Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

My QB was setup to include both packaging and raw materials in one GL account. To fix this I created another GL account (Packaging Materials) and changed all of the packaging items to use that as the asset account. In doing this I'm aware that historical transactions will change, however only the item receipts moved to the new Balance Sheet account and my build assemblies did not. As a result, my Raw Materials Account is now negative and Packaging materials is positive - the net amount of these two agrees to my previous one account.

How do I move the build assembly transactions so that the credit from the journal entry is posted to the new Packaging Material account instead of Raw Materials? Why did only certain types (item receipts) of historical transactions change to the new account and not others (build assemblies)?

Thanks for your help! - Jamie

Welcome to our forums, @jwesterman,

I appreciate the in-depth information you shared. This will help us get to the bottom of the problem.

When you build an assembly, it will create a separate profile in your Item Lists. If you update the Asset Account of your inventories, you'll also need to update the account on your Assemblies that has the same item.

That should do it! The transactions using the assemblies should now be on the correct account. You may refer to this article to know more about the process: Create, build, and work with inventory assembly items

Please let me know how this goes. I'm here if you need further help. Wishing you a great and productive day!

Hi Jen_d,

Thank you for your reply, but I don't think we are on the same page with this. I don't need to update the asset account for my assemblies since they are correctly going to the right account (Finished Goods). My problem is with the depletion of my packaging materials.

1. I changed the asset account for all packaging items to my new account Packaging Materials from the old Raw Materials

2. All of the item receipts related to these items are correctly posting a debit to my new Packaging Materials account

3. All of my historical build assemblies that use this inventory item have a credit to the old raw materials account, I assumed this would change to the new asset account (Packaging Materials)

4. Now I'm left with all receipts for these items in one balance sheet account and all credits or depletion of these items is posted to another balance sheet account.

5. I need the historical builds to credit the new Packaging Materials BS account and not the old Raw Materials account

Basically when I created the new account and assigned all of my packaging items to it, QB moved the receipts to that account but not the builds.

Hopefully this clarifies my original question!

Thanks!

Thank you for your reply Jen_D, however I don't think we are on the same page here.

My issue relates to the depletion of my packaging items that are now assigned to a new BS account 'Packaging Materials' instead of the old account 'Raw Materials'

When I made this change QB moved all historical item receipts for these items to the new 'Packaging Materials' account, however all of the historical build assemblies that use these items are still posting a credit to the old 'Raw Materials' account.

What I'm left with now are all item receipts for these items that I changed the asset account on posting to one account and all builds or credits (depletion) of these items posting to another. Please note I have not tried a new build, I'm only referring to the historical transactions.

I assumed that when I assigned the item a new asset account that all historical transactions would be routed through that account, but only the receiving side (debit) but not the depletion (credit).

Hopefully this clarifies my question. Thanks for your help!

Hi @jwesterman,

Thank you for taking the time to explain further your concern. I'm here to share additional insights about the posting account of your inventory builds.

To start, changing the asset account of your inventory assembly allows you to update the posting account of your builds.

Thus, a pop-up says You changed the account associated with this item.

If you've clicked on Yes, it will automatically post to your new asset account. However, if you've clicked on No, it doesn't post to your new account.

With this, you have the option to change again the asset accounts of your assemble build. Making sure to post them to the correct accounts.

Let me show you how:

In addition, here's an article you can read to learn more about inventory assembly: Create, Build, and Work with Inventory Assembly Items.

It'll be always my pleasure to help if you have any other questions. I'm always around ready to help.

Hi Jonpril_L

I changed the asset account related to an inventory part, not inventory assembly. That inventory part is included in several inventory assembly items as a part for the build. The account that my inventory assemblies post to is 'Finished Goods' and is correct, no changes to that.

I changed the asset account for an inventory part, this updated only the historical item receipts and invoices to the new account and not the historical build transactions or the credits/depletion of the inventory part.

Before I made this change all debits and credits for my inventory parts posted to the same account. Now that I have changed the account the historical receipts or debits were moved to the new account (this is correct), the historical credits or reduction of this inventory part stayed in the old account. Why would only a portion of the historical transactions that involve the part where I changed the asset account on be updated and the rest stay in the old account?

I do appreciate your help, but the responses I have received so far don't really relate to my issue at hand. Is there another avenue for support with intuit?

Thanks,

Jamie

Hi there, @jwesterman.

In QuickBooks, Inventory Assemblies and parts have their own asset accounts. Let me provide additional details about this and help you from there.

When you change the asset account of your inventory part, transactions involving them are the only ones transferred. If you want to transfer the amounts from your old asset account to the new one, I suggest changing the asset account on your assemblies.

