Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIn QuickBooks Online, we can create a credit memo and apply it as payment to an invoice. You can check out this article for the detailed steps: Apply a Credit Memo, Credit or Refund to a Customer.

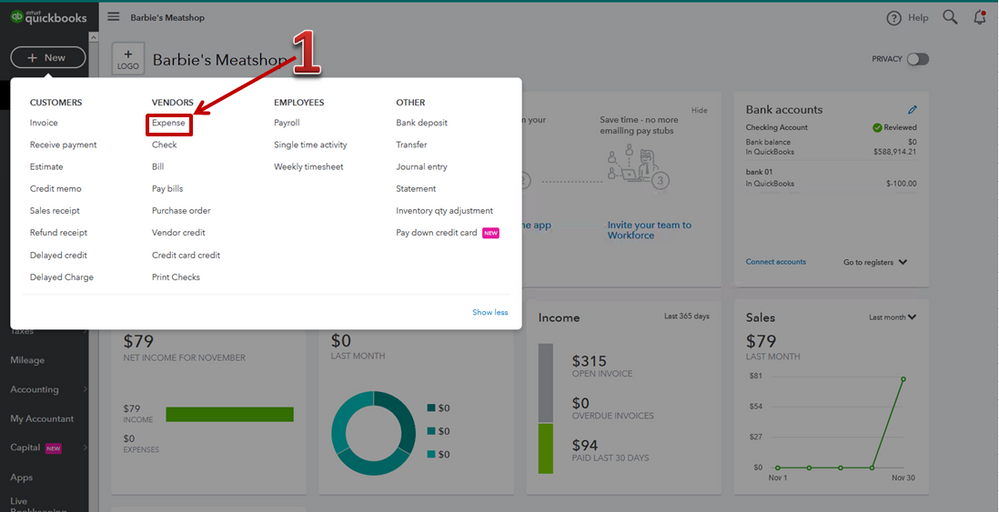

We can enter it as Vendor Credit:

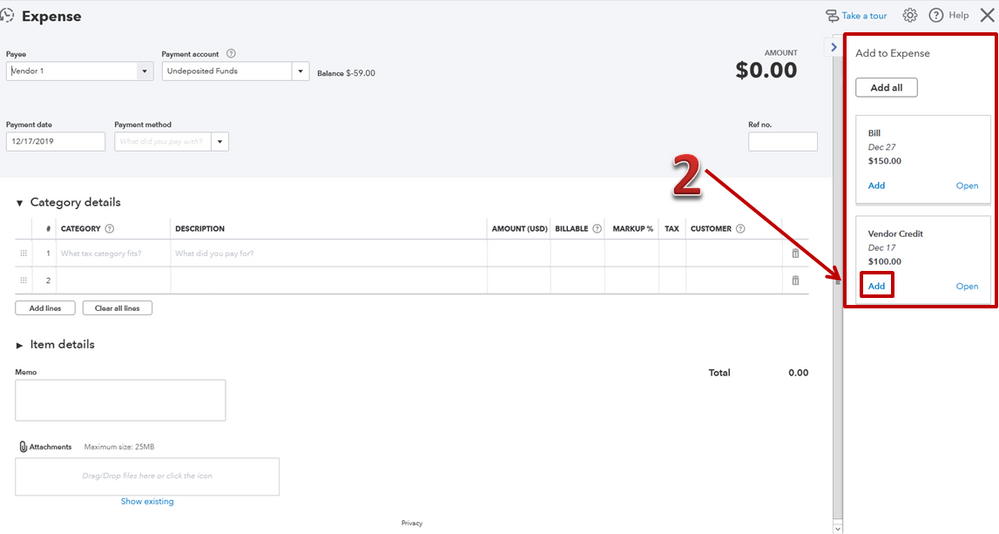

Or you can use the Vendor Credit as payment for an open bill. Here's how you can apply it to the open bill:

Feel free to browse this article for more information about vendor credits: Manage Vendor Credits.

| You can also get one-on-one help with accounting for your business: Check out QuickBooks Live. |

Let us know if you need anything else.

I go into the original invoice (if unpaid) and add a new line item to the invoice "RETURN" with the Credit Memo #, and enter the credit amount as a NEGATIVE item. It adjusts the total due on the invoice immediately. If the invoice is already paid, I suppose I could just enter the Credit as a NEGATIVE Bill.

In QuickBooks Online, we can create a credit memo and apply it as payment to an invoice. You can check out this article for the detailed steps: Apply a Credit Memo, Credit or Refund to a Customer.

We can enter it as Vendor Credit:

Or you can use the Vendor Credit as payment for an open bill. Here's how you can apply it to the open bill:

Feel free to browse this article for more information about vendor credits: Manage Vendor Credits.

| You can also get one-on-one help with accounting for your business: Check out QuickBooks Live. |

Let us know if you need anything else.

How would I apply a credit to an overall amount do to a vendor? Meaning, we were invoiced a couple of months ago, so the invoice has already been paid, then made a return this month, so the original invoice has been paid, but we still need to take the credit?

Thank you in advance!

Steve

Hello there, Steve99.

If you're trying to record a credit/refund for a returned item, you'll have to enter a deposit, then link it to the vendor credit.

