Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe are a volunteer nonprofit utilizing QB 2019 premier for nonprofits, accrual method.

May we provide an example:

We receive a $200k grant from HUD:

dr A/R grants for $200k

cr Grants income account

Next upon contract, we contract a contractor to execute the project and upon completion::

dr Grants income account $180k

cr Contractor A/P

Note: now we have left in the income account $20k, this is our admin fee.

Next, we pay the contractor for project completion"

dr A/P Contractor $189k

cr Cash $180k

Result:

QB ignores the income account when posting to the P&L. This means, either I did not make

a proper entry or QB has an error in its software.

Please advise how this problem can be fixed. It is urgent !!!!

Regards,

qikd

email: [email address removed].

Solved! Go to Solution.

I got you covered, @np8.

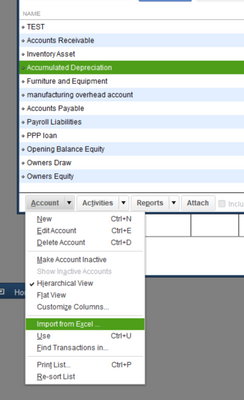

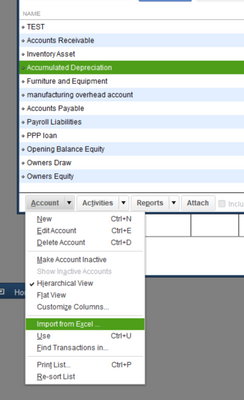

Let me share to you detailed outline to ensure that you're able accurately tracked your non-profit transactions. Also, I've added screenshots as visual reference.

Following the suggestions of @john-pero, since the built-in account in the chart of account does not suit your business structure, you can easily create one.

Also, you can import your existing chart of accounts. You can refer to the steps below:

Once completed, you can create a service item and associate the income account you've created to it.

Now, you can create an invoice and record its payments.

Now, you'd want to deposit the payments to the bank account where the actual grant was deposited.

Meanwhile, you can create a bill to track the expenses used in implementing your projects.

By following the steps above, you can make sure that all transactions are accounted accurately.

Lastly, I've added these articles to help you manage your non-profit transactions:

Swing by here in the Community if you have other questions about getting the most out of QuickBooks full potential. I’m just a few clicks away.

1. STOP using journal entries for money movement. Use deposits, checks, sales receipts etc. Journal entries bypass the accrual vs cash concepts and cannot be used to track by name.

2. If your P&L is not displaying $20k income and $0 expense as your example indicates then

A. your accounts are not set up correctly

B. Your postings are incorrect

C. Software messed up? Possibly but for simple money in money out, unlikely.

Consider this, after your example , unless you missed a hugely important step you still have receivables of $200k and negative $180k in the bank.

If the grant is only a promise of money to come later use an Invoice, posting to an income account. For contractor use a Bill, and pay later.

Thank you for your directions. We will work on your advice.

QB is much different than our prior software. It appears

QB works from entries on their forms when constructing

statements as opposed to constructing from the journal.

Your direct comments and advice are greatly appreciated.

Just to add to the prior reply:

All accounts register the proper amounts within the

chart of accounts under activities. Bank records are

in order. It is only within the architecture of QB whereby

one must use their sales, invoice, et.al. to construct

proper statements. Therefore, the statements and

trial balance cannot be accurate without making the

entries in the sales, invoice, etc. accounts.as you

so correctly advise. Mostly, these accounts do not

apply to nonprofits. QB claims it has a nonprofit

program but the nomenclature and other items

do not resemble nonprofit accounting nomenclature

in many areas. With thanks again as it is obvious

that you know this product in detail. Sadly, I don't.

Regards

I got you covered, @np8.

Let me share to you detailed outline to ensure that you're able accurately tracked your non-profit transactions. Also, I've added screenshots as visual reference.

Following the suggestions of @john-pero, since the built-in account in the chart of account does not suit your business structure, you can easily create one.

Also, you can import your existing chart of accounts. You can refer to the steps below:

Once completed, you can create a service item and associate the income account you've created to it.

Now, you can create an invoice and record its payments.

Now, you'd want to deposit the payments to the bank account where the actual grant was deposited.

Meanwhile, you can create a bill to track the expenses used in implementing your projects.

By following the steps above, you can make sure that all transactions are accounted accurately.

Lastly, I've added these articles to help you manage your non-profit transactions:

Swing by here in the Community if you have other questions about getting the most out of QuickBooks full potential. I’m just a few clicks away.

Wow. Thank you for such detail and the time you must have taken to help us out.

Appears my fault for not using the software as it was designed. Both replies will

allow me to fix the problem. The bank and liabilities are all in order. It is just

that I expected the statements would generate from the journal. Thanks to

you both for straightening it our for me. Regards.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here