Thanks for joining us here in the Community and for sharing details about your concern, @KMH2.

I've got options for you to correct the beginning balance issue you have with your reconciliation.

First, you may record the bounced check amount issued to fix the current opening balance. However, it might create a discrepancy so you'll have to consult with your accountant for the best advice. This way, you won't mess up your valuable transactions.

Also, you can do a mini-reconciliation to amend the beginning balance difference and create a bank deposit to offset the bounced check. Mini-reconciliation is a method that uses an "off-cycle" reconciliation which means that you leave the reconciled periods to correct the current balance.Here are the steps on how to do a mini-reconciliation:

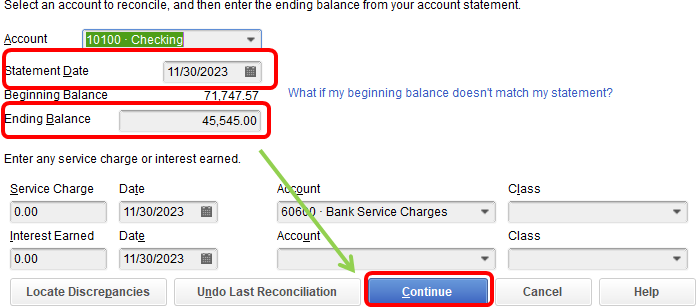

- Go to the Banking menu then choose Reconcile.

- Select the bank account with the transactions you need to reconcile.

- In the Statement Date field, enter date for an "off-cycle reconciliation." This date can be any date between your last reconciliation and the next scheduled one.

- Enter the balance of your last successful reconciliation in the Ending Balance field then click Continue.

- In the Reconcile window, check off the transactions you are fixing and re-reconciling.

- Make sure the Difference field shows $0.00.

- When everything looks good, hit Reconcile Now.

I'll be adding these articles for more information about the mini-reconciliation process in QuickBooks Desktop:

Please let me know if you have more questions. I'll be here to assist you further. Have a good one and always take care!