Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thank you for your answer, but what type of account is your "prepaid"? Other current asset?

Thank you very much.

This worked and was easy to execute

Is the prepaid account and income account or expense account?

this does not work

I'll share insight on your concern about recording transactions for your vendor, who's also your customer.

You can follow the steps provided by @qbteachmt above. You use a clearing account to record the transactions.

You'll need to create the clearing account first. Here's how:

Check out this article for more details: Record a barter transaction. Scroll down to Step 2: Create an invoice and receive payment to continue this process.

Post a reply below if you have other concerns with your QuickBooks Online company. I'll be sure to take care of it.

To make this answer clearer and more useful to non-accounting experts (i.e. people who run their own small businesses and enter transactions into their QuickBooks on their own), could you please provide the following:

The community appreciates your help. By taking a little extra time to add detail and refrain from using acronyms, more people can benefit!

To make this answer clearer and more useful to non-accounting experts (i.e. people who run their own small businesses and enter transactions into their QuickBooks on their own), could you please provide the following:

The community appreciates your help. By taking a little extra time to add detail and refrain from using acronyms, more people can benefit!

Thanks for joining the thread, ChaosFreak and providing detailed information about your concern.

I'm here to answer your query.

To start, you're right that JE is a Journal entry. You can use this transaction as a last resort when entering a transaction. For more details about this, see this article: Create a journal entry in QuickBooks Online.

Then, as for your Prepaid account question. I'd like to verify if how do you set it up? Is it a Prepaid expense or Prepaid income?

A prepaid expense is a purchase you make for goods or services you will receive in the future or over a specified period. You initially recorded this as an asset as they have future economic benefits and are expense at the time realized. On the other hand, the prepaid income is used as a customer prepayment before the invoice has been created for the sale of inventory items.

As for your last question, since every business structure is unique, I suggest reaching out to your accountant for additional guidance. They can ensure the correct account and amount is used to debit and credit the transaction.

Get back to me here if you have any other concern in managing your QuickBooks account. I'm always here to help. Take care always.

Hi MirriamM

Ok so I tried this and instead of deducting the amount of the billable expense from the customer invoice, it added that amount.

This is what I'm trying to do. I have the same customer and vendor. Let's call them ABC-C for Customer and ABC-V for vendor.

I invoiced ABC-C $1500 for Herbal tea. They sent me a check for $1000. They have $500 amount of expenses that they charged us in our invoice. Lets the $500 they charged us was for $200 promotion discount and $300 for running ads for us for the Herbal Tea. So I made a vender bill for ABC-V for $500, marked each expense as billable expense, then added ABC-C under Customer.

I went back to the invoice for ABC-C. I added the Billable expenses. Instead of deducting the invoice by $500, it increased it by $500.

Now if I added a (-) to the billable expense in the customer invoice it will deduct that amount and make the invoice "seem" correct. But I don't know what will happen to the Vendor bill.

Sorry, I am new to all this accounting stuff. Any help would be appreciated.

Note: I will we could just add expenses directly to the invoices. That would be much easier.

Thank you

You’re almost there, @smomin. I’ll lay down some information to help you zero out the invoice as well as the vendor bill.

I appreciate the things you’ve done so far. What you did to your invoice is correct. You can also create Vendor credit with the amount of 500 and apply it as payment to the vendor bill. This way, we can zero out the bill too.

Here’s how:

After that, we can apply the vendor credit to any open or future bill. I’ll show you how:

I highly recommend seeking help from your accountant if you want to know more tips on how to better record them. This way, we can make sure your books are accurate.

Once done, you can then proceed to reconciling your account in QuickBooks Online. It contains all the steps and guides to ensure your bank statements matched with QuickBooks.

Kindly leave a reply below if you need further assistance managing your invoices or vendor. I’d be glad to help you. Keep safe!

Thank you JamaicaA for your response.

You mentioned that what I did with the invoice was correct. Do you mean changing the billable amount to a negative amount was correct? I have attached the screenshots of what I did.

Also, how do I do the vendor credit? And would that incorrectly affect my P&L reports?

Thank you, I appreciate your time.

Thanks for getting back, smomin.

Changing your account preferences or unchecking the option to mark all expenses as billable won't affect or change the previous items/transactions created. The changes only affect on the transaction/s created after unchecking the Mark all expenses as billable box. However, marking expenses as billable also depends if the Billable column is manually checked/unchecked.

In, creating a vendor credit to make sure the credits hit the expense account you use for this vendor. In addition, to track credits for your vendors, you should consider entering bills in QuickBooks. This way you can track your account balance and credits using Accounts Payable. Otherwise, you can enter a note to remind yourself about this credit in the future.

Also, P&L report displays your income and expenses. Income is the amount your business takes in while expenses are what it spends money on. If you want to see the snapshot of your business's accounts receivable, liabilities, and owner's equity or capital, you can open the Balance Sheet report.

If the amount is not reflected on your report accordingly, you can try to review the transaction created. Let's make sure that the correct account is used.

You might also want to read this article to learn how inventory tracking impacts your Profit and Loss report: Impacts of inventory tracking on balance sheet and profit & loss reports.

Additional details about managing vendor refunds or credits are discussed in these following articles:

Please don't hesitate to reach out to us again if you have other questions in mind. We're always here to help you out again.

I hope as old as this thread is you can still help me.

I get a payment from a customer/vendor less a bill I own them.

