Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Great question. The cost of off-site storage is not an expense, it should be capitalized (added to the value of inventory) and then expensed to COGS when the items are sold.

Here is the tax code:

26 CFR § 1.263A-3 - Rules relating to property acquired for resale

5) Storage costs -

(i) In general. Generally, storage costs are capitalized under section 263A to the extent they are attributable to the operation of an off-site storage or warehousing facility (an off-site storage facility).

Let me record the cost of goods sold in QuickBooks Online (QBO), accounting-kahun.

The cost of goods sold (COGS) refers to the cost of producing an item or service sold by a company. To know the cost bill of $200.00, will need to review how you set up COGS in QBO. If you purchase inventory using bills, just use the asset account you created to track its value in the Account field. This "transfers" the money into the asset account, increasing the value of your inventory. Here's how:

This Journal Entry decreases the value of your inventory (indicating you have less) and increases your Cost of sales. To track properly the Cost of Good Sold, let me guide you through the steps on how to set this up:

First, create an account to track your inventory value.

Then, create an account to track your cost of goods sold. I'll show you how below:

To learn more about the process mentioned by visiting this article: Can I track inventory manually in QuickBooks Online? Also, you are correct when you say COGS automatically calculates once you issue an invoice or sales memo. Learn more about how QBO calculates COGS through this article: Cost of goods sold: How to calculate and record COGS.

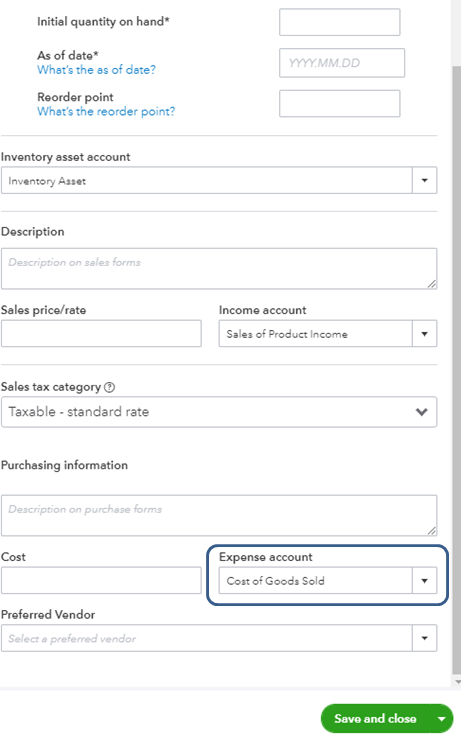

If you're trying to set up a COGS account for an inventory item, then you can add it under the Expense account. Just create an item by following the steps below:

To give more information about managing inventory and what reports are available in QuickBooks Online, check out the following articles:

I want to hear any updates after performing the steps. Also if you have additional questions about running a report for COGS, please add a reply below. I'd be happy to assist you further. Take care always.

Hi RCV,

Thank you for your detail explanations on how to setup the Inventory and COGS accounts and on how to enter them in a journal entry. I found that very useful.

Let's say I bought 1000 units from a supplier and they charged me $1000. That's $1 per unit. That makes my Inventory asset to $1000. And then I sent these 1000 units to a third party 3pl warehouse to store them.

Let's assume that my inventory would be at 1000 units for next 12 months. At the end of each month, the 3pl warehouse would charge me $200--meaning 20 cents storage cost per unit.

If this $200 storage cost could be considered as a part of COGS account, do I need to update my unit cost to $1.20 = $1 + 20 cents? And make my Inventory asset to $1200?

What is the best way to record this $200? Is this a part of an expense or COGS account?

Kind regards

Great question. The cost of off-site storage is not an expense, it should be capitalized (added to the value of inventory) and then expensed to COGS when the items are sold.

Here is the tax code:

26 CFR § 1.263A-3 - Rules relating to property acquired for resale

5) Storage costs -

(i) In general. Generally, storage costs are capitalized under section 263A to the extent they are attributable to the operation of an off-site storage or warehousing facility (an off-site storage facility).

Hi Rainflurry,

Thank you. Since an offsite storage cost is COGS, I will add $200 storage cost to my Inventory asset for that month and make it $1200 and update my new product cost per unit to $1.20 for that month.

Thanks again.

Hi there, Rainflurry.

I appreciate you for always sharing your knowledge about QuickBooks. This will definitely help other users as well in the future. Please keep on posting here in the Community.

Keep safe and have a great rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here