Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHey, @tammyleninsky.

I'm here to walk you through the process of reimbursing your boss. We need to create an owner's draw account to get you started. An owner's draw is an equity account that tracks payments made from the company's assets to pay the owner. Follow the steps below on how to set up the owner's draw account, and how to write a check from that account.

Set up the owner's draw:

Write a check from the owner's draw:

Now, you'll be able to reimburse your boss. For more information on how to recording the payment to your boss, I suggest reaching out to your accountant.

Reply to this thread if I can help with anything else, have a good week.

I'm having the same problem but my boss paid some bills that are billable to a customer, I'm wondering how to enter the bill and how to pay the bill and apply it to owner's draw.

Hello there, Diamond Framers.

I appreciate you for joining this thread. I can help you record the bills that were billable to a particular customer. I'll show you how.

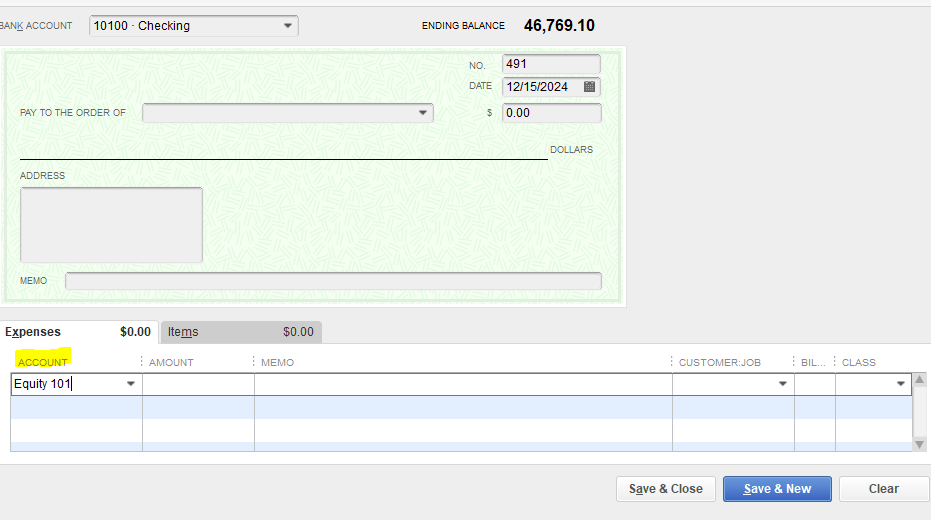

First, create an equity account or use the open balance equity in your QuickBooks. Ensure the account has an existing balance.

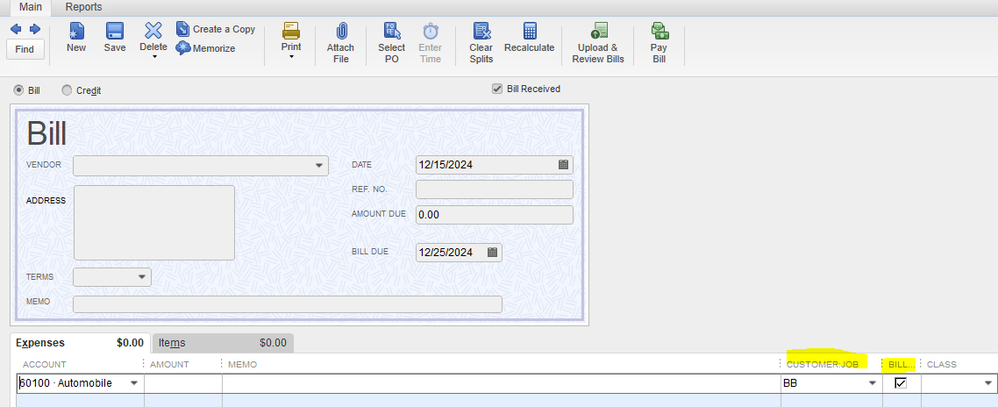

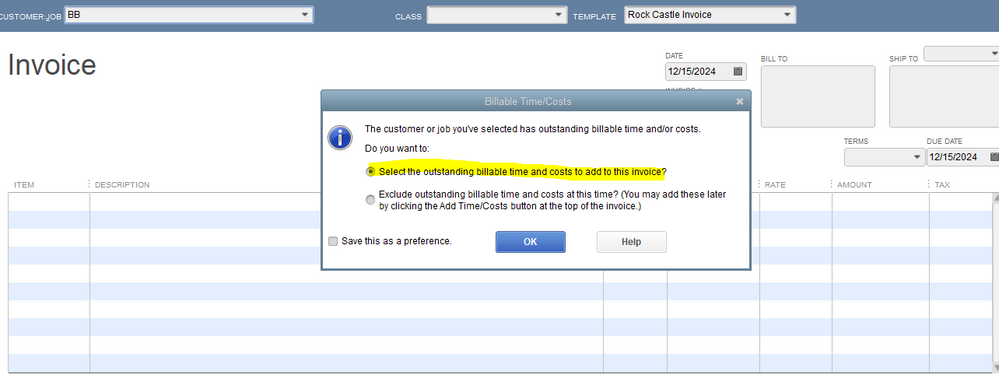

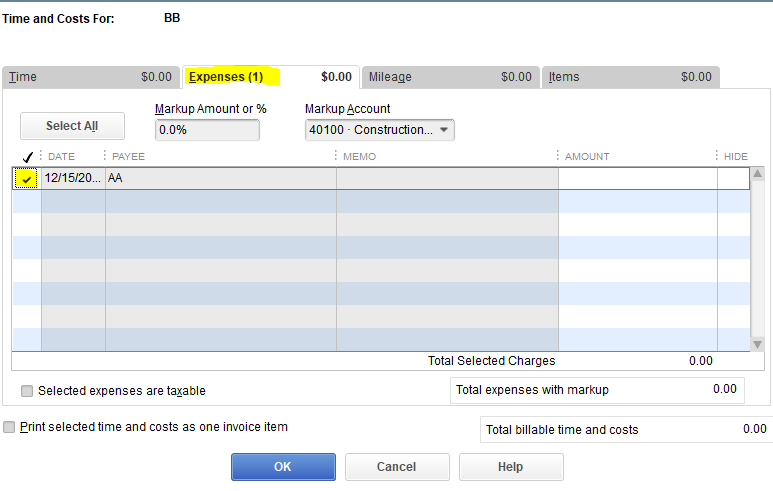

Next, transfer the funds from the equity account to a bank account. Once done, we can follow these steps to record the flow of your transactions. Here's how:

Feel free to visit this article: Help Articles in QuickBooks Desktop. It provides information about handling transactions and other details in QuickBooks.

Let me know if you have more concerns about recording transactions within your company file. I'll be around to help you in any way that I can. Take care and stay safe

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here