Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello,

i have an apartment building and the mgmt company sends me the P&L monthly. i input that in to QB's so i can run reports if needed. i also, transfer the profit from that month in to another QB account where i keep track of other expenses for that apartment. when i run a P&L, the profit does not show up. anyone know why and how do i correct it? thanks

Solved! Go to Solution.

Thanks for visiting the Community today, rmp7345.

Let me provide some information on why you’re unable to see the bank transfers in your Profit and Loss report.

The financial statement summarizes your business revenues, costs, and expenses incurred for the month. This is to check whether you’re operating at a profit or a loss. Also, it will show the subtotals for each income or expense account in your chart of accounts.

Regarding your bank transfers, we’ll have to identify first how it’s recorded in the company file including your other transactions. Thus it affects how the data is shown in your report and will help check why the entries didn’t show up.

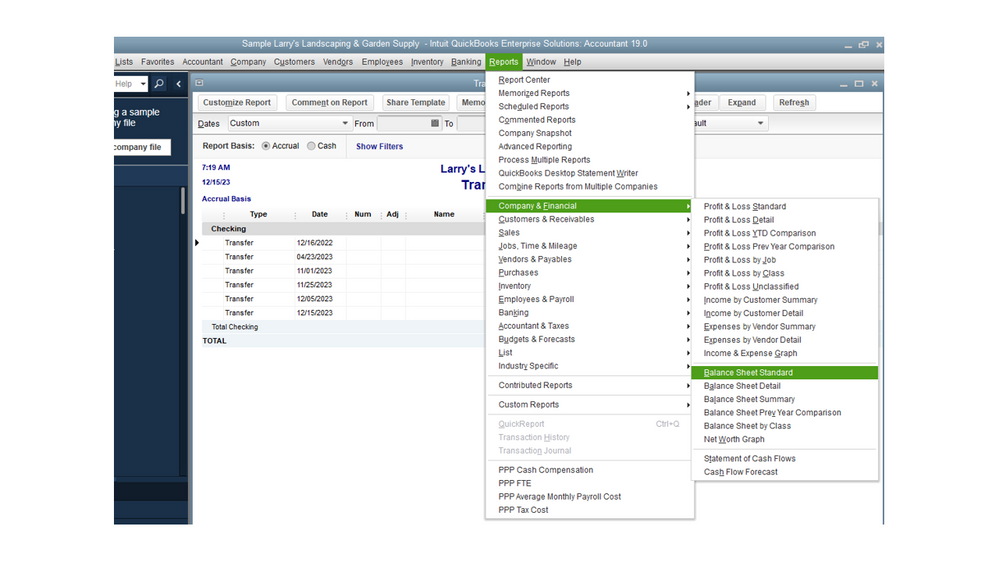

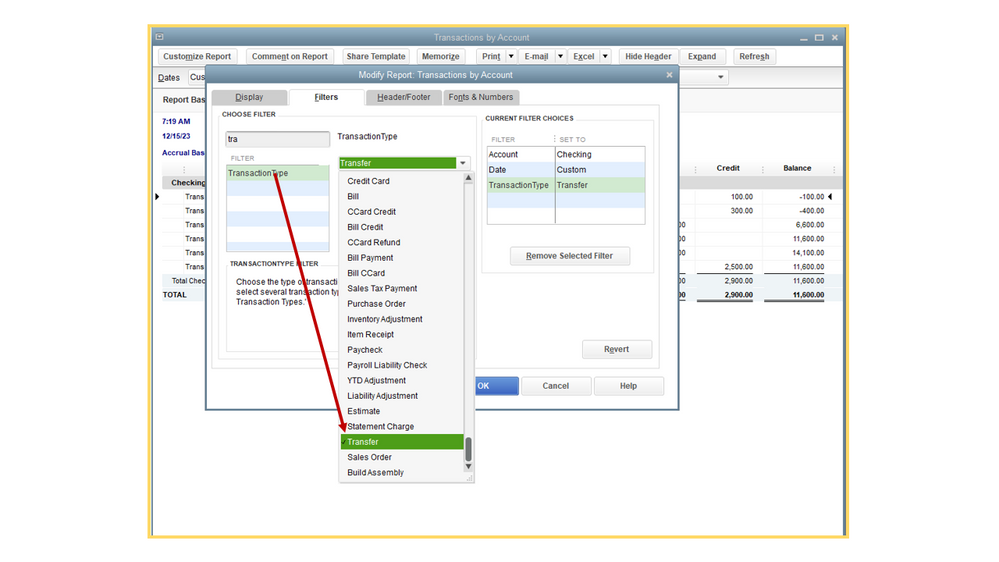

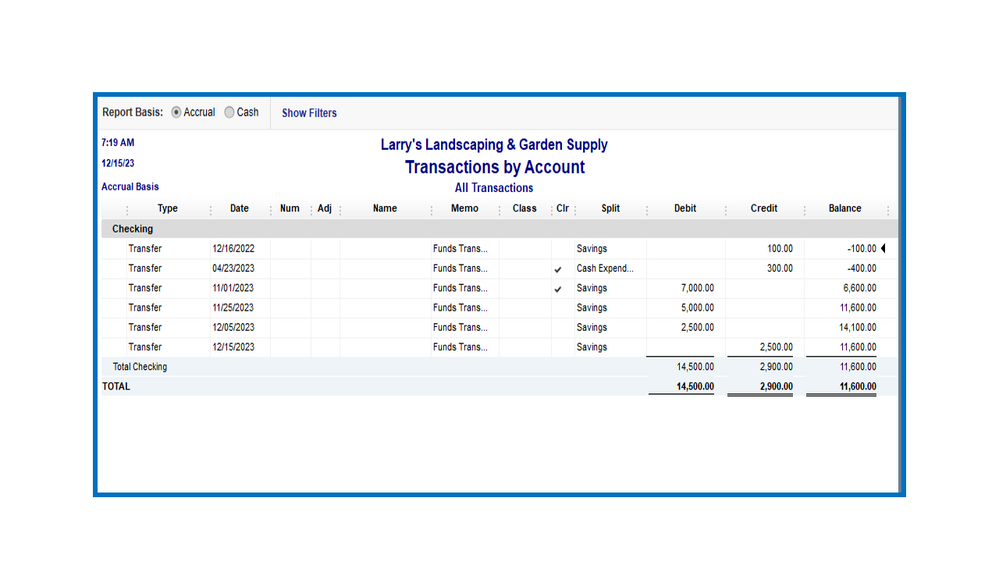

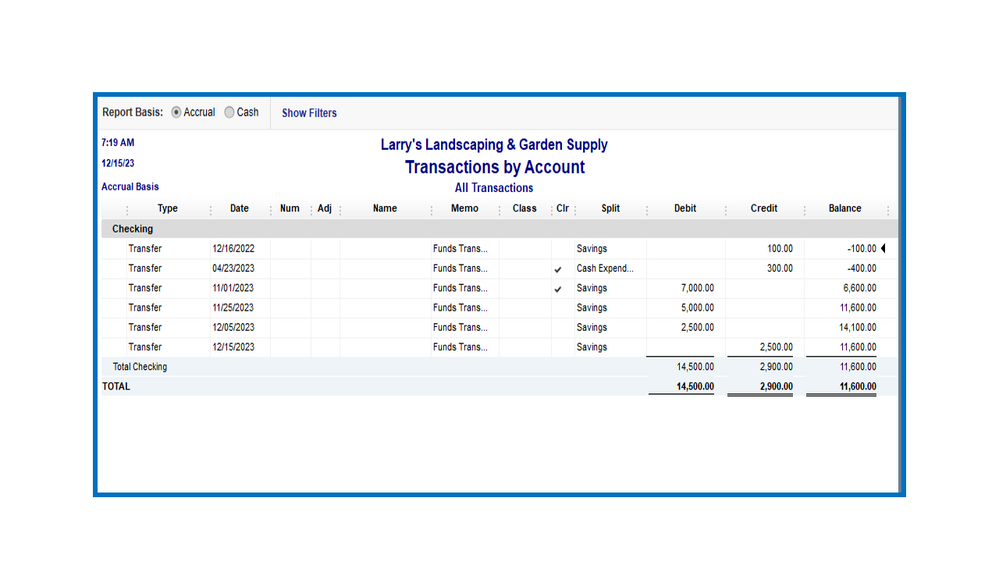

You can run the Balance Sheet report to check the activities incurred in your bank accounts. Then customize it to see the bank transfer.

