Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I would like to create a credit memo for a discount that was not applied to a sales receipt. I cannot record a negative credit memo, how do I account for this in QB Desktop?

Thank you,

Solved! Go to Solution.

@GGAngel wrote:I would like to create a credit memo for a discount that was not applied to a sales receipt. I cannot record a negative credit memo, how do I account for this in QB Desktop?

Yes, the case is that discounts work the same way on credit memos as on invoices. There isn't a way to add a lone discount to either type of form and enter a positive amount for it. So, to handle this I created an Other Charge type item and called it "Discount CM", using the same account I use for other discounts. I use it on credit memos for this very case - when I've granted a customer a discount after the fact and the sale is already processed.

Hi @GGAngel,

Welcome to the Community. I'd be glad to help you handle the customer discount in QuickBooks Desktop.

You provide sales receipts for immediate payment of products or services at the time of sale. It's recommended to mirror out transactions on how they happen in the actual scenario.

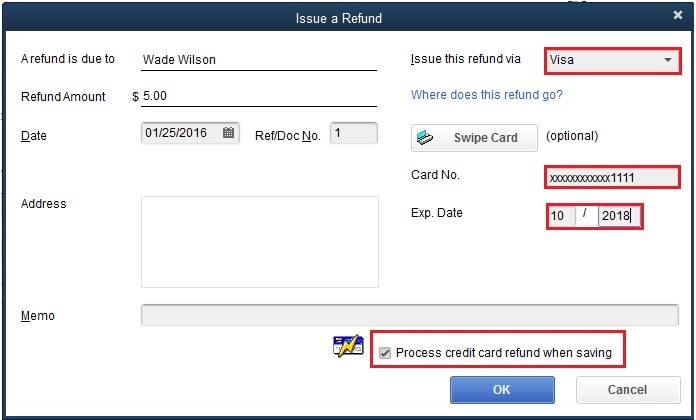

Currently, the option to enter a negative amount when creating a credit memo is unavailable. If your customer used a credit card and got charged in full, you can refund the partial amount for the discount.

There's a box you can tick within the memo to create a credit card refund for the discount. Here's how:

QuickBooks applies credits and refunds to your customer’s card when it settles your latest batch of transactions at 3:00 PM PT each day. However, it may take time before your customer sees the credit, depending on their bank. The industry standard is 7 to 10 business days.

I've included some links that contain three options on how to handle the credit, as well as some steps to create item discounts in QuickBooks:

Feel free to hit that Reply button if you have additional questions. Have a great day ahead.

@GGAngel wrote:I would like to create a credit memo for a discount that was not applied to a sales receipt. I cannot record a negative credit memo, how do I account for this in QB Desktop?

Yes, the case is that discounts work the same way on credit memos as on invoices. There isn't a way to add a lone discount to either type of form and enter a positive amount for it. So, to handle this I created an Other Charge type item and called it "Discount CM", using the same account I use for other discounts. I use it on credit memos for this very case - when I've granted a customer a discount after the fact and the sale is already processed.

@AlcaeusF RE: "I'd be glad to help you handle the customer discount in QuickBooks Desktop."

You write that and then... you don't help at all.

The OP knows how to create a credit memo. They didn't ask how to create a credit memo. They asked a different question, which you did not answer.

Thank you for your reply. So, you would use the same thing for a sales receipt?

@GGAngel wrote:Thank you for your reply. So, you would use the same thing for a sales receipt?

Well, that would be a sale then, not a refund. You'd be charging the customer more. So not sure, but it depends on what you're trying to do.

So, our customer paid full price for an item, the transaction was on a sales receipt. We would like to refund them the discount they didn't get. I'm guessing, I don't need to create a credit memo for the sales receipt, I am not sure how to handle that.

Yes, you'll have to create a credit memo for the refund. I'm here to guide you how, GGAngel.

Giving the money back to credit a discount to your customers is easy and simple. You can follow the steps below on how to do it:

To create a credit memo:

Then, you have several ways how to handle the credit. I've added this article for you to be guided: Give Your Customer A Credit Or Refund In QuickBooks For Windows. Moreover, QuickBooks downloads transactions in different ways. Depending on the banking mode, you can review and match transactions by following this article: Add And Match Bank Feed Transactions In QuickBooks Desktop.

Reach out to us if you have any questions about refunds and discounts in QuickBooks. We're here to make sure that everything is taken care of.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here