Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there,

You can transfer credit from one customer to another by creating a journal entry and the credit. Here's how:

You can refer to this article for the detailed process: How can I transfer credit from one customer to another?

I have also added some links you can check. These will show you more details about handling customer credits:

For additional QuickBooks-related concerns, don't hesitate to post them here in the Community. We're always available and willing to lend a hand to your queries. Have a great day ahead.

Hi,

When I try to do this journal entry, I get a pop-up window that says "You cannot use more than one A/R or A/P account in the same transaction." Is there something I'm not doing that's causing this issue?

Thank you,

Thank you for getting back to us with more details, atlanticwws.

I'll continue to help you with transferring the overpayment from one customer to another, and explain why we can't have multiple A/Rs in a journal entry. The solution is a little bit longer and different, but it's more appropriate for your scenario.

We can't use A/R or A/P accounts on multiple lines in a journal entry because it will make the transaction confusing. Each journal entry represents a single transaction, and A/R is linked to a specific customer. In other words, there should be just one A/R (customer) for each transaction. I highly suggest reaching out to an accountant to gain more insights about this.

To move the overpayment to another customer, we'll first transfer the amount from the A/R account associated to the original customer to a Clearing account. Then, transfer the same amount from the Clearing account to the A/R account associated to the receiving customer.

The transferred amount will become credits on the receiving customer, and therefore be used to pay their invoices. Let me lay down the steps for you.

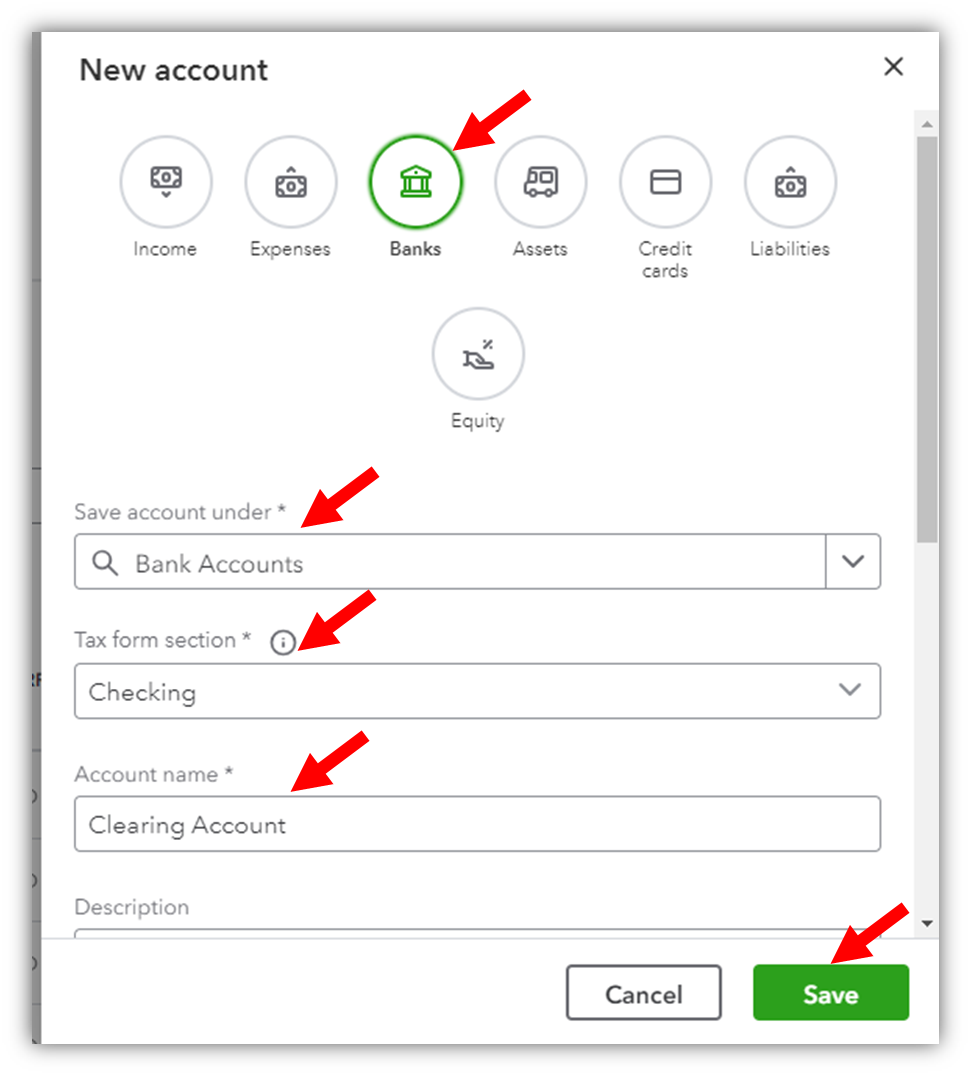

First, create a clearing account.

