Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Let me show you some options to charge your customers for the credit card processing fee in QuickBooks Online (QBO).

As stated by Fiat Lux Asia above, QuickBooks Payments doesn't have this feature. As a workaround, you'll want to create a service item for the fees and manually add it to your invoice. Follow these steps to proceed:

Once completed, add the processing fee as an additional item to your invoice to charge your customers.

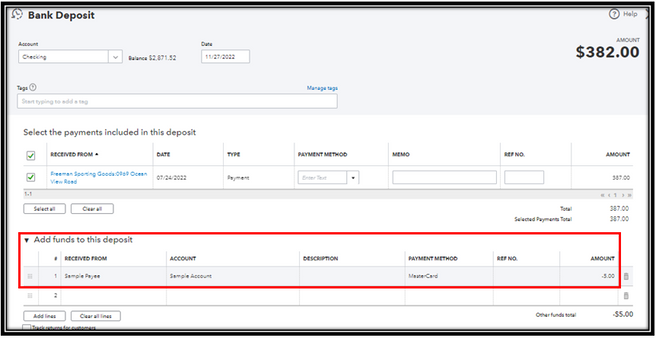

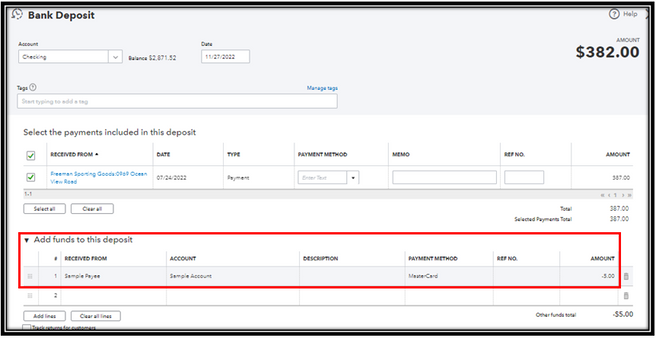

Another option is to add negative amounts for the fee together with your transactions when generating the deposit. Here's how:

On the other hand, here's a resource that you can follow when your customer has overpaid you: Handle a customer credit or overpayment in QuickBooks Online. You can use the credit toward an invoice, refund the customer, or enter the overpayment as a tip in QuickBooks.

Feel free to post again if you have other QuickBooks concerns. The Community forum is always open to answer your questions. Have a great day!

QB Payments does not yet offer this feature. Are you running a B2B or B2C company? You can use a 3rd party solution for this requirement.

Let me show you some options to charge your customers for the credit card processing fee in QuickBooks Online (QBO).

As stated by Fiat Lux Asia above, QuickBooks Payments doesn't have this feature. As a workaround, you'll want to create a service item for the fees and manually add it to your invoice. Follow these steps to proceed:

Once completed, add the processing fee as an additional item to your invoice to charge your customers.

Another option is to add negative amounts for the fee together with your transactions when generating the deposit. Here's how:

On the other hand, here's a resource that you can follow when your customer has overpaid you: Handle a customer credit or overpayment in QuickBooks Online. You can use the credit toward an invoice, refund the customer, or enter the overpayment as a tip in QuickBooks.

Feel free to post again if you have other QuickBooks concerns. The Community forum is always open to answer your questions. Have a great day!

All of the Intuit / QB support staff who keep posting that we should add a line item to cover the cc processing fees understand that this isn't an actual workaround for the problem, right? I can't add a line item that magically disappears if the customer chooses to pay via ACH, nor that magically lowers itself if the customer choose to pay via debit card vs credit card. The point of this feature is to incentivize customers to pay via ACH versus via CC. There are also laws in various jurisdictions for charging customers payment processing fees in excess of the actual fees paid.

And in case Intuit isn't prioritizing this important feature because they are concerned that it will lower their own revenues, then I say shame on them. And I hope they recognize that if they don't provide features to the benefit of their customers because they're concerned about short-term revenue impact, I'll remind them that eventually they'll have a larger revenue impact from losing customers altogether to other tools that decide to meet customer needs. To that end: I'll note for anyone reading this that Bill.com supports this dynamic surcharge pass-through, and there appear to be good solutions for sync-ing invoices & payments from Bill.com with QBO. We can't use them because they don't support multi-currency invoicing, but if you're all USD-based, you should definitely take a look & let Intuit/QBO know that you're able & willing to switch away from their Payments solution if they don't implement this functionality.

