Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am having the same problem. I have created the Vendor Credit, I have added the refund to the deposit and when I go to create a check the only thing that come up is the vendor credit. I cannot seem to link the deposit to the vendor credit and the vendor credit is leaving a negative balance in my accounts payable account. Ugh Help please

We'll have to link them via Pay Bills, LisaG7.

This way, we'll be able to zero out the negative balance. This is the last process to keep your vendor expenses accurate:

We can customize the Transaction List by Date report to show all the payments created by the vendor.

Let me know if you have other questions.

Thank you so much. The deposit account selection of "Accounts Payable" was what was missing to link the credit and the deposit together.

The steps given did not work. I do not have a plus in Enterprise 2020 Gold Edition. How do you record in this program. It is a refund from a vendor for product that was returned.

Thank you

I can show you the easy steps in recording vendor refund in QuickBooks Desktop, LeadingForce.

The steps provided by a colleague is for QuickBooks Online users. Creating a vendor refund in QuickBooks Desktop depends on how you received it from your vendor. For returned items, you'll just have to create a bank deposit and then a bill credit which you'll link both using the Pay bills option.

Record a deposit

Create a Bill Credit for the returned items

Link both deposit and credit

There may be other ways you'll receive vendor refunds in the future, you can follow the steps on the specific scenario on this page: Record a vendor refund in QuickBooks Desktop. To help you manage vendor transactions, you can run reports on QuickBooks Desktop.

Keep me posted if there's anything else that you need help with. Take care!

I'm having a similar problem. I just started using QBO two days ago, and this is driving me nuts!

-- I paid for an online video service with my business credit card, which is connected to QBO.

-- I decided I didn't need the service, and canceled it.

-- The vendor issued a refund to my business credit card.

-- I now have two transactions to review and confirm: the purchase and the refund.

How do I categorize them so they cancel each other out? Obviously, I can categorize the initial expense, but there's nothing in the Chart of Accounts for receiving a refund. I know I can't add it to Other Income. So where the heck does it go?!

I'm using the Simple Start plan, so I can't create a Vendor Credit. I've seen other answers say to get around that by creating a bank deposit. But I didn't receive a check, just the credit card refund. If I create a bank deposit, aren't I creating a third entry for this one transaction?

It shouldn't be this difficult just to record a simple refund. ARGH! I would be grateful for any help anyone can offer. Thanks in advance!

Hello there, mlowery.

I know how important for your business to be able to track the vendor refund. Let me guide you in the right direction on how to record the entry.

The process to input the refund depends on how you record your purchases. Since you’re using the Simple Start version, create a credit card credit to input the refund given by your business credit card.

Then, connect the account of the downloaded transaction to the expense account used in the original purchase. Doing so ensures you can match them in the For Review tab.

Next, update the downloaded credit adjustment from Uncategorized Asset to the expense account. Here’s how:

To help manage your downloaded transactions, see the following links. These resources provide an overview of classifying bank data and adding rules to online banking entries.

Reach out to me again if you have any clarifications or other questions. I’ll get back and answer them for you.

If using Simple Start - rather than complicating the issue, you can simply assign (categorize) the deposit to the same expense account you assigned in initial purchase to. The debit & credit will cancel each other out.

okay, I tried this method, and it cleared out the A/P but left two negative amounts in the Vendor history. So, it basically changed the vendor history by the amount x2... It did eliminate the open A/P balance. but the vendor balance is not offset - I've got the negative for the Vendor credit created and another one for the Deposit. But on the P&L for the year it appears correct. But you have to number the check you create - QBO made me enter a ck number... when it's really not a check...

Background. My history for this transaction the Client created a bill for orig. expense, and paid it. So the Vendor history screen has a +50 and a -50. This was a deposit on a utility exp. by a builder on a property....

Well, then the Vendor history screen after this method

1.Enter the Vendor Credit and

2. Enter Deposit for the refund and

3. Enter a check Bill Payment transaction to connect the bank deposit to the vendor credit,

results in the P&L Expense (in my case COGS) was reduced by this refund... Which is correct, (just print a P&L YTD and you can see your result of these transactions...

I had printed different QB reports to try and trace these transactions through to see if they resulted in the correct end result. I looked at "Transaction list by vendor" "Transaction Report" and "Purchases by Vendor Detail" to try and see these transactions, and you have to be careful to examine each entry on those reports because all entries you make are not all P&L expense accts.

I did have a question on this. I use the projects function of Quickbooks online and I want to make sure as I am doing these vendor credits and following the steps that the reduced amount from the vendor shows up in my expenses tab for the project.

Thanks

Sean Brown

Hey there, @sbrown300.

Thanks for joining in on this thread.

Yes, the vendor credits will appear in the Projects feature. You can add them to the Projects through the field Customer/Project listed below in the picture on a vendor credit:

It's that easy!

Review this guide for more details about Projects.

This should do the trick. Feel free to come back if you have any other questions. Have a great day!

