with them. To achieve this, simply explore the Reports menu, refer to the Who owes you section under the Standard tab. Please see the screenshot below for visual guide:

Please let me know in the comment section if you have more questions regarding this or any QuickBooks concerns. Have a good one.

Does this discount have to be applied manually after payment for it to apply to early only payments? I don't see where it could be checking if the payment was received before applying the discount, unless it reads and interprets the "expiration" description.

Hello, wshiflet.

You can either apply the discount before or after you received the payments. However, if the payments are already Deposited, you'll need to manually edit the transactions, and from there, you can add the discount to the transactions.

But let's ensure first you turn On the discount under Account and Settings, so you'll have the option to add the discount on the transactions.

For more details about it, please refer to this article: Add a discount to an invoice in QuickBooks Online.

You may want to design form styles to make it more personalized when sending it to your customers, refer to this link: Customize invoices, estimates, and sales receipts in QuickBooks Online.

I'm always here if you need further assistance. Have a great day.

This is bogus. We aren't trying to add discounts to invoices. We are trying to set up payment terms correctly. This has been no issue in QBDT for at least two decades, but STILL can't be done in QBO? So we have to remember when a discount might apply, manually figure out whether or not a bill payment falls within the discount terms manually calculate the discount amount, and then manually enter it on the bill before paying it? In desktop once terms are set up correctly all of that is automatic!

Thanks for joining this thread, Jo Landers.

I can certainly understand how an ability to automatically apply discounts to transactions could be useful and have submitted a suggestion about it as of today.

You can also submit your own feature requests while signed in.

Here's how:

Your feedback's definitely valuable to Intuit. It will be reviewed by our Product Development team and considered in future updates. You can stay up-to-date with the latest news about your product by reviewing Intuit's Product Updates webpage.

For the time being, you can add discounts to sales forms using the steps shared in ReyJohn_D and AileneA's posts.

I've also included a detailed resource about working with invoice payment terms which may come in handy moving forward: How to Adjust Invoice Payment Terms

I'll be here to help if there's any questions. Have a great day!

This is ludicrous that we can't create payment terms with discounts. Might as well go back to the pen and paper.

Has there been any progress on this request. I must admit I am completely shocked to lose this capability, especially considering the hefty Saas fee associated with QBO!

Creating payment terms with discounts is still not available in QuickBooks Online, Duska12. I can see the potential efficiencies this feature could bring to your business processes.

Rest assured, we're actively taking notes of customer suggestions through various feedback channels, including the Community forum. I'll also share some details to make sure you can add the discount when there are early payments.

For now, these are the available terms that can be used when creating invoices in QBO:

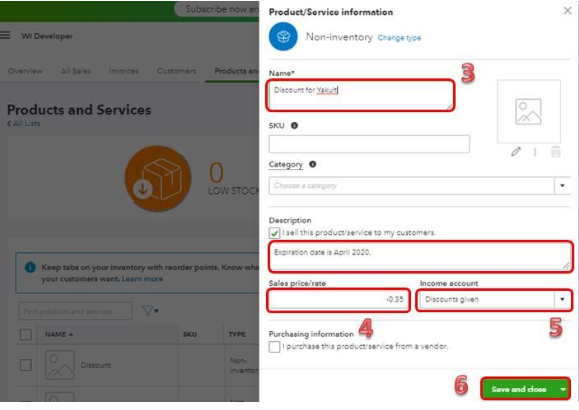

In the meantime, you can create a non-inventory item for the discount. Then, add it to the invoice when there are early payments or whenever applicable. Allow me to also share these steps with you:

Then, edit the invoice and add the item in the Product/service column.

You can also refer to this article for additional details: Add a discount to an invoice in QuickBooks Online.

If you have other suggestions or requests for improving this feature, we encourage you to share your feedback with our development team. You can find instructions on how to submit your feedback in this article: How do I submit feedback?

Let me also share this additional reference material when working with payment terms in QBO: Fix inconsistencies in due date and invoice date in QuickBooks Online.

Should you have any more questions or require further assistance with invoicing and receiving payments in QBO, please do not hesitate to post them here in the Community. We are here to help and will ensure that you receive the support you need.

RE: Rest assured, we're actively taking notes of customer suggestions through various feedback channels, including the Community forum.

Oh I feel so much better knowing that.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here