Announcements

Get your business taxes done right with unlimited expert help. Check out QuickBooks Live Expert Tax

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and accounting

- :

- How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

Solved! Go to Solution.

Labels:

Best answer February 14, 2020

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

Hey, @Mike0926.

I hope you've had a great week. Follow the steps below to print your 1099's.

- Go to the Expenses tab and then the Vendors section.

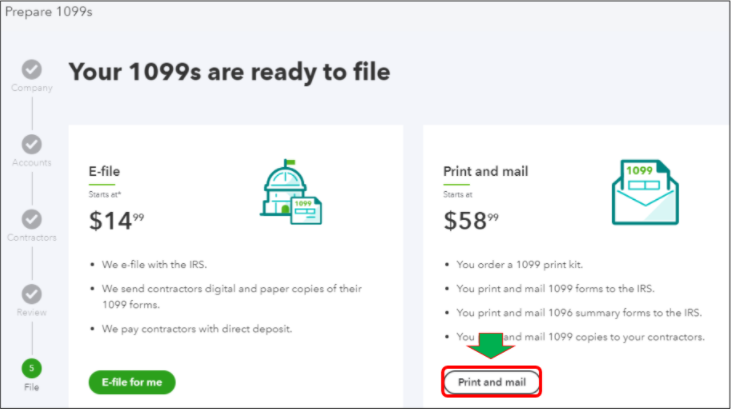

- Choose Prepare 1099's and walk through the module until you reach Step 5 - File.

- Click I'll file myself. Complete the on-screen instructions to print the forms.

Here's an article that you may find useful if you have more questions on printing the forms: Print and mail 1099s in QuickBooks Online.

Let me know if there's anything else I can help you with by replying to this thread. Have a wonderful weekend.

8 Comments 8

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

Hey, @Mike0926.

I hope you've had a great week. Follow the steps below to print your 1099's.

- Go to the Expenses tab and then the Vendors section.

- Choose Prepare 1099's and walk through the module until you reach Step 5 - File.

- Click I'll file myself. Complete the on-screen instructions to print the forms.

Here's an article that you may find useful if you have more questions on printing the forms: Print and mail 1099s in QuickBooks Online.

Let me know if there's anything else I can help you with by replying to this thread. Have a wonderful weekend.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

Thank you! I was nervous that it would e-file for me, again, so never went through to the end.

Take care.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

You’re very welcome, @Mike0926.

You have the option to manually file it or use our e-file service in QuickBooks Online.

Let me share this article as your guide moving forward in case you need the information to organize your QuickBooks account: Help articles.

Always know that Community is here anytime you need help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

My question is the same regarding how to get a copy of 2019 1099's that have been e-filed. However I have a bit of a different scenario. We are using QBO payroll via Bank of America. When in our BOA account I select Business and am directed off-site to Intuit Payroll. I run PR through here but for 2019 did not pay subs via QBO as they were paid through BOA directly.

I did use Intuit 1099-E-File Service, entering data. I can provide confirming email from Intuit that confirms the IRS accepted the forms [MISC and INT]. I need to print a report of recipients, or copies of the 1099's, to satisfy Workers Comp Annual Audit requirements.

Might you help?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

Hello @cmaddox,

You have the option to review and print a copy of your 2019's 1099 forms from the 1099 E-Services website. I'll show you how.

- Log in to your 1099 E-Services account.

- Go to Taxes & Forms.

- Select 1099.

- Click Print For Your Records.

- Select Archive.

- Find your 2019's 1099 forms.

- Select View.

- Click Print.

In addition, here's an article you can read to learn more about how you can print a 1099 form from your e-services account: How do I E-file and print a form?

But if you're unable to find the form, you can consider contacting the support team of Bank of America. From there, a specialist can help you view and print your form since your payroll and payments are made directly from them.

Lastly, I've got you this helpful article for ideas about how you can view a report of 1099 payments: Create a 1099 report for vendors and vendor payments.

Stay safe and give us a comment or post again if you have any other questions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

I have this same problem. I just want to get a darn copy of the 1099s that QBO filed on my behalf. When I follow these instructions to do step 5 as "print & mail" it wants me to pay $58 to buy red 1099 forms. Without them, I assume it's just going to print the raw data on a blank piece of paper.

This is really lame. Why can't I just access the forms somewhere like with my payroll w2s? I tried the "access 1099 EServices, and even though I'm an administrator it says "You don't have the proper permission to access the 1099 E-File Service from QuickBooks Online."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

Hello how would we print a copy of a 1099 from 2019? It is now 2022?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I get a copy of a 2019 1099 that has been e-filed with QBO? The contractor lost his copy.

Good day, @Chris CNO.

I hope your day is going well so far. I’m here to help you reprint your 1099s in QuickBooks Online.

There are two ways to reprint it. Rest assured, I’ll walk you through the steps so we can do this with ease.

Here are the steps if you manually filed the form:

- Navigate to Expenses, then select the Vendors section.

- Click Prepare 1099s, then select Continue your 1099s.

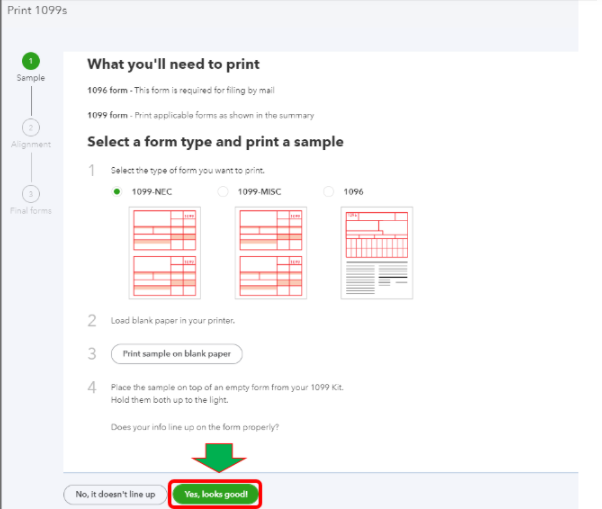

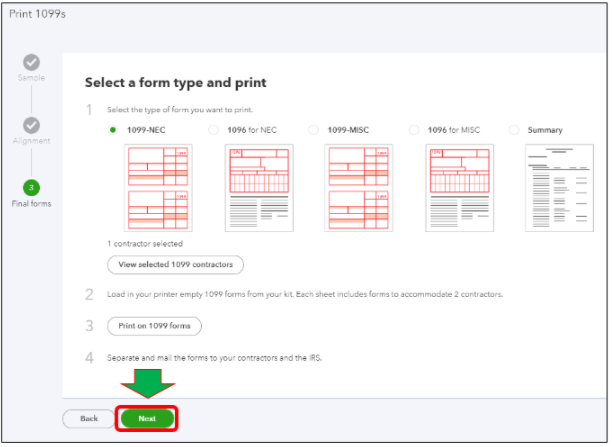

- Tap Finish preparing 1099s, then pick I'll file myself or Print and mail.

- Select Yes, looks good! and Next, then click Print at the bottom.

Another way to reprint them is if you filed them electronically. You can access your 1099 E-File Service account from January 1 to April 30. From there, you can pull up and print all the e-filed 1099 forms again.

You can take a look at this article as well to prepare and file 1099s. It includes steps and FAQs that'll guide you along the process.

Feel free to ask more questions if you have anything in mind about 1099s in QuickBooks. I'm always around here to help. Take care!

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Welcome to our Top 5 Questions series dedicated to Reports & Accounting.

Wh...

When starting your own business, it can be difficult to know where to

begin...

Stay ahead of the curve by catching all of the latest QuickBooks Online

upd...