First, you'll have to enter the refund as a deposit. Here's how:

Next, link the deposit to the vendor credit. Here's how:

Though, if you want to apply a vendor credit to a bill, check this article for the steps (Scenario 2): Manage vendor credits.

We're here if you have other concerns. We'd be happy to help you.

Thank you!

You're always welcome, Steve99.

If you need help with QuickBooks Online, don't hesitate to reach out to us. I wish you a nice day!

I have no idea where you started.

I am in vendors>pay bills. I have selected the vendor which has open invoices and a credit balance.

Now what?

Thanks for reaching out to us, @crusty.

The solutions shared by my colleagues are all different ways to link a vendor credit to a bill. In your situation, the steps you took are correct.

To apply the existing credit to an open vendor transaction, use the Pay Bill feature. Here’s how:

Refer to this article for more information: Enter and pay bills.

That should do it. Let me know if you have any issues after following those steps. I’m always here to help. Have a good one!

Hi There,

Is this for QB online because I don't have a plus sign on desktop.

Thank you,

Stacy

Glad to have you here, @FHGC.

Yes, the answers given by my colleagues above are for QuickBooks Online. I can definitely share with you the steps on how to apply vendor credits to a bill in QuickBooks Desktop.

Applying credits to a bill can be done in just a few clicks:

Please check out the screenshots below to outline the steps:

You may also read through these following links for more insights about handling credits:

If you need further assistance with this process, feel free to get in touch with our Customer Care Team. They have extra tools that can walk you through the steps.

Be sure to let me know if you have any other questions about paying bills. I got you covered with any QuickBooks concern. Thanks for coming to the Community, wishing you continued success.

Thank you so very much!

Using Quickbooks online, and we have dozens of bills to pay to each vendor with dozens of credits....many that need to be edited when the final statement comes in. Using the "Pay Bills" option does not let us see the credits that are being applied (since it only populates amounts), and going through the "Make A Payment" option on the Vendor screen does not allow us to pop back and forth while editing the payment amount and the vendor credit amounts.

Please help us make this more like the traditional Quickbooks desktop version. It is taking hours to pay bills!!

Hello AccountantJr,

You'll have to click on the credit applied column to see the available credits. Let me guide you through how so you can apply them to your bills.

I've attached some screenshots for you.

Also, you can use the side scroll bar to move back and forth when you're in the Vendor screen.

You can read this handy article for more information: How to enter and pay bills.

Feel free to visit our page for future reference: Income and expenses.

Please leave a comment anytime if you have other questions.

I have a vendor credit entered in QBO, however, even when I follow your instructions and go to Pay Bills, and click on the credit applied column my vendor credit does not show. So, I would already have to know how much the credit is before I go in to Pay Bills, and then manually enter the credit amount. What is the point of having a vendor credit, if it does not show when you go to pay bills? I only see it when I go into the vendor profile. The desktop version of QB for Mac used to show the vendor credit in Pay Bills and you could easily select the credit and the amount due to the vendor was automatically decreased. This really needs to be fixed in the online version.

Hello there, @Ele-Mo.

Thank you for taking the time posting in the Community and sharing your experience in using a vendor credit. Let me share another way to apply the vendor credit as payment for an open bill.

For more reference, you can use the following link to learn your way around with QuickBooks Online: Video tutorials.

Please know that I'm just a post away if you have any other questions. I'll be happy to help you out.

Hi Is there a way to credit a vendor credit??

It looks like you're trying to change the vendor credit's amount, Acaballero.

You'll just have to open the transaction, change the figure, then save it. This way, you can credit an amount in the vendor credit. I'll guide you with the steps:

I'll include a screenshot to guide you.

Let me add the article about entering a credit from a vendor.

Tag me if you need more help. I'll personally reply to you as soon as I can.

I am so sorry, I mean to put is there a way to Apply a credit to an Expense (not a bill), but still for the vendor.

Hi, @acaballero.

In QuickBooks Online, we're unable to apply credit to an expense. You can apply it to an open bill.

To apply the credit to an open bill here's how:

I've attached some screenshots for you.

You'll want to read this article for more details and information: How to enter and pay bills.

Please click on the Reply button anytime if you have questions. I'll be here to lend a hand. Take care and have a great day!

Great advice KhimG! It worked! JT

Along these same lines, what if I have more credits than the bill amount? How do I apply credits to the bill to relieve the payable without writing a check? It looks like QBO will not let me write a $0 check or $0 bill payment.

Thanks!!!

I'm here to help you with your concern today, @Babraham.

If you have more credit then you can simply apply it to the bill and the remaining amount of credit can still be applied to the next payment.

Here's how to apply a credit to the bill:

You may also want to learn how to run a report with vendor totals: Run a report with vendor totals.

Feel free to drop a comment if you have additional questions, I'll be glad to assist you.

Thank you for the response, however, if the net affect is $0, it will not let me save. I have $6000 is credits, and a $5000 bill. It will not let me apply credits to the bill if the net is $0. I get the error above.

Hello, @Babraham.

To apply the credit to the bill, you need to make sure that you put a checkmark inside the box and fill in the amount that you are going to pay in the amount box.

Please refer to the screenshots below.

Let me add this article about entering a credit from a vendor.

Please let me know if you need further assistance. I'll be glad to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here