Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, @sbjconstructionl.

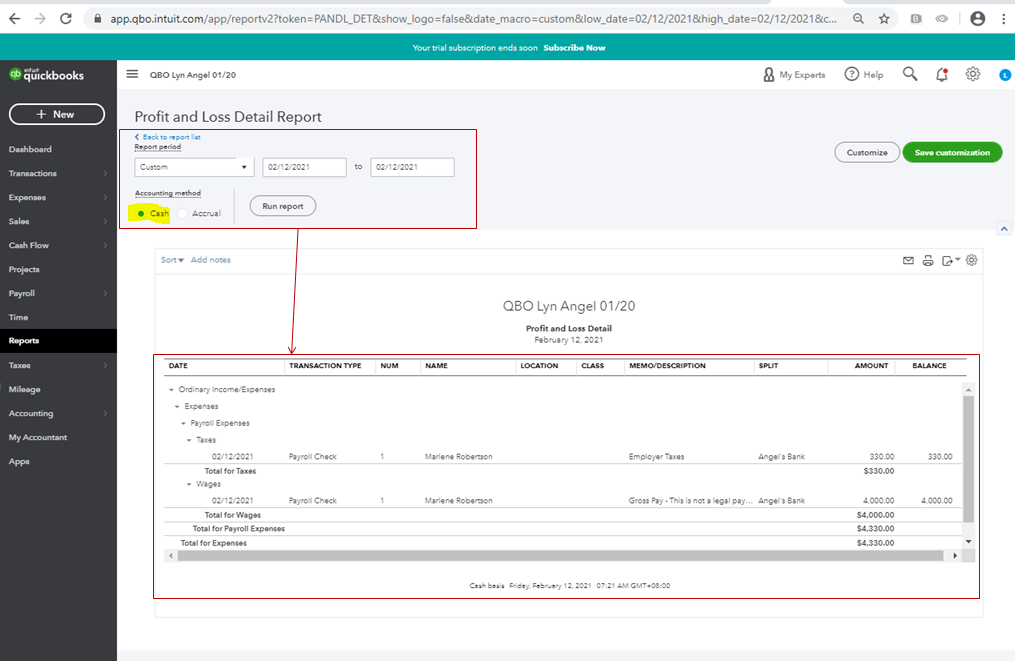

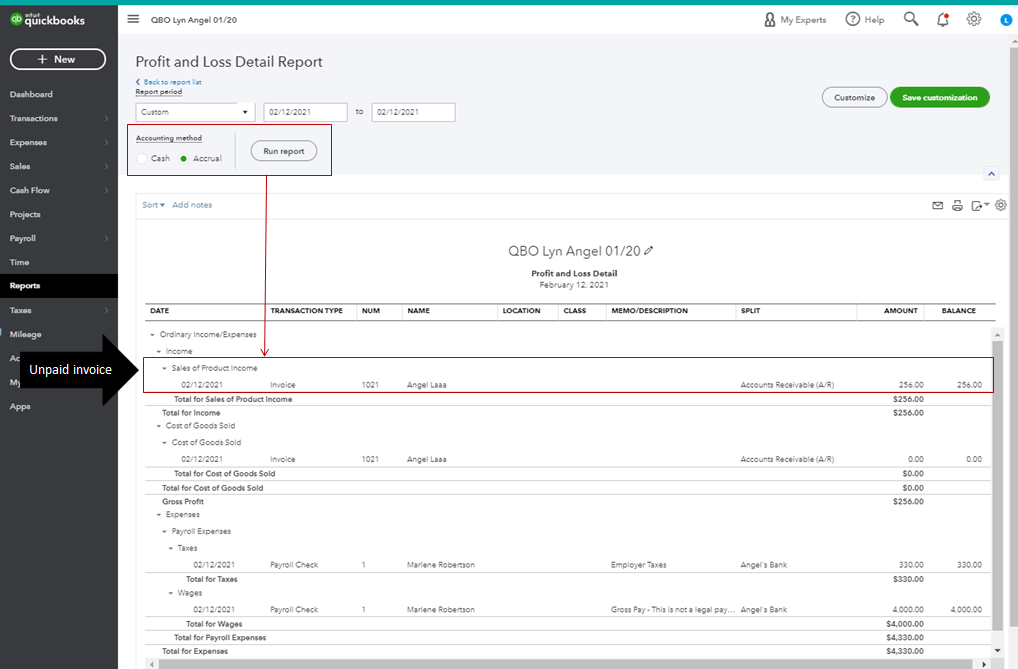

Yes, unpaid invoices will show up under your income when running your reports on an Accrual basis. I'm here to help you with customizing your transactions to get the result you need.