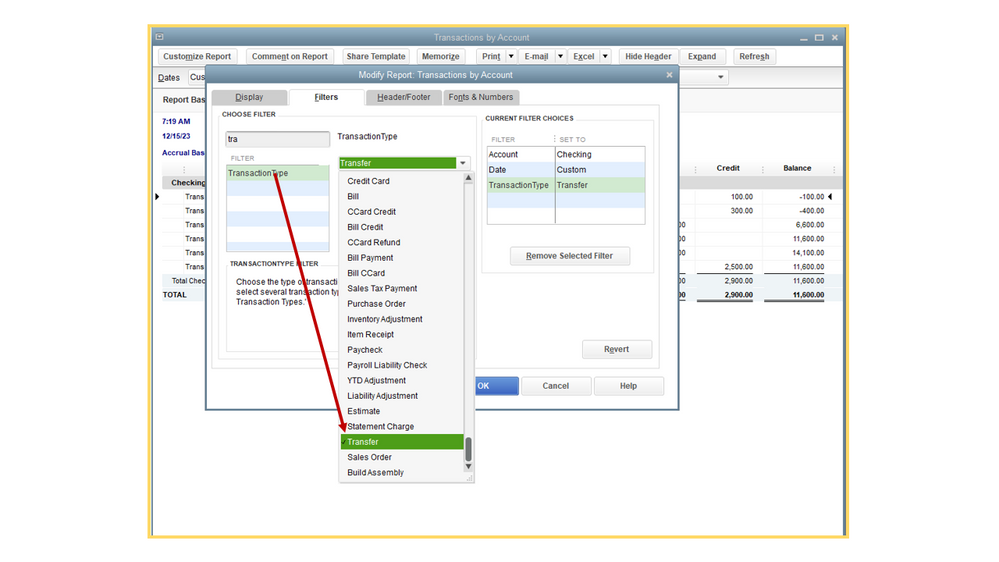

Here’s how:

Check the following resource for additional information: Customize company and financial reports. It provides detailed instructions on how to build and tailor your statements. You’ll see the links on how to perform each process in QuickBooks.

This reference will guide you on how to manage your reports: Customize reports in QuickBooks Desktop. It outlines the complete steps on how to use the Display, Filters, Header/Footer, and Fonts & Numbers tabs to name a few.

Stay in touch if you have additional questions about running financial reports and other QuickBooks concerns. I’ll jump right back in to assist further. Have a great weekend ahead.

Thanks for visiting the Community today, rmp7345.

Let me provide some information on why you’re unable to see the bank transfers in your Profit and Loss report.

The financial statement summarizes your business revenues, costs, and expenses incurred for the month. This is to check whether you’re operating at a profit or a loss. Also, it will show the subtotals for each income or expense account in your chart of accounts.

Regarding your bank transfers, we’ll have to identify first how it’s recorded in the company file including your other transactions. Thus it affects how the data is shown in your report and will help check why the entries didn’t show up.

You can run the Balance Sheet report to check the activities incurred in your bank accounts. Then customize it to see the bank transfer.

Here’s how:

Check the following resource for additional information: Customize company and financial reports. It provides detailed instructions on how to build and tailor your statements. You’ll see the links on how to perform each process in QuickBooks.

This reference will guide you on how to manage your reports: Customize reports in QuickBooks Desktop. It outlines the complete steps on how to use the Display, Filters, Header/Footer, and Fonts & Numbers tabs to name a few.

Stay in touch if you have additional questions about running financial reports and other QuickBooks concerns. I’ll jump right back in to assist further. Have a great weekend ahead.

Thank you Rasa-LilaM - that makes sense! appreciate your help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.