Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy now"Since the Account Type or Detail Type cannot be changed, I would like to utilize these tools to enter as much detail as possible"

Income and Expense are no different for you, but you name them, such as Donation Income, Grant Income and Donation-in-kind income; income from sales and services such as event tickets, Christmas Wreaths, whatever. This is your Statement of Financial Activities.

"what is the best way to differentiate between unrestricted, temporarily restricted and permently restricted funds."

Fund Accounting is more often managed by Balance Sheet activities. To handle restricted, unrestricted, etc, this is often done in Equity. Equity, for instance, is where you would create and manage your Net Assets. This includes the new topics for other assets and other liabilities for Deferred Inflows and Outflows. This is your Financial Position.

"How many subaccounts can you have per account? Can you have a subaccount of a subaccount? What are the exact limits on name lengths and other restrictions?"

I haven't explored all the limits yet, and I haven't found a website showing it. But the program always shows what you can do. Add one account, then teset it by adding a subaccount and a subsubaccount. You will get a warning if you are exceeding the limits.

"Can a subaccount, class and subclass be assigned a number?"

Even if there is no separate numeric field, you can always put the digits in the name as part of this text.

"We have two bank accounts - one for operational and one for capital. A challenge with this is that expenses have crossed between accounts. i.e. Operational expenses have been paid from capital account, so I will need to properly classify them by fund within each bank account. "

You always class track the details of all the data: from what bank on behalf of what account and with which other crossreferenced data is always needed. But, since these are errors, you also need to "repay" from the one bank to the other, when these errors occur. I explain this like roommates: if one roommate (bank) did not pay their own share of an expense, they need to repay the other roommate (bank account).

A city gets two Phone bills: one for Sewer Department and one for Water Department

Sewer Bank is used to pay the Whole bill, but the data is split on that check, and each phone expense is separately classed. Meanwhile, Water bank owes the Sewer Bank money.

"do I have to establish the Operational account as unrestricted and the Capital account as restricted?"

If those bank accounts hold only funds that meet that restriction, then it is good to indicate this.

I actually have a parent level of "Investment account" (bank parent level marked Not To Be Used). Then subaccounts:

Unrestricted Operations Surplus

Restricted Surplus

"If so, then I cannot enter the past activity by account."

I don't understand this comment. If you "can't" do this, then you have something set up incorrectly. We all need to be able to enter whatever happens in reality, into the bookkeeping. All past activity is always entered with all the same details as current activity, if you expect to be able to report it to the same degree.

Please note the following released August 2016 by FASB:

ASU 2016-14, Presentation of Financial Statements of Not-for-Profit Entities

• Replaces the three existing classes of net assets (unrestricted, temporarily restricted and

permanently restricted) with two new classifications, shown on the face of the statement of financial

position:

o Net assets with donor restrictions, and

o Net assets without donor restrictions.

• The change in the amount of each of the two new net asset classifications will be shown on the face

of the statement of activities, as well as the currently required amount of total net assets.

• Continues to permit either direct or indirect method of presenting operating cash flows on the face

of the statement of cash flows; but, if direct method is used, no requirement to also present

indirect method (i.e., reconciliation of changes in net assets to cash provided/used in operating

activities) too.

• Requires expenses to be classified by both nature and function, adding to the current requirement

of presenting expenses by function. This could be on the face of the statement of activities, a

separate statement, or notes to financial statements.

• Requires classification of “underwater” net asset amounts of donor-restricted endowment funds are

part of net assets with donor restrictions.

• Removes the over-time approach for the expiration of restrictions on capital gifts and requires the

placed-in-service approach when there are no donor specific stipulations.

• Additional disclosures, including:

o Composition of net assets with donor restrictions at the end of period, and how the

restrictions affect the NFP’s resources.

o Descriptions and amount of underwater endowment funds.

o Information, in the notes to the financial statements, about NFP manages its liquid resources

available to meet the cash needs for general expenditures within one year of the balance

sheet date

• Eliminates the requirement to disclose netted expenses for investments (e.g., mutual funds, hedge

funds) that are presented net of related external and direct internal investment expenses.

Thanks for joining this thread and providing details, @RhondaL.