At this time, you can open your report on a cash basis to get the accurate total of your income. As stated above, accounts receivable transactions (overdue invoices) are showing up on an Accrual basis.

For more tips about running and customizing reports in QuickBooks Online, you can open this article: Run reports in QuickBooks Online.

You can also skim through the topics from our help articles for more resources while working with QuickBooks in the future. Here's the link: Find QuickBooks help articles, Community discussions with other QuickBooks users, video tutorials, a....

If you have any other questions about your invoices and income transactions, please let me know by adding a comment below. I'm always here to help. Have a good one!

Good morning @Angelyn_T

Thanks for your answer. I tried what you said, but I still can see the paid invoices in my income and they're still duplicating the total.

Thanks for trying the steps shared by my peer. You can run two reports to get the data you need, @sbjconstructionl.

Let's ensure that the invoice had been matched to a deposit by running the Transaction List by Customer and Transaction List by Account.

You'll only need to filter it to show the Cleared status and the Transaction Type.

Here's how:

After filtering the report, look for the invoices that don't have a letter C under the CLR column. This means that they are not yet matched to any deposits. Once duplicates are confirmed, follow the steps to learn more about how you can handle your duplicate transactions: How to Void or Delete an Invoice or Other transactions?

For future reference, read through this article to learn more about finding the duplicate invoice, estimate, or sales receipt numbers.

If you have any further questions, just let me know. I'll be here to extend help.

thank you @katherinejoyceO it was helpful the info you shared, however, after I followed all those steps and I identified all the unmatched invoices, added to undeposited funds, and added to a new bank deposit, when I come back to my profit and loss and check my income, those invoices are still there doing the same mess. So, probably, I've lost at some point. I can't see the letter C in the invoices I've matched to undeposited funds and bank deposit, and I'd appreciate if you can guide me to the next step after identifying the unmatched invoices.

Hi there, sbjconstructionl. I'd be more than happy to share some information about deleting/voiding transactions.

If one was created by accident, it can be voided or deleted. This will prevent it from affecting your account balances and reports. In the event any of them are duplicate recurring transactions, they can be turned off to prevent another record from being created.

Here's how:

Once you're prepared to void/delete your duplicate records, you'll need to determine which option's appropriate to use. In most cases, it's best to void rather than delete. Voiding will leave a record of it behind, whereas deleting won't. Once an invoice is voided, QuickBooks won't void any payment(s) that've been linked with it. You can apply it/them to a different invoice.

Only delete transactions if you're certain you don't need records of them. If one's deleted by mistake, you can use your Audit Log to recover some of it's details, but not the entire record.

In the event you're still not sure whether to void or delete a transaction, I'd recommend consulting with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find an Accountant. All ProAdvisors listed there are QuickBooks-certified and can provide helpful insights for driving your business's success.

Here's how to void/delete a transaction:

Now your duplicate transactions will be voided/deleted.

You'll additionally be able to find many detailed resources about using QuickBooks in our help article archives.

I'll be here to help if there's any questions. Have an awesome Friday!

Were you able to find a fix to this issue? I'm currently going through the same trouble. Thanks!

Thanks for checking in with us, UpSquad.

If you're referring to the paid invoices included on your income and they're still duplicating the total, let's ensure that the invoice had been matched to a deposit. We can check them by running the Transaction List by Customer and Transaction List by Account report. We'll only need to filter it to show the Cleared status and the Transaction Type. Here's how:

After filtering the report, look for the invoices that don't have a letter C under the CLR column. This means that they are not yet matched to any deposits. Once you know the duplicates, follow the steps in this article on how to handle duplicate transactions: Void or delete transactions in QuickBooks Online.

Feel free to visit our Sales and customers page for more insights about managing your company's income and customers.

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Feel free to reply to this post and I'll get back to you. You have a good one.

Thank you @sbjconstructionl for posting this. I am having the same issue and I have gone through all the steps...and I am still unable to clear the duplicate Accounts Receivable. I had this issue before and paid hundreds for a QB Accountant to remedy.

I have followed all the steps which "fixed" the issue last time, but it appears QBO has a mind of its own and my P&L is not accurate.

I need a real solution, maybe QB's can change the software to make this insanity stop.

Please advise.

That shouldn't have happened, Nina Oxide. I'll help ensure to get rid of the duplicate from your books.

Here's how:

For future reference, check out these links below to help you learn about managing managing your transactions in QuickBooks:

Feel free to message me again if you have additional concerns about fixing the duplicates in your account. Take care!

The OP @sbjconstructionl has 'Transaction Type: Deposits' on their P&L screenshot which indicates they were most likely not receiving customer payments properly. Payments received from customers on invoices must be recorded as a payment received (New > Receive Payment) and matched to the invoice. This reduces A/R by the same amount as the payment.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here