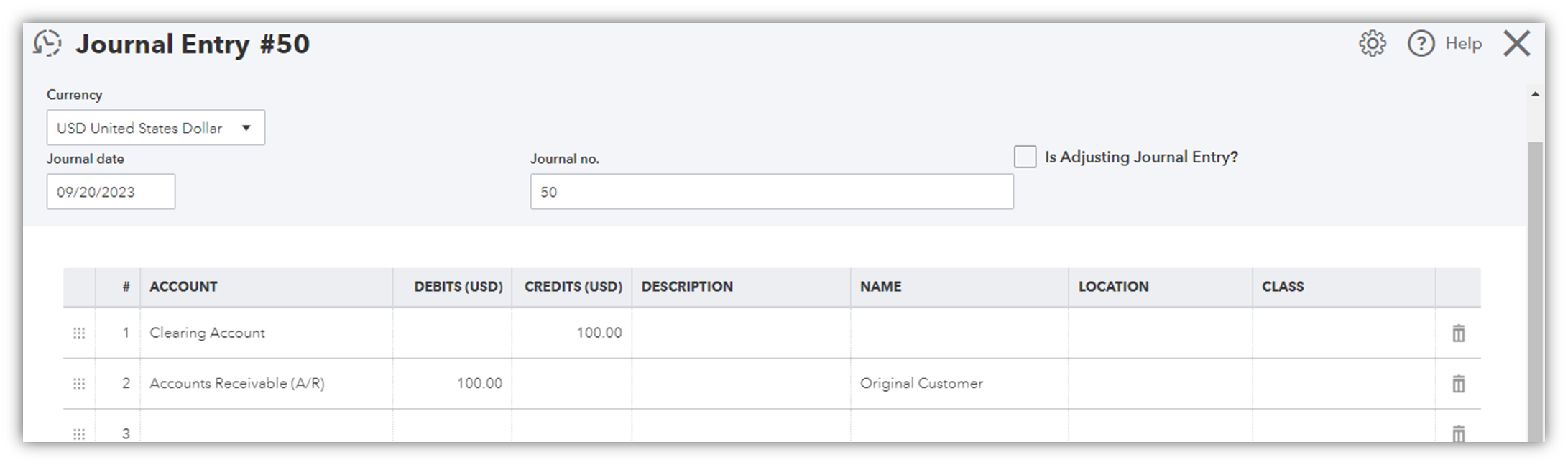

Second, transfer the overpayment from the original customer's A/R to the clearing account via a journal entry. Basically, we'll just have to associate the A/R account to the original customer, so money will be removed from their profile/balance.