I got stuck in your instructions where the clearing acct/prepaid is suppose to zero, in and out...

Could you use number examplers:

I got paid say 9300 I owe 300 so they sent a check for 9000, I have bill for 300 and invoice of 9000.

I appreciate you for following the thread, @isee.

Getting your issue resolved is our main concern. But I need more details about it.

May I know if you are using QuickBooks Desktop or QuickBooks Online? This way, I can determine and provide you with the best resolution.

I'd appreciate any additional details you can give. I'm looking forward to your reply. Have a nice day!

Good day

QB desktop Premier Plus is what I am using.

ISEE

I've got another way to handle your payment , isee.

You can create a Barter account to record the barter transactions in QuickBooks Desktop. I'll show you the process.

First, set up the Barter Bank account. Here's how:

Second, create an invoice and record the invoice payment.

To create an invoice:

To record invoice payment:

Next, enter and pay the $ 300 bill you owe.

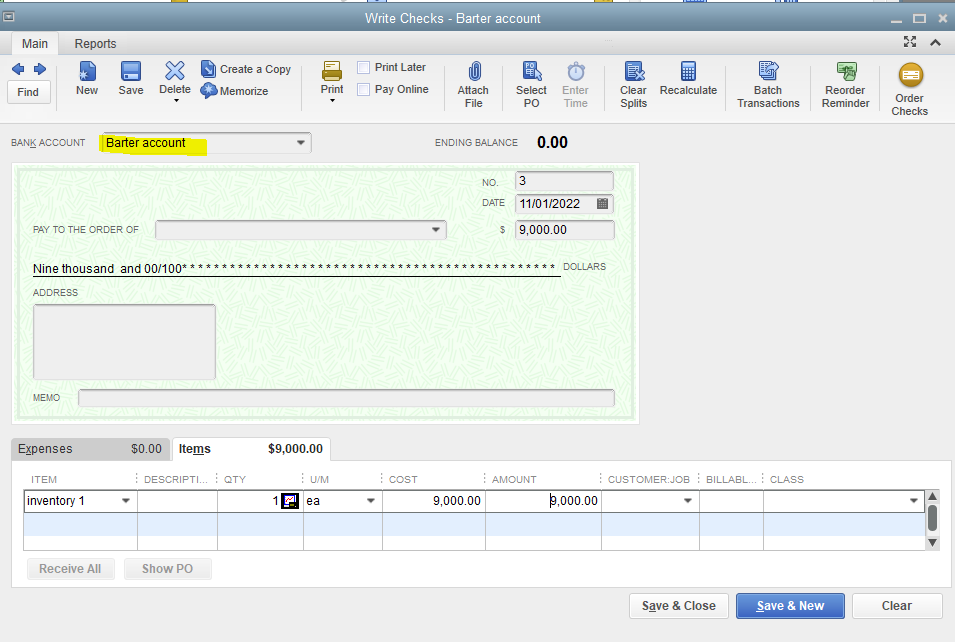

Once done, create a Check using the Barter Account. Here are the steps:

With these instructions, you should be able to zero out the Barter account in no time!

If you need help reconciling the account to ensure the amount is balanced, you can check this link for detailed instructions on how: Reconcile an account in QuickBooks Desktop.

If you have additional questions about the process, feel free to add a reply below. I'll be sure to get back to you.

how did you zero out the invoice.

I'm here to assist you with your question about zeroing out an invoice in QuickBooks, @Bschanel2019.

There are different ways to zero out your invoices in QuickBooks Online, and the method you choose will depend on the specific scenario you have.

Are you expecting a payment from your customers? If yes, then we can simply utilize the receive payment feature to zero out the invoice. Let me show you how:

If your customer owes you money but you can't collect it, you need to record them as a bad debt and write them off. This ensures your accounts receivable and net income stay up-to-date. For detailed steps, you can utilize this link: Write off bad debt in QuickBooks Online.

Additionally, I'll be sharing the following articles to help you personalize and handle invoices in QBO. These articles include steps to make the invoicing process smoother and more efficient for you.

If you have any further questions or encounter any challenges while implementing the steps we discussed, please don't hesitate to reach out to me again. I'm here to provide ongoing support and ensure that you can successfully manage your invoices and accounting tasks in QuickBooks.

Please find attached a very detailed explanation of my issue that is really quite complicated at least from my eyes. Hopefully someone in the community can enlighten me.

Thanks for sharing a thorough explanation and snapshot of your concern, mrp2. Let's discuss and work together to handle these matters.

To start, let's change the VPOS monthly payment's linked account by editing it from the Item List window. Here's how:

Once finished, any entries tied to the item will be posted to your preferred account. This factor is affected by whether you've chosen to update your existing data or leave them as is, impacting only your future transactions.

On the other hand, sales and income transactions should be entered as positive values. Meanwhile, expense or money-out transactions should be recorded as negative amounts when processing them on your recurring sales receipts.

Regarding the invoice deduction from the remittance funds, it's best to seek advice from an accounting professional. This way, you'll ensure the preciseness of your entries, which allows you to maintain accurate records in the software. They can also guide you through managing your charges/fees effectively.

Additionally, you may utilize your reports to review the status of your sales and inventory records. It provides insights into the items you buy and sell and your finances for these items.

If you have more questions about managing your charges or fees when processing invoices or sales receipts, hit the Reply button. The Community team is always here for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here