Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWelcome and thanks for posting in the Community, @usererichenry32.

If you're using a single Employer Identification Number (EIN) for the two LLCs, you can use the Class or Location tracking feature to categorize them. These features will help you track your transactions by departments, product lines, or any other meaningful segments in your business.

Check out these articles for more information:

However, if you have different EINs, you need to have a separate QBO subscription for the other one. From there, you can now categorize transactions to the member LLC. However, I suggest consulting your accountant for further assistance with the process to ensure your books are accurate.

See the following articles for information about owners or partners mixing business and personal funds:

Please know that I'm only a few clicks away if you have any other concerns or questions. I'll be here to assist. Enjoy the rest of the day!

Thank you for your response. I may need to clarify. I have an LLC with 2 owners/members and 1 EIN associated with it. My question is how do I set up the withdrawals we each take as income from the work we complete? I see some set up as a equity draw but I'm not sure if that will work out to be the best option. If this is the case...would it be set up as (Member 1 John Doe and Member 2 Jane Doe) as the equity draw account names? Are these draw accounts an expense?

Hi there, @usererichenry32.

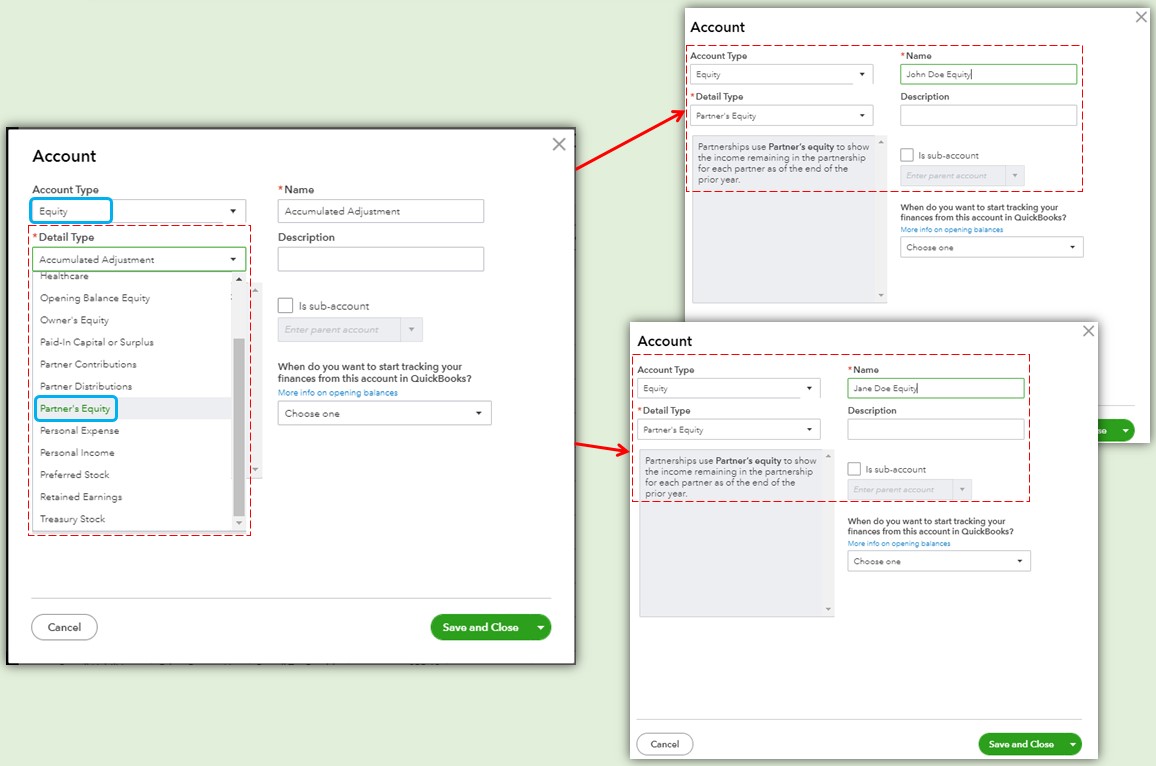

Thank you for letting me know about the details. Since you have an LLC business and 2 owners, you can create a Partner's draw account that is also an equity account.

Then, create a Journal Entry to assign the profit to the Partner's draw after deducting all the expenses.

Here's how to set up a Partner's draw:

I'd also recommend speaking with your accountant before doing these things to ensure the accuracy of your books.

I've added this article to have more details about the process: Learn about the chart of accounts in QuickBooks.

I'll be here if you have other questions. Let me know in the comment section. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here