Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello Community

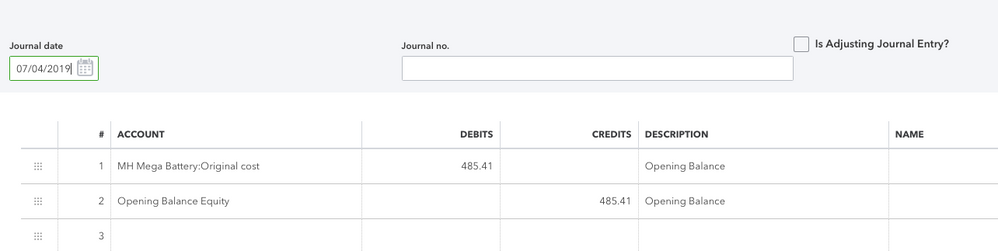

I believe I made an incorrect entry for a fixed asset, I'm trying to correct, and would like to confirm here. I bought a mega battery (expense), when entering the transaction, created a fixed asset category, created subcategory Depreciation, and Original Cost.

The value shown in the name of the asset row appears to double the purchase price. Is this accurate? The images below show my entry. My concern is the value of my asset will not match the tax return. Obviously I'm a little confused at what Quickbooks is doing, and looking for some feedback to help me figure this out.

Thank you

Solved! Go to Solution.

You put this in first as n expense, and additionally as a Fixed Asset. At less than $500, unless it is permanently attached to something like a building it is just a plain old straight expense. Expenses are record though Check or Expense and never or rarely ever in a Journal Entry. Delete the journal entry. Delete any reference to this Office Supplies or Small Tools as a Fixed Asset and re-record the purchase as what it is - and it is not something you have to depreciate

You put this in first as n expense, and additionally as a Fixed Asset. At less than $500, unless it is permanently attached to something like a building it is just a plain old straight expense. Expenses are record though Check or Expense and never or rarely ever in a Journal Entry. Delete the journal entry. Delete any reference to this Office Supplies or Small Tools as a Fixed Asset and re-record the purchase as what it is - and it is not something you have to depreciate

Thank you John,

It was my understanding, property used for an income-producing activity, with a determined life for 1 year or more, must be depreciated?

I understand I entered the transaction as an expense, but I do believe I can still depreciate the asset?

Best Regards,

There are exceptions from Section 179 to Safe Harbor de minimis rules where assets can either be written off 100% in year or purchase or straight expensed without even treating as an asset (drills, saws, computers, printers up to $2500 each)

But you cannot do both, expense and depreciate. If you add it as a fixed asset do not expense it also. The expense will be the annual depreciation. $500 @ 5 years is $50-$100-$100-$100-$100-$50 6 years to recover cost (first year half year) or a full $500 if it qualifies under the Section 179 rules.

If you elect safe harbor it would not be entered as an asset but as an expense.

Bottom line is you entered it twice. If you wrote a check it should only have as detail either the fixed asset OR the expense.it appears ypu used s journal entry - bad way to enter any purchase.

Good Evening John-Pero

I agree with you sir, on the depreciation of assets, and entering the expense twice. I don't recall using the Journal entry to enter expenses as I never do. This is what I believe happened in my process

1. Entered the expense by creating and created a fixed asset category

2. Set up original cost, and track depreciation of asset as of...

This caused me to enter the transaction as an expense, while simultaneously creating the fixed asset. Also, I should point out, I'm trying to get the books aligned with previous year depreciation.

Here's what I did a moment ago, as I think work through this based on your input.

1. Deleted the expense which aligned my original cost to the actual purchase price

2. Made a J/E crediting depreciation, debiting opening balance equity

The result is a book value aligned with prior year depr. Meaning, if my basis is 485 minus 49 prior year depr, current book value is 436.

I believe this is accurate because book depreciation schedule shows prior year depr. at 49 and if I continue following the same method, I should be ok?

Good Evening John-Pero

Well, I believe I'm wrong. As I completed the steps below, I know have the original expense appearing to be unreconciled. So clearly, I'm not back to square one.

Now my question is:

1. I purchased an item I want to depreciate. I need to make an entry for this item to be a fixed asset, so that I may track depreciation within QBO. How would I make this entry because clearly, I'm not doing it correctly. LOL

I also need to depreciate this asset because it was on last years tax return.

Best Regards,

Good evening again John-Pero,

My apologies. I believe I answered my own question. It was just a matter of going back, and recategorizing the purchase to the fixed asset. I was able to reconcile the transaction, without having the expense, and the asset.

I appreciate your help, and patiences. If you feel I'm still don't have the right idea, I'm open to feedback.

Best Regards,

If it is on last year's return then isn't it already in the books? When and how was it paid for? That transaction is where it is added as a fixed asset if you are going to depreciate. No other entry is necessary to get it on the books. Depreciation itself is a separate transaction involving only 2 accounts. Depreceiatin expense and Acclatrd Depreciation. You do not adjust the asset value when you take the expense. Some accountants will set up sub asset accounts to record the asset and its accumulated drpreciation so that a nonpostong parent asset will display the net current value but is generally unnecessary

Rule number 1.

Enter once and enter correctly so you do not have to revisit

Following this, when you purchase any item that is of fixed asset nature (depreciable) enter the fixed asset in the purchase transaction as a fixed asset and not an expense. The expense comes later.

Good luck with your business and feel free to reach out anytime with questions

Good Evening Sir,

I'm sorry I don't have the terminology, and still learning. I do have subcategories; original cost, and accumulated depreciation. It was my understanding I have to make a J/E to account for depreciation each year. I believe I'm making it harder than necessary because I'm doing so per asset.

What I was trying to explain is that as I make the J/E, the value of the asset based on the original cost, and depreciation entry, aligns with what was on the tax return.

Best Regards,

Thank you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here