Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDelete what you did

use receive payments in QB, enter the actual amount paid for that invoice, when you save QB will ask if you want to refund or keep as a credit. Then use deposit funds and put the received payment in the bank

download banking and match

the work flow is and has always been, enter transactions, download banking, match

I received payment and put in the amount of the check and QBO did not ask me what I wanted to do with the difference. So do I create a credit memo?

Hi there, @sarah17.

You might have entered the payment along with the invoice transaction, that's why it was not recorded as a Credit memo. I can show you the way to correct this. First, you'll have to delete the payment transaction. Then, re-create it and enter the total amount paid in the Amount received box. I'll also include how you can match this transaction on the Banking page. That way, we can ensure that the transaction is cleared.

Here's how to re-create the payment:

Once done, you can deposit the customer's payment. I'll show you the steps below.

Then, you can match this if the payment transaction is already downloaded on the Banking page. You can refer to the steps below.

You can also review the process in this article: Categorize and match online bank transactions in QuickBooks Online.

When you're ready to assess your business financials, you may consider checking out this article: Reconcile an account in QuickBooks Online. This contains a video tutorial and tips on how to fix any issues during the reconciliation process.

Please don't hesitate to tag my name in the comment section below if you need further assistance. I'd be happy to help you succeed. Take care and have a blessed day!

@MarsStephanieLthank you for the reply. Question is, what happens to the difference, in your example, if $400 is deposited on a $250 invoice (what happens to the $150)? I received the payment in the full amount and I'm left with a credit but I'm not sure what to do with that credit. I sent the customer a check for the difference today but not sure what to do with that reconciliation one it comes into QBO. Thanks!

I'm here to guide you on how to clear and link the check to the customer's open credit, @sarah17!

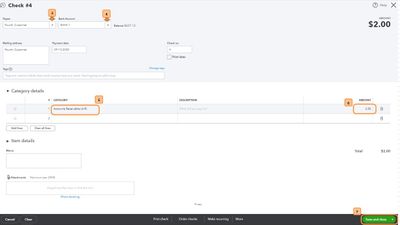

Did you record the refund through Check using the following steps below? When recording a refund using Check, you'll have to debit Accounts Receivable for the amount of the customer's open credit to offset the overpayment.

Anyhow, you can edit the transaction using the steps above. I'll show you how.

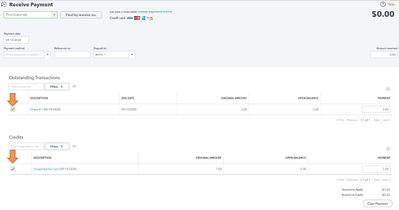

Once done, here's how to link or apply the refund to the customer's credit.

You can refer to these articles for more insights about handling customers credit or overpayment in QuickBooks Online:

Lastly, when it's time to reconcile your account, it will show the received payment, as well as the Check you sent to your customer. It will compensate to the actual amount of the invoice.

Keep in touch with me here should you have any additional questions or concerns. I'm always available to help.

@LieraMarie_A Here's what I originally did: I first received the full amount (let's say $1500) on the invoice that was $1000 which left me with a credit of $500, which I then sent a check to that customer but it's done online through Wells Fargo so it's not a physical check that I can record. I am hoping that once that $500 is out of our account (in QBO) I can then match the payment received ($1500) for the invoice and the credit of a remaining balance ($500)? If not, I'm not sure what to do because others have said that once I received the payment in the full amount received of $1500, that it would create a credit of $500 but it didn't do that for me. I hope I am making sense. I can delete what I've done and start over but I'm not exactly sure what steps I'm taking is giving me the right results? Thanks for your help!

Let me help you from here, Sarah17.

When a customer overpays, it will create a credit on their account. Then, you have three options on how you can handle the overpayment:

In your case, you've sent a refund check to your customer. It means that you'll also have to create it in QuickBooks Online. This way, the matching of downloaded and existing transactions will be easy. I'd suggest deleting and starting over to ensure that we'll record it correctly. Next, record the payment the usual way so it will create a credit. Then, create a customer refund.

You can also check this article for better guidance: Handle a customer credit or overpayment in QuickBooks Online.

If any questions arise, please feel free to leave a comment below. We'll get back to you as soon as we can.

My issue is similar, but different. I get a feed from the bank for customer payments. I select a deposit and then select Find Match. I check off everything that is being paid, but I come to one where the customer has overpaid. Exactly what do I do? If I put it as a reconciling transaction, I can't figure how to use the credit which the customer has now deducted on their next payment.

I've got some steps we can perform to apply for the customer's credit when matching the downloaded transactions, debi8.

For customer credit or overpayment, we can use the credit toward an invoice, refund the customer, or enter the overpayment as a tip in QuickBooks Online (QBO). Just follow the steps and details in Handle a customer credit or overpayment in QuickBooks Online article to keep track of the credits in your account.

Then, deposit the customer's payments in your account. Let me show you how:

Once done, match the payment transaction that is already downloaded on the Banking page. Here's how:

If the amounts are different, just locate additional matched transactions or select Resolve Difference. This opens the Add resolving transactions fields wherein we can include the Category and Amount of a resolving transaction until the difference equals zero. We can also use the Add new transaction button to add multiple resolving transactions. Just review the process in the Categorize and match online bank transactions in QuickBooks Online article.

When you're ready to assess your business financials, you can reconcile your bank account in QBO. Feel free to visit our Banking page fr more insights about managing your bank transactions.

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. You have a good one.

In my case, the "extra" money paid was paid as a tip, and customer does not want a credit on next invoice.

Thanks for sharing your concern here in the thread.

I know how important recording the tips you received and matching them to your invoice transactions is to make your account balance. Let me guide you to get you back in matching your transactions.

There are three options to record invoice overpayments in QuickBooks Online. It includes sending a refund, recording a credit memo, or a tip. Since your customer doesn't want to credit it to their next invoice, I recommend creating a tip account so you can record the extra money received.

First, you can create a new income account to track the tips. Refer to the steps below:

Next, you need to create a tip item. Here's how:

Then, you can now record the extra money as a tip by creating an invoice.

Lastly, you can now record the payment as received.

Furthermore, you can categorize and match your transactions to make your account balance.

Also, you can review and match your bank statements with the recorded transactions in your QuickBooks account: Reconcile an account in QuickBooks Online.

If you have other concerns besides recording tips, you can leave a comment or start a new thread in the Community space. We're always here to give you the support that you need. Have a wonderful day!

In my case,I have a payment that is less than the invoices amount because I was charged a comission or fee by the customer I performed the services for,cause he is an intermediary,so When I try to match,of couse it does not let me match. And if I go to receive payment,I record it on undeposited funds,But then I do not find out how to match the dowladed payment I have from the bank please help

Hello Mailen,

Thank you for reaching out to the QuickBooks Community! For this situation, it would be best to connect with your accountant to see what would be the best approach. However, for the commission fee, you could add a line item to the invoice. If you don't have an accountant, we offer a way for you to contact Proadvisors. They even provide a free consultation for most. Here's how:

If you have any other questions, I'm just a post away. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here