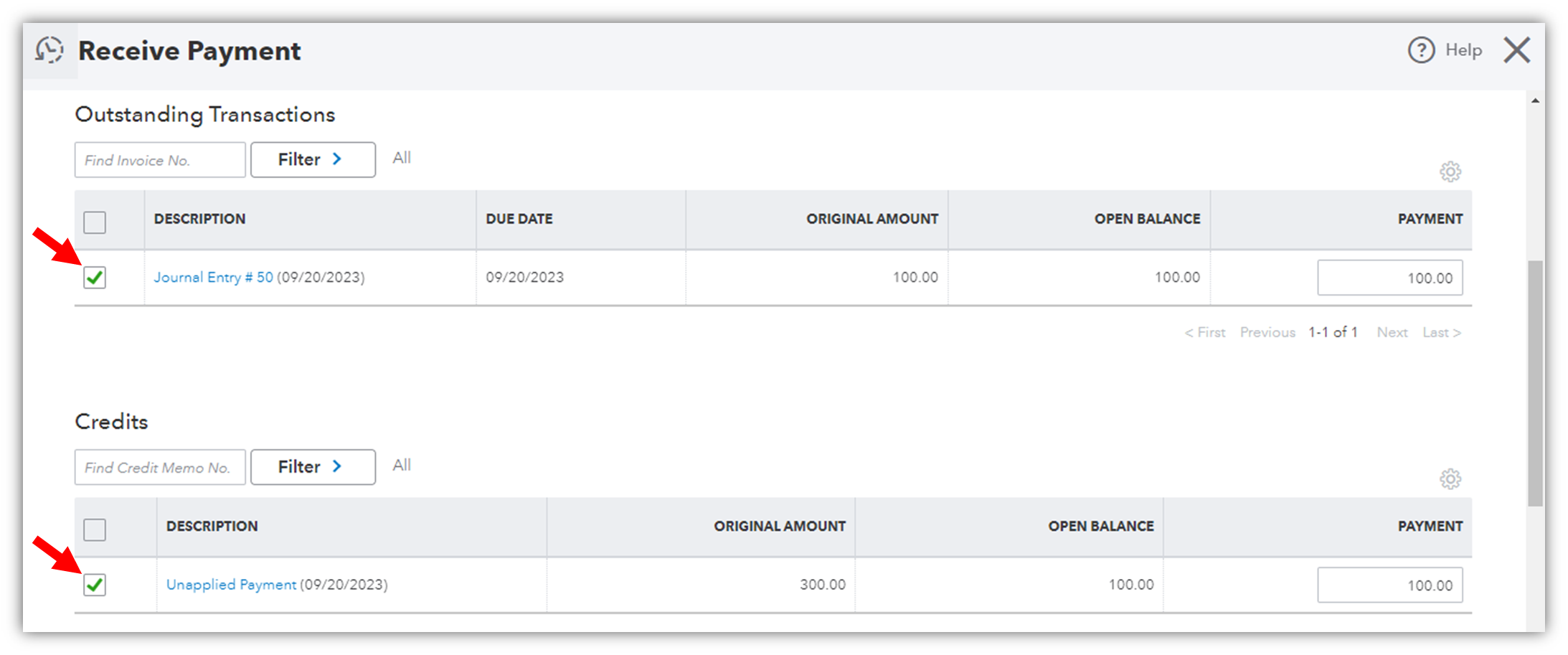

This transfer also creates a trail on the original customer, so it needs to be linked to the overpayment (unapplied payment) to close them both.

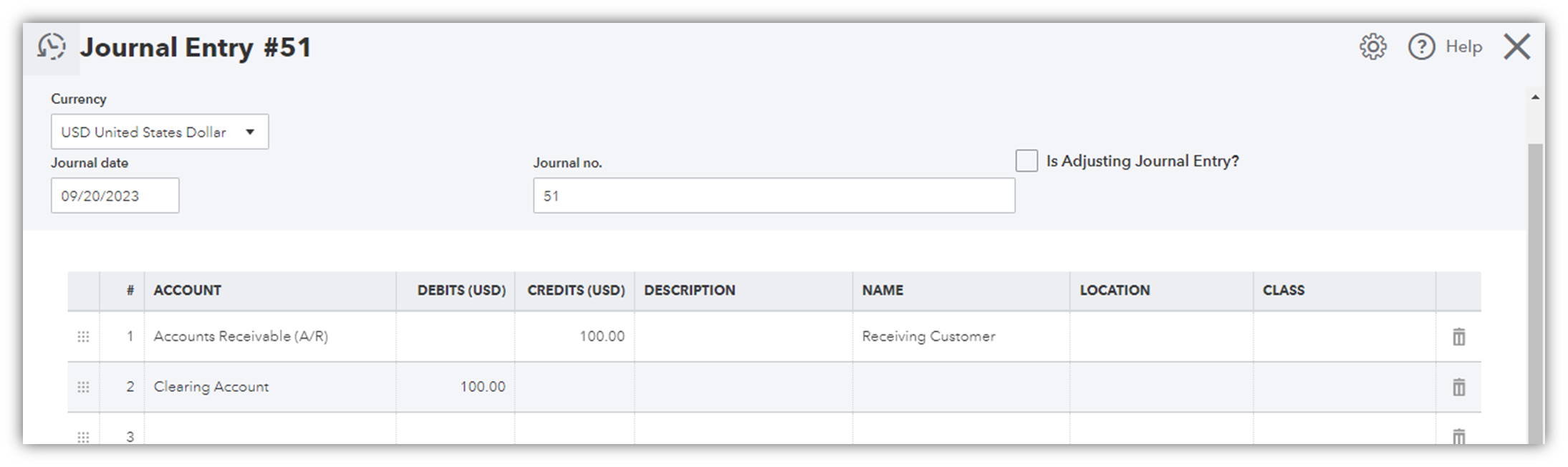

Third, transfer from Clearing to A/R and associate it to the receiving customer.

Now that the overpayment is transferred and turned into credits, just do a Receive payment transaction to each invoice. Then, select the journal entry to be applied as a payment.

There you have it. Please let me know if you need further assistance with your transactions. Take care and have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here