Limited time. 50% OFF QuickBooks for 3 months.

Buy now & saveAnnouncements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and accounting

- :

- Is there any way to create a bill from a PO & also be able to accept the inventory on that PO? Some vendors are prepaid and need to be billed real time. Is there a fix?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is there any way to create a bill from a PO & also be able to accept the inventory on that PO? Some vendors are prepaid and need to be billed real time. Is there a fix?

I need to be able to bill my invoices that require prepayment at the time of the order for my accountant. I also need to be able to receive the inventory when it arrives, not at the time of payment. Has anybody found a solution or workaround to make this happen?

Labels:

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is there any way to create a bill from a PO & also be able to accept the inventory on that PO? Some vendors are prepaid and need to be billed real time. Is there a fix?

It’s nice to see you in the Community, chuck26.

Yes, you can create a bill from a purchase order. When you enter a bill, the inventory count for the products will be affected. To ensure your records are correct, input the entry when you receive the items.

For your other concern, record the prepayment and then apply it to the bill. Then, associate the transaction to Accounts Payable. Allow me to help show the steps to do the process in QBO.

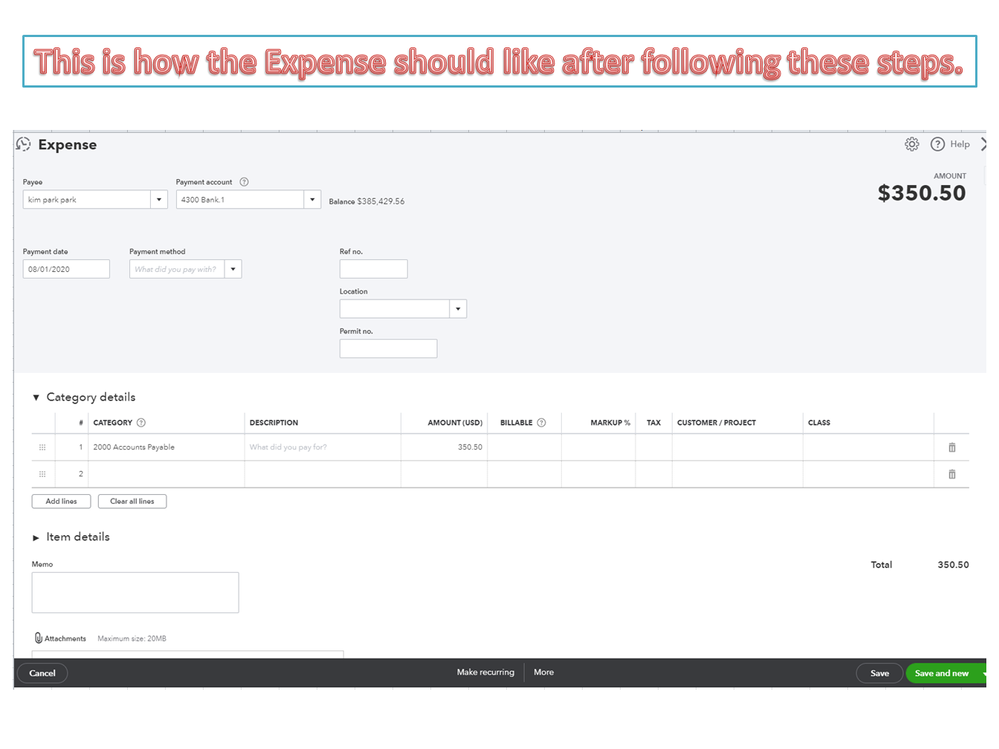

- Go to the Plus icon or New menu in the upper left corner and select Expense under Vendors.

- In the Payee field, select a vendor and pick the bank/credit account to credit the expense.

- Enter the date of purchase in the Expense/Payment date field and specify the payment method for the transaction.

- In the Accounts section, pick Accounts Payable and key in the amount.

- Click on Save and close.

To link the bill to the prepayment:

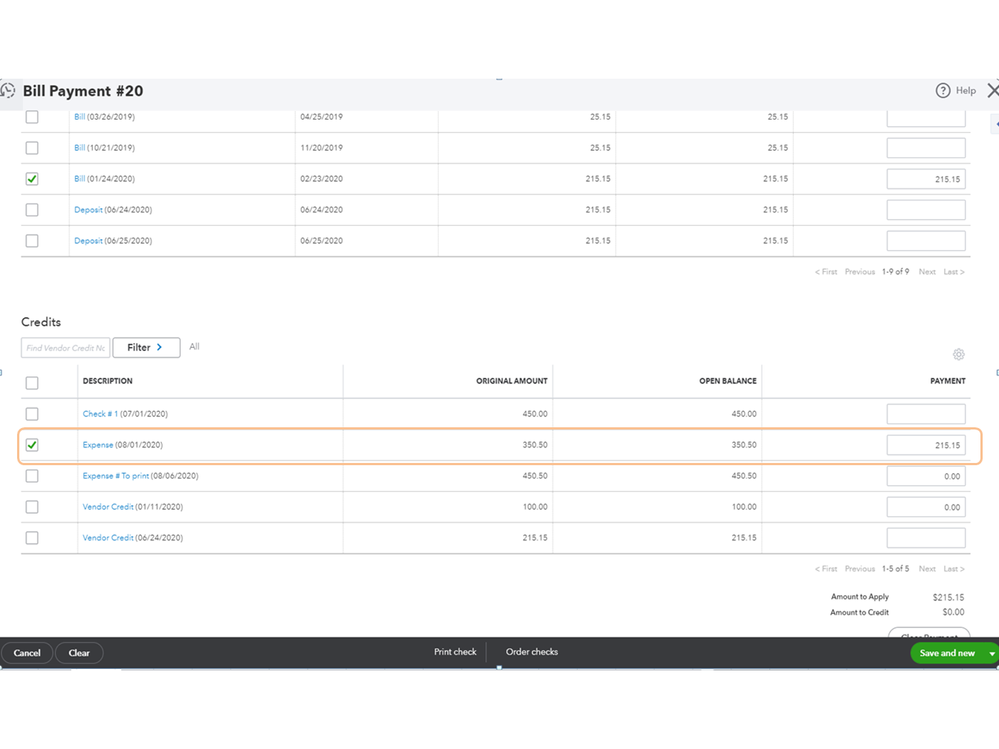

- Tap the Expenses menu on the left panel and choose the Expenses option.

- This will open the Expense Transactions page.

- From there, select the bill you’re trying to pay and click the drop-down under the Action column to select Make payment.

- On the Bill Payment screen, go to the Credits section and tick the box for the prepayment.

- Hit Save and close/Save and new.

However, if you want to bill the transaction to your customer, let me share the Enter billable expenses guide. It outlines the complete instructions to track expenses incurred and steps to apply them to invoices.

I'm also adding a link that can help manage prepaid items. It outlines the complete instructions on how to create a purchase up to linking the bill and check on the Bill Payments page: How to track your prepaid inventory.

Keep me posted if you have any clarifications or concerns. I’ll get back to answer them for you. Enjoy the rest of the day.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...