Yes, you'll have to take responsibility for making sure you comply with various jurisdiction's laws around surcharges, but that's what we pay you for, and that's what a proper payments solution should do.

I agree. You know QBO can easily add the feature. Perhaps, they are too busy adding annoying adds for their other products I do not want, despite a general expectation that since we are paying for QBO our experience should be ad free, or at least give us the option to say we are not interested once and not have to keep being annoyed by the ads. I am going to have to raise my hourly rates to cover the CC fees I should have the option to pass to the consumer.

I own a small music school and the credit card fees are just eating me alive.

It is hopeless to see how it is 2023 an QB doesn't offer this feature.

I asked ChatGPT and this is the answer I got for whatever is worth:

If you're looking for an online bookkeeping service that offers the ability to charge credit card processing fees to your customers, there are several options you can consider. Here are a few popular choices:

1. Xero: Xero is a cloud-based accounting software that offers a range of features for small businesses. It integrates with various payment gateways and allows you to pass on credit card processing fees to your customers during the checkout process.

2. Wave: Wave is a free accounting software that also provides an option to pass credit card fees onto your customers. It supports payment processing through Wave Payments or integrates with third-party payment processors like Stripe.

3. Zoho Books: Zoho Books is another comprehensive accounting software that enables you to pass on credit card processing fees to your customers. It integrates with multiple payment gateways, including PayPal and Stripe.

4. FreshBooks: FreshBooks is known for its user-friendly interface and invoicing capabilities. It offers the ability to include credit card processing fees as a separate line item on your invoices.

5. Square: Square is a popular payment processor that provides integrated point-of-sale solutions for businesses. It allows you to pass on credit card processing fees to your customers during transactions.

It's important to note that the availability of certain features may vary depending on your location and the specific pricing plan you choose. Therefore, I recommend researching each option's pricing, features, and compatibility with your business needs before making a decision.

Hey! I've not too much idea but Can I record Processing Fee as an other Income via Journal entry?

If I don't want to add a line item in my Invoice.

Actually I have to record a fee separately due to my software limitation. If I've a Invoice of $100 and I push payment $100 and want to push a fee $4.00 separately instead of one payment 104 (payment + Fee)?

Please guide me in the right way.

I appreciate you for joining the thread, @Brilliant16.

Yes, you’re correct that you can also use a Journal Entry (JE) to record the processing fee incur by your customer's invoice. Since your customer has already paid the amount, there isn’t a way we can add this to the invoice. To keep your record in shape, you can create a JE, then Debit the $4.00 fee from your Expense account and Credit this to your Bank account.

Here's how:

I also added this article for more details: Create journal entries in QuickBooks Online.

However, I still recommend consulting your professional advisor to guide you through the process and keep your records accurate.

In addition, I have a set of articles that you can use to organize your transactions and reconcile your account. By doing this, you will classify your transactions correctly and prevent any discrepancies in your books:

Let me know if you have more concerns about adding a processing fee. I’m just a post away. Have a good one!

Hey @Anonymous Thank you for reply but my case is slightly different.

When we make a line item with minus (-5) in Deposit, That will delete the amount from total payment.

e.g: $100 (Payment) - $5 (fee) = 95.

But My scenario is different. I'm already syncing the payment by excluding the fee from my system.

e.g: I don't push payment of $105 ($100 Invoice Payment + $5 Fee) While I only sync $100 to QuickBooks and want to record $5 without affecting the customer direct balance.

Many of the the QBs comments ignore the main, bottom line issue of the business does not know how it will receive payment (check, ACH or credit card) beforehand and does not want to go-back and correct invoicing. Easy fix by QBs programmers but they refuse.

Someone who should work for QB (GandCo). Blows my mind how this can't be a auto feature that is added when they click pay with card.

Thank you for the lead. I knew someone would have an answer for this common issue.

Does this is a right approach to add a Customer Stripe processing fee without affecting Customer Credit balance or there's a good approach to accomplish this without adding Invoice line item.

