Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Let me welcome you first to the Community, @lindab2810.

I can provide clarifications on why the Cost of Sales Expense category doesn't show from the Default expense account drop-down.

The Cost of Goods Sold account is added to your chart of accounts the first time you add an inventory item. QuickBooks uses this account to track how much you paid for goods and materials that were held in inventory and then sold.

That's why the category doesn't appear as one of the default accounts for vendors. You can consider consulting an accountant for advice on which Expense account and category type to use.

Let me help run a search to find one of our experts.

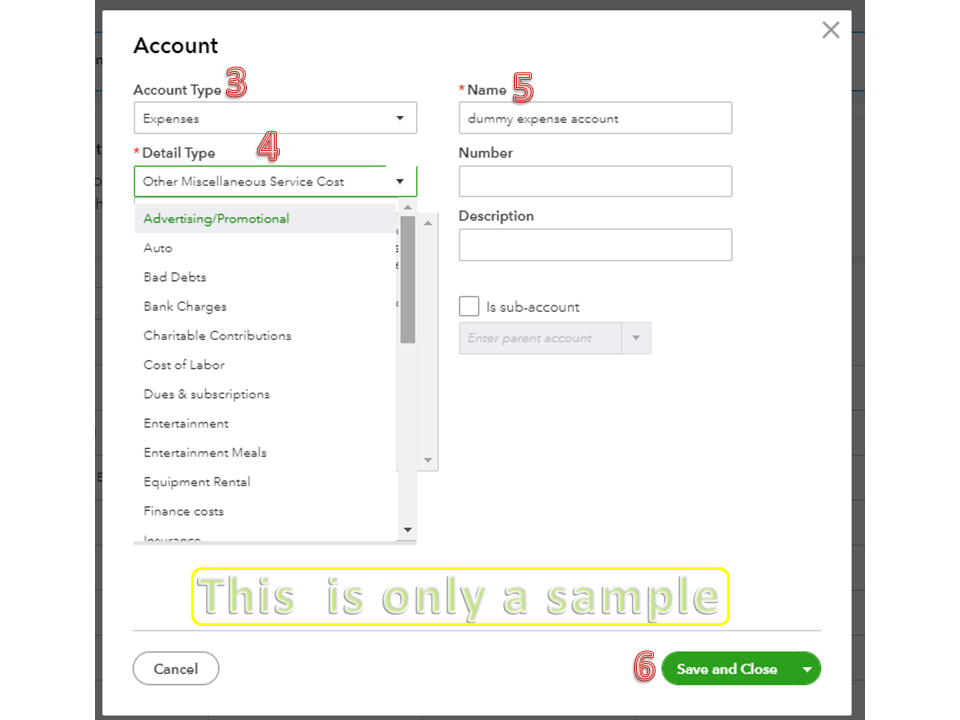

Once you have the complete details for the account, let’s set it up in QuickBooks. Here's how:

After setting it up, you’ll be able to associate it with the vendor’s profile. For additional resources, the following articles provide an overview of how to add an account and which category type to utilize.

Keep in touch if you have any other concerns or questions. I’m more than happy to answer them for you. Have a great rest of the day.

Hi I do not understand why any account with an account type 'Cost of sales' can not be used as a default expense account?

I understand why you do not want to touch the stock accounts but what about other cost of sales, for example shipping costs, delivery costs etc - i want to set my supplier to point at these ledger accounts?

Hello there, @JamesW2.

I appreciate you for getting back to us here in the Community. Let me share some clarification about the accounts in QuickBooks Online.

The Cost of Sales and Cost of Goods sold both tracks how much it costs a business to produce a good or service to customers. Currently, an option to use it as a default expense account is unavailable.

Please know that I appreciate your input on this feature. We will continue to improve QuickBooks Online, and this preference might be added in the future.

For now, I suggest following the recommendations of my peer regarding consulting an accountant. One of them will be able to provide expert advice about the best way to handle costs for shipping, delivery cost, etc.

Also, when creating accounts, you can check the descriptions to help you decide for the detail type (see screenshot below).

As we assess this, I suggest you visit our QuickBooks Blog to stay updated with all the changes that are being made.

I've attached some articles you can use to know more about the Chart of accounts:

Drop me a comment below if you have any other questions. I'll be more than happy to help. Wishing you a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here