Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowLet's review each transaction and get it corrected, 110maindelhi-gma.

In your Profit and Loss report, let's check the two-income lines by clicking on each of their amounts. Doing so helps understand why the amounts aren't the same.

If the transactions should be under one account, then let's merge them. If not, leave them as is to ensure your books remain accurate. Also, if you don't need the other account, we can inactivate it to avoid duplication and confusion in the future.

You may follow these steps to merge the accounts:

Here's how to make your account inactive:

You can customize the reports to hide inactive accounts in QuickBooks Online. This helps you view accurate data.

Additionally, I've included an article that will help you learn more about the accounts in the Chart of Accounts. This helps identify which can be deleted, edited, or merged in QuickBooks Online: Manage Default and Special Accounts.

This information should point you in the right direction. If you have additional concerns, let us know to assist you.

Thank you, Charlene; this seems to have worked but now my Square Income line is showing both the Square transactions and the Square deposits to my bank account. So is my additional step to either disable the Square sync (of transactions) and just use my bank despots labeled as Square Income to get an accurate reflection of my Income on the P&L for income from Square?

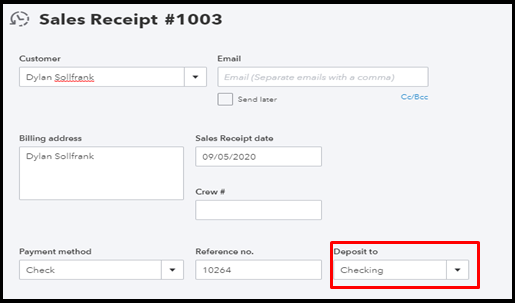

Let's check first where the Square income is deposited, @110maindelhi-gma.

This is to ensure we can take the proper course of action and prevent messing up your books. Here's how:

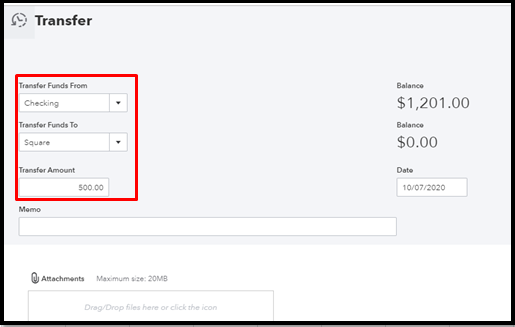

This time, you have two options on how to proceed. First, if you have a Square Bank account where all the income is deposited, you don't need to add them when the bank updates. You can just create a Bank Transfer where to put all the income. Let me guide you how:

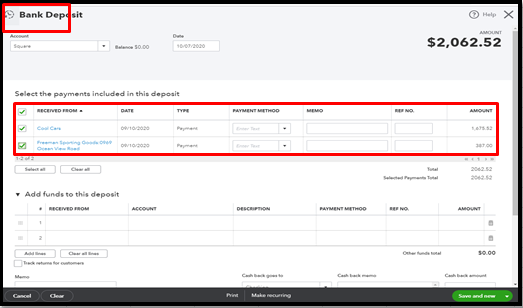

On the other hand, if you're using the Undeposited Funds account, you can create a Bank Deposit. Just select all payments (or income) from Square to your Square Income account. Let me show you how:

You can personalize your Profit and Loss report to get the info and formats you need. For more insights, please see this article: Customize reports in QuickBooks Online.

Then, you'll want to memorize the said report to save its current customization settings. This way, you can quickly access it for future usage.

You can count on me if you have more questions about managing your reports or transactions in QBO. Take care and have a good one, @110maindelhi-gma.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here