Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI just started working for a small NPO. We're using Desktop Pro Plus 2020. I've cleared most of the old transactions, but there are a dozen I don't know what to do with. These were never reconciled, but have been paid or deposited. Some date back to 2018. Is there any way to clear them off the books?

It's a pleasure to have you here in the QuickBooks Community, @KellyLifeLine.

I want to help you out with clearing the entries in your company file. There are 3 options to remove data in QuickBooks. It can be done by manually deleting the transactions, having an admin or external accountant bulk delete and using a deleter app.

For the first option, all you need to do is open the transaction and press the Delete option. You can also use the keyboard shortcut CTRL + D to auto delete an entry.

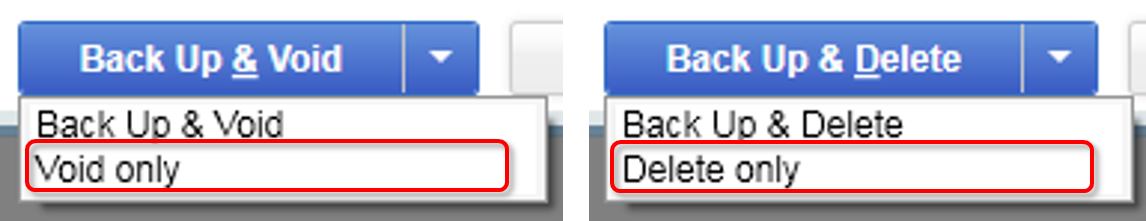

Now for the second option, you can have the Admin or External Accountant user sign in an bulk delete the transactions. Please note that this feature is only available in QuickBooks Desktop Accountant 2018, Enterprise and Enterprise Accountant 18.0, and later versions.

Here's how:

Lastly, you can visit the Desktop Apps website to get a deleter app that works for you. Search the keyword "deleter" in the finder field to filter your options.

| You can also get one-on-one help for your business: Check out QuickBooks Live. |

Let me know if there's anything else I can assist you other than this account corrections concern. I'll be right here to give you a hand.

Not a simple issue, I feel for you... So a couple of questions and I'll give give you my best guess on how to deal with it. Maybe someone will have a better idea. And sorry, I'm thinking of all the variables, so this won't be a short reply. Let me run off some questions comments and then some thoughts. Get back to us with any answers to my questions, which may give someone a better idea than my first attempt.

NOTE: BACKUP FIRST!!! Maybe even pull an extra copy of the Company File to your Desktop!!!

NOTE: Don't Delete anything until you get down to my Delete comments below!!!

Since your Reconciling, I'm assuming this is a Checking Acct. Let me know if it's Credit Card, Savings or some other account. But for this Acct, does your monthly Reconciliation end up with a $0 balance and everything matches (that should match)?

When you get done Reconciling, is the actual Acct Balance in QBs way off from what the Bank shows? If it matches, is it possible the Unreconciled transactions may just be duplicate entries.

If you look at the Unreconciled transactions and then look around at the other transactions before and after, do you see any matches. For Deposits, it's possible someone grouped a few checks together, so you may have one Unreconciled item that matches a few other individual deposits or the other way around.

You might look at the Undeposited Funds Account for the same time and see if anything stands out. You might also look at the Deposits around that time an see if the associated Account stands out. There could be a Deposit directly to Sales and not associated with a Invoice Payment, etc.

Similar idea with the Payments out. Is there anything off about the Check Numbers or Vendor Name? Is there anything in the Memo field that you make you think the entry came from a Bank Feed or was manual entered. Anything off with the associated Account here too. Are any of them just Accounts Payable and not associated with paying a Vendor Invoice?

If you do find duplicates or individual entries that match other single ones, take your time to figure out which one is correct. It may or may NOT be the Reconciled item. Right Click on the Check and choose Edit. See if you can confirm which one is attached to an Invoice, etc. and is the correct entry. Once you've done that, Delete the incorrect entry.

When you are done Deleting, then take the LAST Statement that you reconciled. Put in the date and amount of that statement. Check off ONLY the items that you have just corrected and the Balance should come back to $0. You can do this process a few times if you want to, just be sure not to check off and Reconcile any extra transactions.

If you get all done and you still have extra items. Then I'd make and Journal Entry to bring the QBs Account in Balance with the Bank Account and then do the above Reconciliation again with the last statement and clear out these entries.

You may want to check with your CPA on where they want the Journal Entry and what date. I'd guess 01/01/22, but you should check with them.

Hope this helps. Get back to us with any results or other questions & info.

Great info -- can you please tell me how to do it in Quickbooks Online?

Thank you for posting, @Michelle0531.

Can you tell me more about the steps you'd like to perform in QuickBooks Online (QBO)? That will surely help us provide an accurate solution to the concern that you're having.

You can click the Reply button below to add more details.

I'm looking forward to hearing from you soon! Take care, and have a wonderful day!

@MJoy_D Good morning!

There are duplicate deposits due to a previous bookkeeper not understanding how the banking portion works. When I deleted them like I was told on here, it makes my account "not ready to reconcile" due to the difference of the ones I deleted. I put them back in and it still shows as "not ready" with that amount as a difference.

Suggestions??

Hello there, @Michelle0531.

I'd be glad to help you finish your reconciliation in QuickBooks Online.

Before you begin reconciling, you'll receive a message saying, "Your account isn't ready to reconcile." if you make changes that affect your beginning balance. Here's how to fix it:

Once done, review each transaction on the report one by one. To do that:

For more detailed process, please read this article: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

If you need to speed up the categorization of your bank transactions, you can refer to this article for the steps: Set up bank rules to categorize online banking transactions in QuickBooks Online.

Don't hesitate to reach us again if you need further assistance with your reconciliation in QuickBooks Online. The Community is available 24/7 to assist you. Have a great day.

I have a similar problem. I have several entries dating back several years, actually. The entries include some checks that were duplicate entries, some were checks made on an invoice to a company that closed up and never cashed the check. I vaguely recall my previous accountant had told me I could list in one JE the Dr's to the Bank account they were drawn on if all on the same account; and Cr the Retained earnings the same listing. This would allow the Bank Reconciliation window to have the the entry showing in the opposite side (or the Deposits Box) so I could cancel them out and reconcile with all old entries gone. Then do the actual month end reconciliation with the correct balances going forward. MY question is, since these are in multiple different previous years, and I do submit my taxes to an accountant do I make separate JE's for each year they occurred in? I am wondering how this will affect my previous years of closing my tax years out? I do not give the accountant an Accountant's Copy, nor do I change anything unless it's a memo or conf# once I give my year of books to them. By the way, my accountant is no longer with this company and I am considering perhaps employing a different accounting firm so that is why I am asking you this rather than the accountant. Thank You. I'll be awaiting your response.

"MY question is, since these are in multiple different previous years, and I do submit my taxes to an accountant do I make separate JE's for each year they occurred in? I am wondering how this will affect my previous years of closing my tax years out?"

The JEs should be made in 2023 (if you haven't close it out yet) or 2024 if you have. You don't want these JEs to post in previously closed years.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here