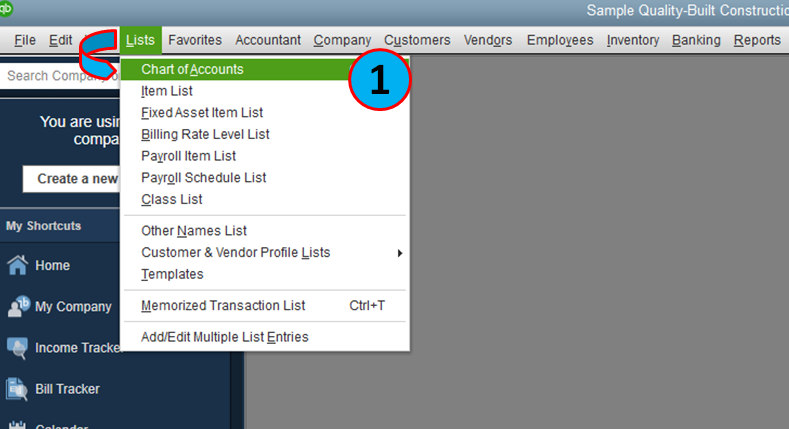

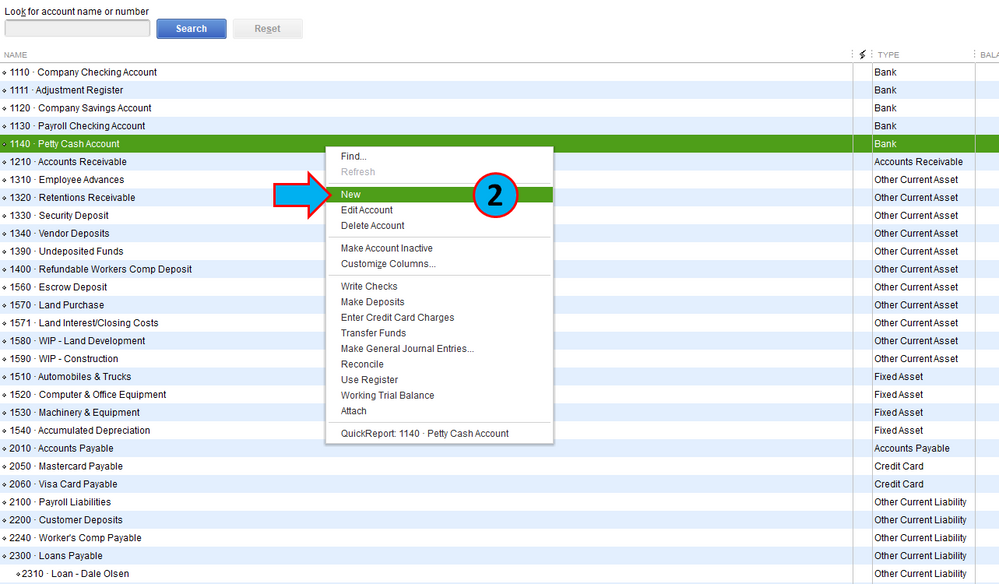

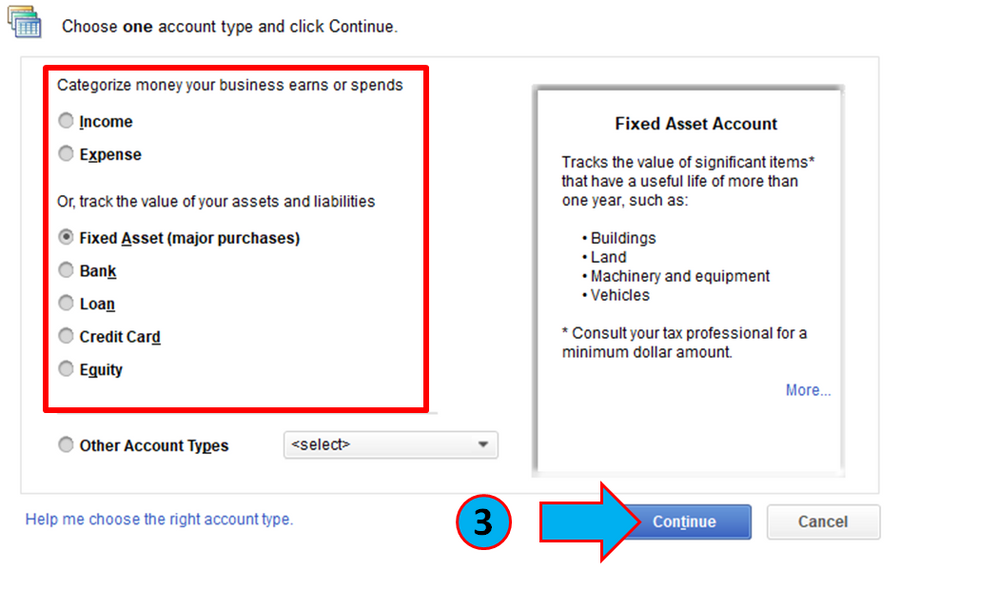

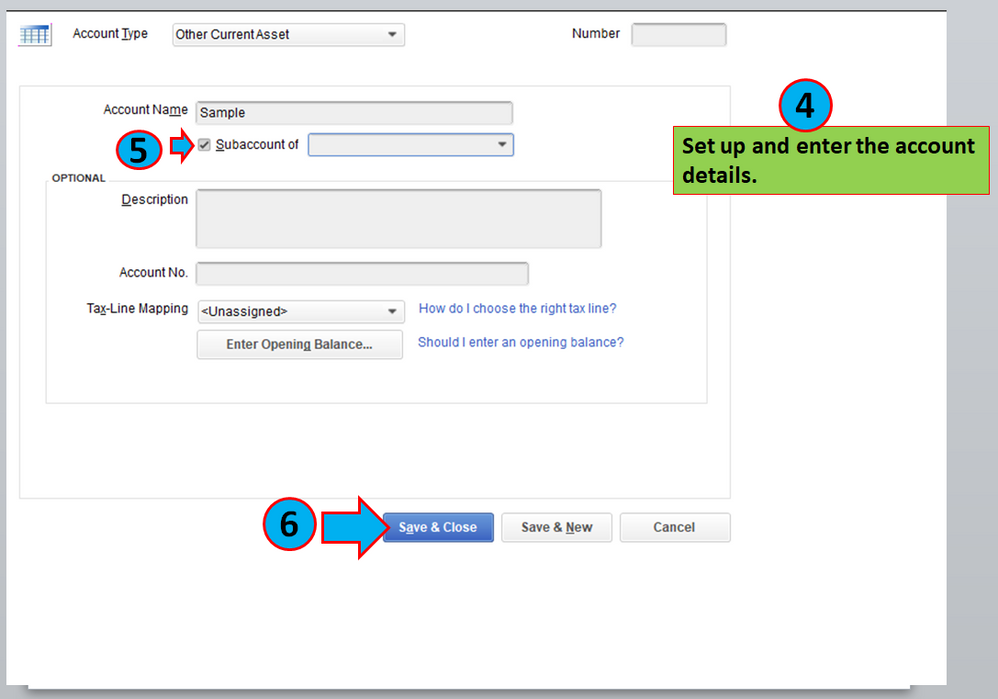

Yes, you can. Creating an account and assigning their sub-accounts in QuickBooks Desktop is easy. I'll show you how:

For future help about editing or deleting accounts, you can refer to the link. It'll give you the overview and the steps. Moreover, you can check this article to learn more about types and common task about accounts: Understand QuickBooks Chart of Accounts.

I'd also suggest consulting an accountant to help and guide about setting up and choosing the account type. He/She can provide more expert advice in dealing with this concern.

Keep me posted if you have follow-up questions about Chart of Accounts. I'm always here to help you further.

Thank you for your reply, @RhondaL.

When creating an account in QuickBooks, it uses a specific account and detail type. This is to ensure it’s placed according to the Generally Accepted Accounting Principles.

Since you’re considering using the bank as the sub-account to track your Operating Expense account, I recommend consulting an accountant first to ensure it won’t throw off your record.

If there’s anything else I can help you with, click on the Reply button and leave a comment. I’m always here to assist further. Wishing you the best.

@Rasa-LilaM Thanks for your additional input.

A pro-advisor said that sub accounts with banks, would create a huge mess... and he works closely with our CPA. How to I create the classes with the bank accounts to make it easy to differentiate what is in those funds and if they are operating or restricted? Thanks for your help... it's an area I need to move forward quickly on.Hi there, @RhondaL.

I appreciate you checking with an accountant about setting up the banks as sub-accounts. Decisions like these are important since it will affect the recording of finances.

If creating classes and assigning it to the bank accounts is your other option, this is currently unavailable. You can only use Class Tracking on individual transactions to help make sorting expenses easier.

Check out this article for the list of reports available by Class in QuickBooks Desktop: Filter, sort or total reports by Class.

In the meantime, I’m passing the idea to the right department for consideration in future updates. To see what’s new in QBDT, follow the steps below:

Reach out to me if you need further assistance. I’m always here to keep helping. Have a good one!

Thank you for this information. Is there a similar process for QBO? Thanks in advance!

Thank you for joining the thread, @AME SRA.

As mentioned previously, creating accounts in QuickBooks needs to use specific account and detail type matching to your business or organization needs. That said, it would be best to work or asks suggestions from a professional account to help you with setting up your accounts accordingly and share best practices with recording your finances.

On the other hand, I'll be sharing with your some articles that will guide you on how to manage am account for a nonprofit organization. Feel free to read the topics from here:

Also, check out the details from these links to learn more about creating accounts from the Chart of Accounts:

Post again if you have any other QuickBooks questions, @AME SRA. I'm always here to help you out. Keep safe always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here