Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello @pauch,

Thanks for posting in the Community. I'm here to provide information about reclassifying accounts.

Assigning classes to transactions only allow you to track account balances by department, business office, separate properties, etc. You can change or merge them since this information only helps track your company expenses.

Here's how you can merge them:

I also recommend seeking an accountant's advice about when is the best time to reclassify classes in your company file.

Please don't hesitate to reach out you need further assistance. The Community will be around to help.

Not just charities would find it useful!

Hello, we are using QB Accountant, and we have the same issue in Balance Sheet by Class. Then, how can we prepare Balance Sheet by Class? Do we need to prepare it manually after downloading Transaction Detail by Account to Excel? We have 5 classes per each location/bank account. Please help as soon as possible. Thank you very much, and best regards, KZ

Hello kzuber,

Thanks for posting here in the Community.

As discussed in the previous conversation, being able to choose a class for balance sheet accounts isn't available in QuickBooks. These general transactions in the balance sheet accounts (example: loan liability account) will show under the Unclassified column in the Balance Sheet by Class report.

Please send us feedback about it by clicking on the Help menu and select Send Feedback Online.

In the meantime, you can export this report to Excel. Then, customize it from there to show the amounts in the correct class column. Here's how to pull up the report:

Do you need to prepare this after downloading the Transactions Detail by Account? It would depend. You can print both reports if you need them.

If you have any questions, please let us know. Thanks!

Can you tell me where to find the Balance Sheet by Class report? I'm using Quickbooks Desktop Pro and can't find it.

Or is there a way to create it?

I have submitted this as a suggestion to Intuit. Profit & Loss is not the only report where classes come into play.

Thanks for joining this conversation, @ekileen.

Allow me to chime in for a moment and share some information about the report that you'd like to pull up in QuickBooks Desktop (QBDT) Pro.

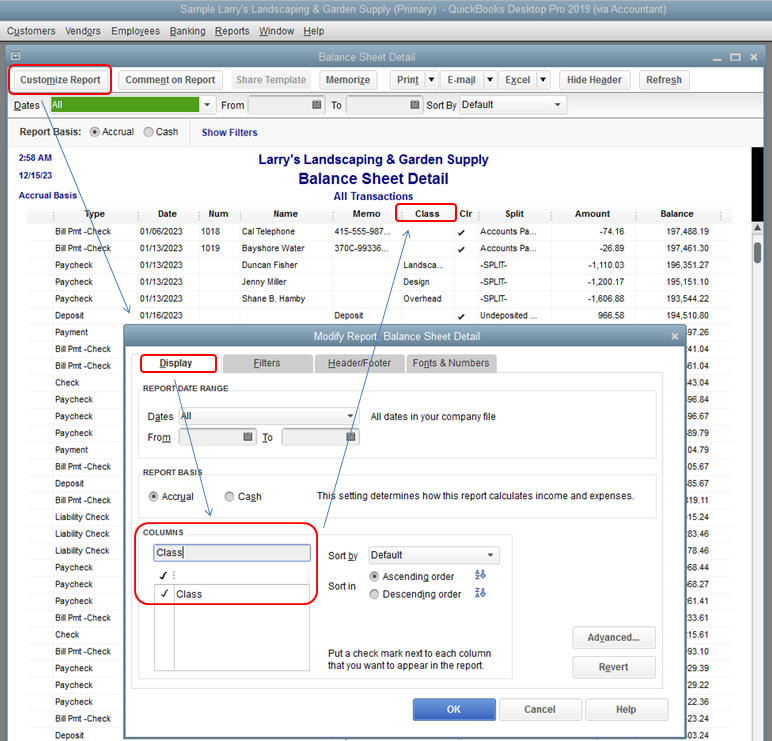

I appreciate you sending feedback to our Product Developers. At this time, the Balance Sheet by Class report is unavailable in QBDT Pro. You can pull up the Balance Sheet Detail report instead as a workaround. This will show a class column.

Here's how:

1. Go to Reports menu at the top.

2. Pick Company & Financial and Balance Sheet Detail in the drop-down.

Just in case, check out this article for future reference: Customize company and financial reports.

This should answer your concern for today. Please let me know how it goes or if I can be of additional assistance. I'm always here if you have any follow-up questions. Take care and have a good one!

Would you care to share your post again? I tried to click the link but it didn’t work.

Hello there, @Anonymous.

I'm here to help share additional information about running reports in QuickBooks Desktop (QBDT).

For me to help give you the right amount of information, may I ask if you're also trying to run the Balance Sheet by Class report in QBDT Pro?

As mentioned by my colleague FritzF, in the meantime, the Balance Sheet by Class report is unavailable in QBDT Pro. However, you may pull up the Balance Sheet Detail report and add the Class column.

To add the Class column:

You can also read this article to learn more about reports in QBDT: Understand reports.

Please let me know if you're referring to something else and if you have any other concerns about reports in QBDT. I'm always here to help you!

Hello QBTeach,

When you say you attach diagrams, was that writing to the person directly? I do not see how to view them. Thank you.

I use the class codes, I have 9 locations, when I run a BS, all the checking accounts show up but when I run one class, my bank accounts do not show up?

Please advise

I'm managing a Non-profit client who has multiple "Funds" (basically cost centers for BS and P&L which must be recorded separately per governing documents); but the CLASSES function in QB Online DOES NOT DO THIS!! It will track the operating activity, great. But when you need to run a Balance Sheet and there is a column that says "NOT SPECIFIED" which contains the BS piece of every transaction for all 8 Funds there is no other solution than exporting to excel and going line by line to create my BS manually. I don't care about bills, bill payment, invoice, checks, deposits and every other window... How did the dev's at Intuit not communicate with actual accountants on this?? I cannot run a Balance Sheet for a client in QB; and trying to explain to them why is laughable. I told them to leave QB and never go back... I really hope someone at QB is looking into this issue. I'm trying Departments now but like everything else it's clunky and not made to get accountants the information they need, but rather more user friendly for clients. But hey, the buttons look super cool!!

I've been managing a Non-profit client who has multiple "Funds" for 5-6 years now and this issue alone adds about 100 extra hours to the audit (basically cost centers per governing documents and Assets must = L+E in each one). In QB Online the CLASSES function DOES NOT DO THIS. It will track the operating activity- great. But when you need to run a Balance Sheet and there is a column that says "NOT SPECIFIED" which contains the BS piece of every transaction for all 8 Funds there is no other solution than exporting to excel and going line by line to create my BS manually. I don't care about bills, bill payment, invoice, checks, deposits and every other window... How did the dev's at Intuit not communicate with actual accountants on this?? I cannot run a Balance Sheet for a client in QB; and trying to explain to them why is laughable. I told them to leave QB and never go back... I really hope someone at QB is looking into this issue. I'm trying Departments this year, but like everything else it's clunky and not made to get accountants the information they need, but rather more user friendly for clients. But hey, the buttons look super cool!!

Hello there, rsturgis.

I can see that you have posted the same topic twice. Here is the link to which one of my colleagues has provided an answer for you: https://quickbooks.intuit.com/learn-support/en-us/reports-and-accounting/re-can-i-add-different-bran...

To have a streamlined conversation, I recommend using that thread for your replies moving forward.

Thanks for visiting us today. Come back any time or mention me on your posts if you have other concerns with Quickbooks.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here