Also, if your parts or assemblies have mark-up amounts, they stay on the old account.

If you want to connect with our QuickBooks Desktop Support, you can Start a Chat with them. Here's how:

Please let me know if you need help with anything else. I'll be around to assist you.

Help please.

I opened my Item List but can't locate the Inventory Assembly, in order to update the Asset Account. Is this feature only available on certain Quickbook programs? I have the Enterprise Solutions 14.

When I did a change on the Asset Account on an Assembly Item, I don't get a pop up message to ask if I wish to make the changes on existing transaction. It just accepted the change and I can see on the item view page that the asset account has been changed. Is this because the pop up message only happens with advance inventory?

Hi there, aya1.

When changing an asset account, QuickBooks will automatically modify the account of the previous transactions.

You'll only be prompted with the Would you like to also update existing transactions? message if you'll be changing either an income account or expense account.

You can also browse this article for more information when tracking items: Track the products you manufacture.

Feel free to get back to me if there's anything that I can help. Keep safe!

Why won't Quickbooks ask if you want to modify existing builds with the new account information? I am encountering this problem also.

If there are certain issues with your company file, the feature and other functionalities of the system become unresponsive, @JenR2.

Let me share some information with you on how to get this fixed.

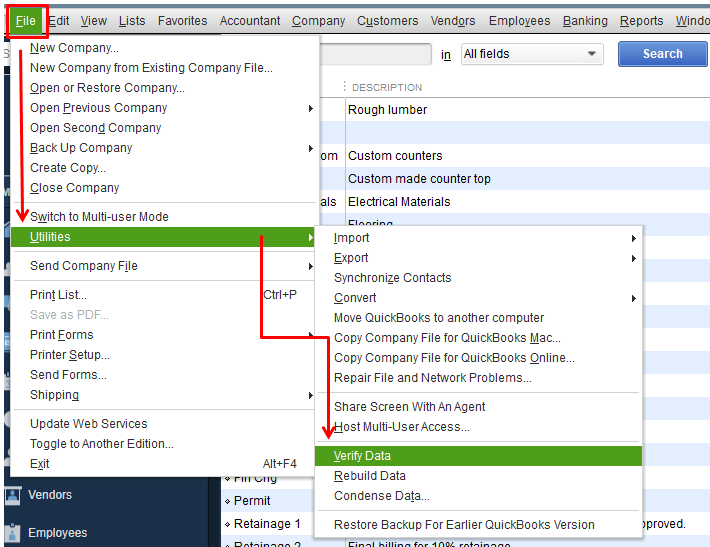

We can utilize the Verify and Rebuild Data Tool. This tool can fix any corruption and data damage in QuickBooks Desktop. It identifies the dilemma and automatically resolved them once found. Here’s how:

Verify

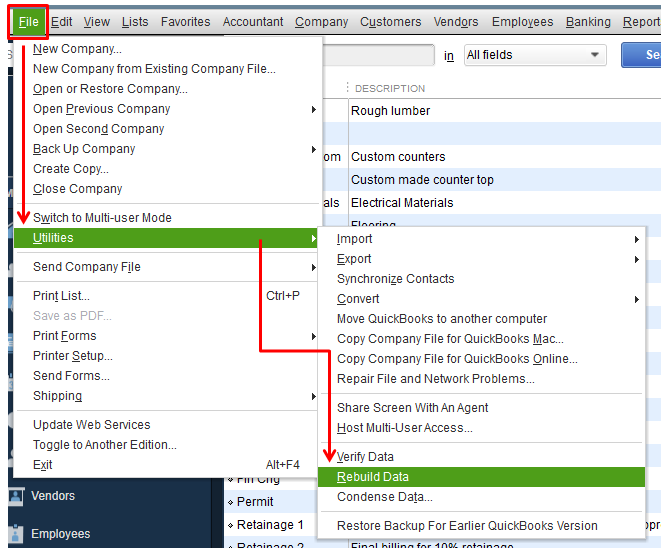

Before proceeding to the next step, the rebuild needs a backup of the company file in advance. Taking a backup of your company file will make sure that you have a copy of your data before any modifications done to it.

Rebuild

You can use this reference for additional information on how to fix data damage. It includes other methods on how to handle them.

QuickBooks will usually not responding until the process is completed. You’ll have to wait to ensure the verification is successfully finished, and then you can go back and check if the system will get back to normal.

It’s essential to have a customized item reports to control and manage your inventory. This way, you can easily track your records.

I’ll be here to help if you have other concerns. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here