When you enter the Vendor Credit, do you need to use the A/P account? Or the Insurance account?

Thanks for reaching out to us, @Melk5397.

Let me give some insights into how vendor credit works in QuickBooks Online. Adding vendor credits reduces and debits accounts payable. Since adding a vendor credit will automatically debit Accounts Payable in QuickBooks Online, you don't need to use the A/P account.

Moreover, if you enter a bill to track your insurance expense, make sure the credit goes to the expense account you use for this vendor.

You can read these articles as a guide if you need to run and manage financial reports in the future.

Please get back to this thread by clicking the Reply button if you need further assistance with your vendor transactions. We're always here to help. Stay safe!

Hi,

I know this topic and the chain of posts is few years old, but I have a similar question.

I use QB desktop Premier Edition 2021.

We paid a vendor last month, he sent us a refund this month. I recorded the deposit, I recorded the credit memo, but I cannot connect the two transactions together. How do I do it? Nothing appears in the Pay Bills window as the bill was paid last month.

Essentially, I need to record a refund to an old paid bill.

Thank you,

Eve

Hello there, @NRomyn.

I want to ensure that you'll be able to apply credit to your vendor successfully. Let's get this sorted out.

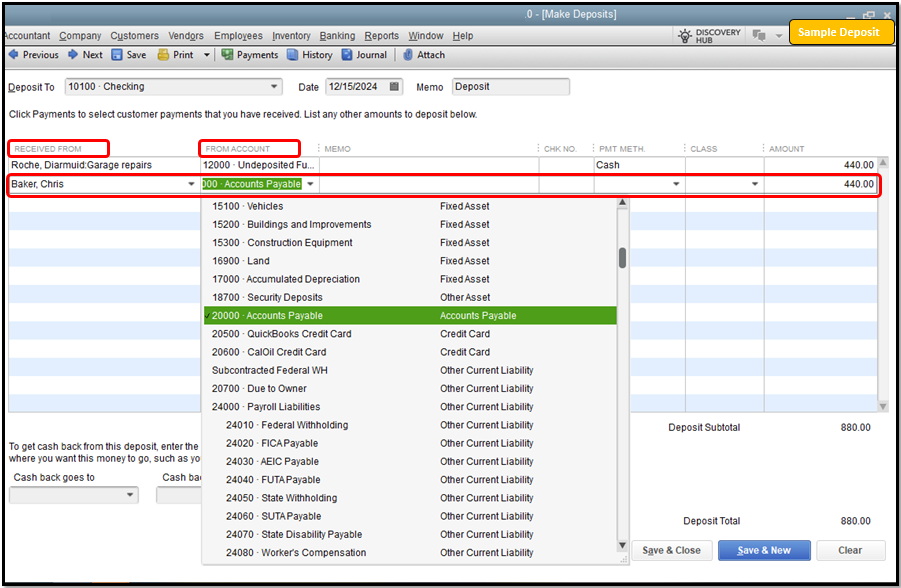

You have mentioned that you created a credit memo from a vendor. That said, the option to link these two transactions together is not possible because credit memo is only for a customer not vendor. To sort this out, we'll need to delete the credit memo instead make a vendor credit. You need to make a deposit and categorize it under the Accounts Payable account. This way, you'll be able to link the deposit to the vendor's credit.

Here's how:

After that, link the deposit to the credit to zero out the remaining balance. Here's how to do so:

In addition to the steps above, I'm adding this link for a guide: Recording refunds you received from a vendor.

Feel free to browse these articles to help you manage the receivables and parables of your business:

If there's anything else that I can help you with, please don't hesitate to insert a comment below. Stay safe and healthy.

Thank you for your help! It worked.

We're glad to know that my colleague was able to help you resolve your QuickBooks concern, @NRomyn.

I'd also like to thank you for your patience in performing the recommendation process that has been provided. Please know that if you need help performing specific tasks in QuickBooks we'll always be here to assist you again. Rest assured that assisting and providing the right resolution for our valued customers is our top priority.

I hope you have a great day ahead and take care!

This in QB online process? I'm assuming. Where do I add funds to my deposit on QBDT version? My mind is totally blank right this very moment! I can think of anything I've learned before right no! LOL!

Yes, the steps above are for QuickBooks Online, SouthTexasBooks360. I'm here to provide the details on how to add funds to your deposit in QuickBooks Desktop (QBDT).

Unlike QBO, there's no specific Add funds to this deposit section in QBDT. Instead, you can add it as a new line item directly in the Make Deposits window. To guide you further, please follow these steps:

Also, there are different scenarios that require a specific set of steps to account for a vendor refund. I'd recommend checking out this article for other ways to record them in QuickBooks: Record a vendor refund in QuickBooks Desktop.

Additionally, you can check out this resource that'll help you in case you want to transfer available vendor's credit: Transfer and apply credit from one vendor to another in QuickBooks Desktop.

Let me know if you have any other concerns with recording vendor refunds in QBDT. I'm always ready to help. Have a great day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here