Thank you for your attention.

Hello there,

As my colleague stated, you can use a Journal Entry (JE) to record the processing fee. Given your customer already paid the amount, there's no other way to add this to the invoice. Create a JE, enter the $4.00 fee as a Debit from your Expense account, and Credit it to your Bank account.

You can follow the steps provided by my colleague above. Also, utilize this article for more details: Create journal entries in QuickBooks Online.

I recommend that you contact your accountant to ensure an accurate account.

Feel free to use this article for future reference: Learn the reconcile workflow in QuickBooks.

If you have any further QuickBooks-related questions, please post them in the Community. We are always ready and willing to assist you with your inquiries. Have a wonderful day ahead of you.

Thank you for getting back on this thread, @Brilliant16. I'm here to ensure the issue with the processing fee is taken care of.

To record the processing fee without adding another line item, you can create a Journal entry, as also mentioned by my peer above.

Here's how:

See the screenshot below:

Another option is to create a deposit to pay your Bank Account from the Undeposited Funds. If you've selected Undeposited Funds in the Deposit to the field, deposit the payment using the steps below. Do this after endorsing the actual check to your bank.

Here's how:

If the transaction shows on the Banking page, you need to Exclude it.

Check out this article for more information: Create journal entries in QuickBooks Online.

If you still have questions about matching bank transactions, please reply in the comment section below. I'll be around for you. Take care.

@LollyNino_C

Following this way This is creating the Journal entry in the Customer account with the open balance.

While I didn't push the Fee along Payment.

I already split the Fee ($4.00) from payment in my software and not pushing along the payment.

e.x: invoice of $100 and received the payment $104 in my software only but I am just pushing the $100 payment to QuickBooks online by excluding the fee ($4.00) in my software,

@LollyNino_C Thank you for the example with the screenshot, Please see my scenario.

Hey there, @Brilliant16. I appreciate you for coming back here.

Let me help you clear things up. If you want to match the payment received in your real-life bank account and QuickBooks, we'll need to Exclude the $100 on the Banking page. Since it will not sync to the $104 you received from your customer. Furthermore, it isn't possible to match the $100 and track the $104 with the same accounts since this will double the recording.

If you want to create a separate account for the $100 payment and the $4.00 fee, we can perform the Journal Entry just like my colleagues mentioned above, and I advise you to reach out to your accountant to put the transaction into the right accounts.

Another simple way to track and match this is to create an Invoice of $100 under the customer who paid it, then receive the payment.

Once done, add the $4.00 as a fee/fund to the deposit we received from the bank deposit. Here's how:

Learn how to review downloaded bank and credit card transactions and put them in the correct accounts by reading this article: Categorize and match online bank transactions in QuickBooks Online.

If you need further assistance with bank transactions, you can always come back to us or click reply on this post. Have a great day!

Actually it's not taking care of. If someone want to pay with a card why should I have to do more leg work. Should be simple for QB just to take the fee directly from them without me being involved when they pay with card. Like my invoice is $100 they go to pay with a card. I get deposit of $100 and QB takes there fee they want and I never see the fee anywhere that I have to track.

As a nonprofit, this would be great.

A lot of other processors offer the "I want to cover the 3% processing fee on my donation" option, via a checkbox on their interfaces.

I record the $100 with Received Payment of invoice $100. I exclude the $4 stripe processing fee in my software and only pushed Net amount $100.

The thing is as you mentioned of banking page. I am following you that I can calculate in banking page.

Then The account Fees Billed in the Add Funds to this deposit section, which strategy I've to update that Account Fees Billed e.g: How can I update the amount of Fee Billed account?

My question plot:

I received from user $100 + $4 (stripe processing fee) => in QuickBooks the invoice is $100 and I received payment $100. so thr $4 is I'm adding in a different way.

this exactly, so simple

100%

For the insane chunk of the transaction that is going to QB, you’d think they would want to make this easier and encourage CC transactions. It is almost comical.

This is the way it should be handled, but this is too simple and customer friendly for Intuit though. Their copy and paste robots keep wanting to tell us how to record this when that isn't the problem for most people.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here